Click & Collect is growing rapidly. It is also highly complex. We examined a year’s worth of Walmart click & collect trips, analyzing in-store pickup and online grocery pickup separately, and discovered that these two types of trips have little in common beyond starting online and ending in-store. If manufacturers want to capitalize on this growth they must adopt a comprehensive and nuanced strategy for maintaining premium positioning on the digital shelf, to ensure that Click & Collect shoppers find their products first. After all, when it comes to the digital shelf, no one remembers who came in second.

While Walmart in the U.S. reported that its 2018 second quarter sales grew 4.5%, its ecommerce revenues grew a staggering 40% (on top of Q1 digital sales that jumped 33%). While admittedly off a smaller base, these growth figures suggest that online sales in all its forms is one of the big growth drivers for the Walmart business.

I’d argue that looking strictly at online sales actually underestimates – at least from the perspective of manufacturers – the importance of ecommerce, for Walmart specifically and all brick & mortar retailers more generally. As part of its Q2 presentation, Walmart reported that “U.S. omni-channel saw significant progress with an expanded online assortment, including 1,100 popular new brands. Grocery pickup is now in more than 1,800 locations, and the company is on track to reach about 40% of the U.S. population by year-end [2018] with grocery delivery.”

Though not strictly an online transaction, online purchase for pickup represents a true differentiator for Walmart versus a company like Amazon. It’s also not the homogeneous transaction it might at first appear to be.

In-Store Pickup vs. Online Grocery Pickup

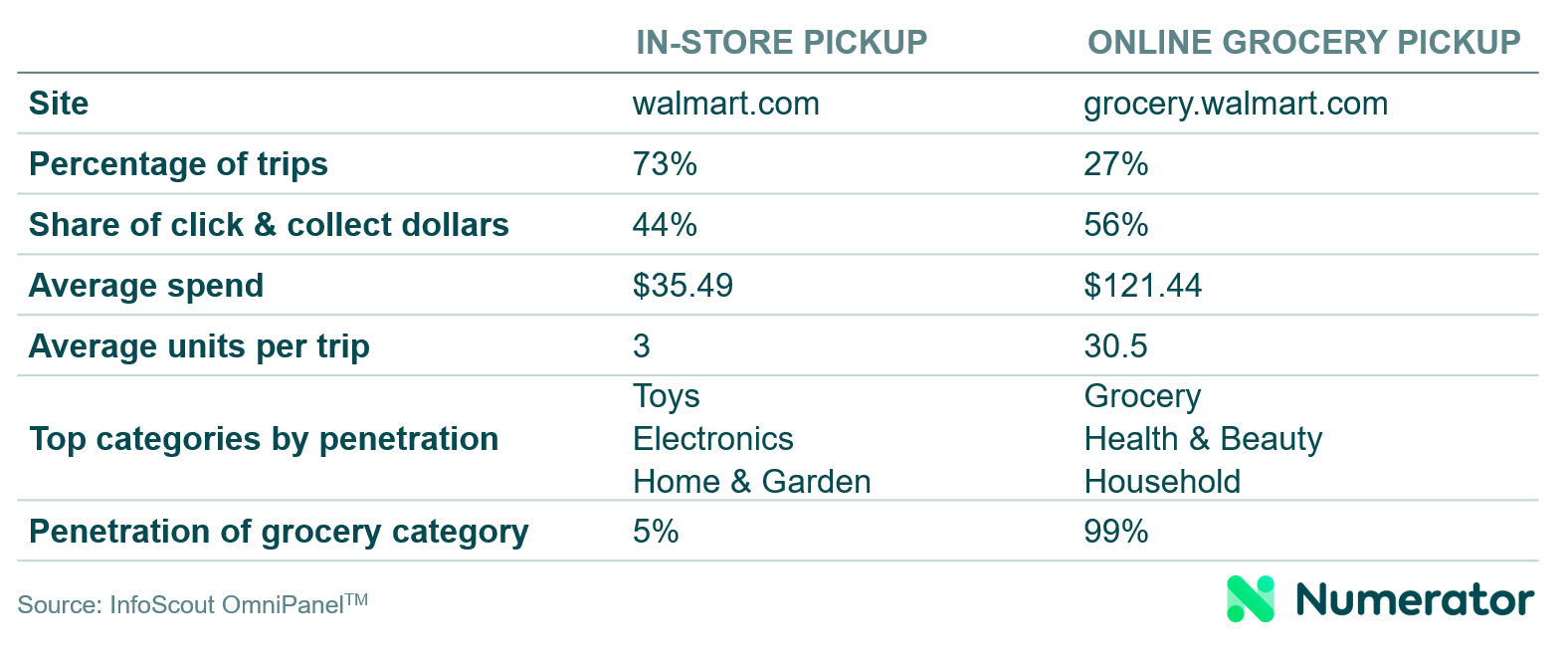

Numerator examined a year’s worth of Walmart click & collect trips, analyzing in-store pickup and online grocery pickup separately. What we uncovered is that these two types of trips have little in common beyond the fact that they both originate online and culminate at the store.

Online orders for in-store pickup much more closely resembles a quick trip, where shoppers need just a handful of items, presumably with some sense of urgency. It’s easier for shoppers to start the transaction online and end it in-store than it is to either wait for the product(s) to be delivered or to conduct the entire shopping trip in-store.

Conversely, online grocery pickup orders seem to bear a closer resemblance to a traditional stock-up trip, anchored by the purchase of grocery and other consumables with additional products included on an as-needed basis.

In looking at 48,625 Walmart click & collect trips taken by members of Numerator’s InfoScout OmniPanel during the past twelve months ending October 18, 2018, what we saw was:

Owning the Digital Shelf

Given both the growing importance of click & collect trips and the variability in trip type revealed by these data, it suggests that a comprehensive yet nuanced manufacturer strategy is required to own the digital shelf, revolving around the following principles:

- Maintaining a shopper’s view of the digital shelf: If companies (and particularly consumer goods companies, those that manufacture durables seem to be further down the learning curve) are monitoring the digital shelf at all, often it’s only in aggregate. But there are myriad ways for consumers to search and shop the digital shelf, and companies need to have insight into all of them.

- Creating diversified merchandising strategies, to reflect different trip types: Pulling directly from the Walmart example above, at a basic level consumer goods manufacturers should be devoting their attention to influencing online grocery pickup, whereas makers of durables need to both own in-store pickup and develop strategies for getting in the online grocery pickup basket.

- Leveraging technology to monitor the digital shelf and implement corrective action: Unlike in-store merchandising, where change often comes more slowly, digital merchandising is changing every day – influenced by consumer behavior, marketing behavior, and algorithmic updates. Without constant monitoring and exception reporting, the digital shelf becomes overwhelming (and a huge time drain for staff), particularly when considering the vast number of online retailers.

The purchase effects of Walmart’s click & collect offer provide a great proxy for working with any retailer, and particularly retailers anchored in a brick and mortar presence. There are more ways than ever for consumers to discover new products and move them into the purchase basket. Manufacturers need to master all the nuances of the digital shelf…before a competitor beats them to it.