Shoppers are intentionally spending more, even as prices soar

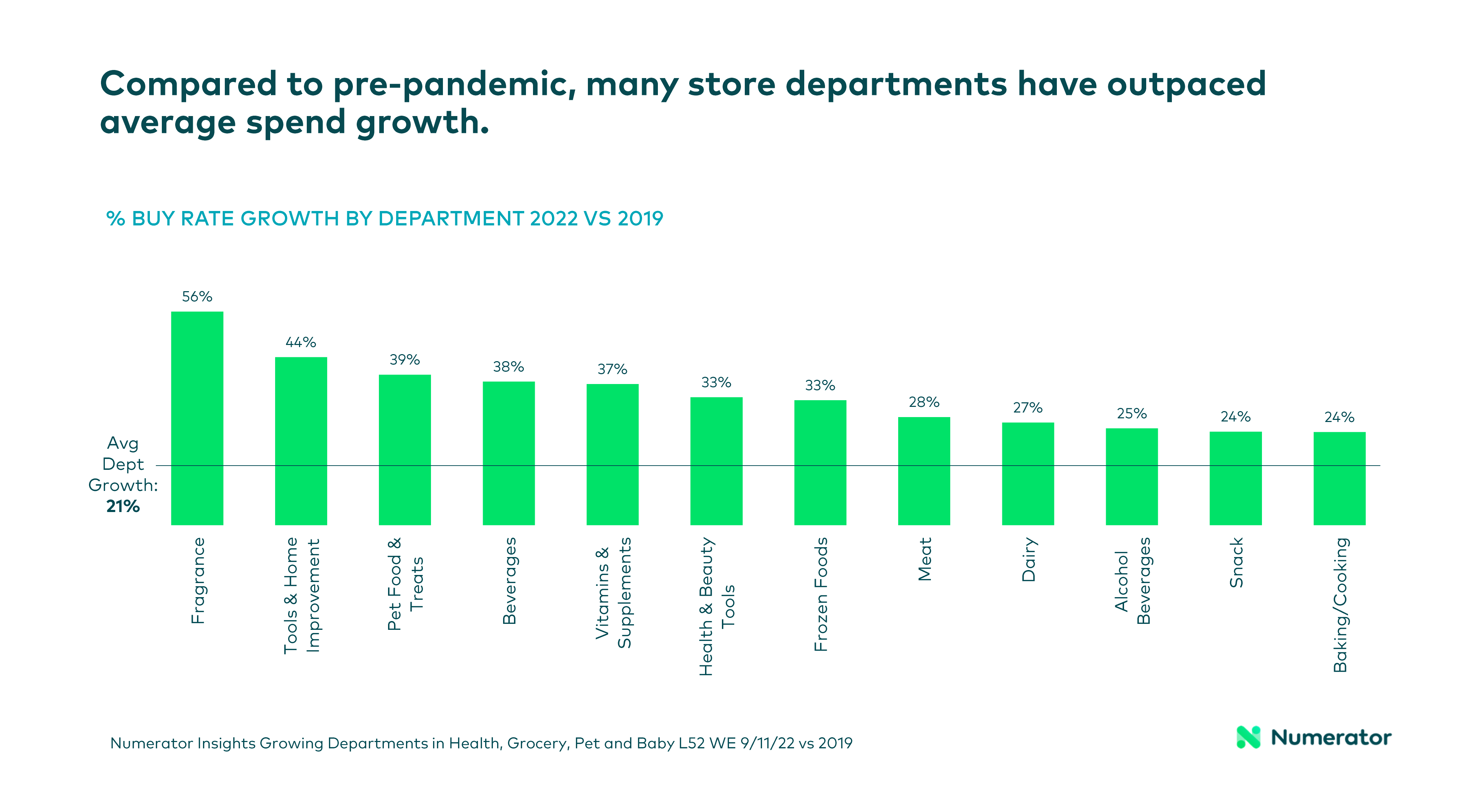

Across a broad range of categories, buy rate has been growing year over year since the onset of the COVID-19 pandemic. While there are many external forces— including inflation— driving this increase, in some categories spending has grown beyond what we might expect to see from those factors alone, suggesting that some consumers are spending more simply because they’re choosing to do so.

Why might consumers intentionally be spending more when prices are already higher due to inflation? During the pandemic, many shoppers had more discretionary income but fewer avenues in which to spend it, and at the same time were more inclined to treat themselves to make up for the lack of social activities. As shoppers reevaluated their priorities, some began to selectively trade up to more premium products and new behaviors emerged, many of which stuck even in the face of price increases.

What is premiumization and how can you recognize it?

Premiumization is defined as “the science of motivating consumers to pay more for brands, products and services”, and it’s a strategy that many brands and retailers leverage to help emphasize the value or quality of their products. But how can you know if it’s happening within the categories you play in?

There are a few key indicators that can help identify premiumization trends. In general, we would want to see that buy rate is increasing due to larger spend per trip that is driven specifically by increased spend per unit. Additionally, we’d want to see that trips and units are remaining relatively steady in order to remove any noise created by other factors, like trading up to larger sizes. Finally, because spend per unit will never entirely be decoupled from inflation, it’s wise to move beyond that metric in any analysis of premiumization. For this reason, in our study we chose to use branded tiers rather than price tiers to analyze premiumization behavioral shifts.

The overarching shopper rationale for buying premium brands is a desire for quality. But premium buyers are not a monolith— their contributions vary by segment and their motivations are diverse—so premiumization can present both opportunity and risk, depending on the category buyers who are driving it. In the next sections, we’ll explore this idea by examining premiumization within the Dog Food, Hair Appliances and Spirits categories, getting to know the shoppers behind these trends and their motivations.

The Premium Pet: indulging our furry friends

Since 2019, dog food’s overall household penetration rate has remained steady but, in that time, premium has diverged from mainstream as the preferred offering—buy rate for premium dog food has increased 31% compared to only a 12% increase for mainstream brands.

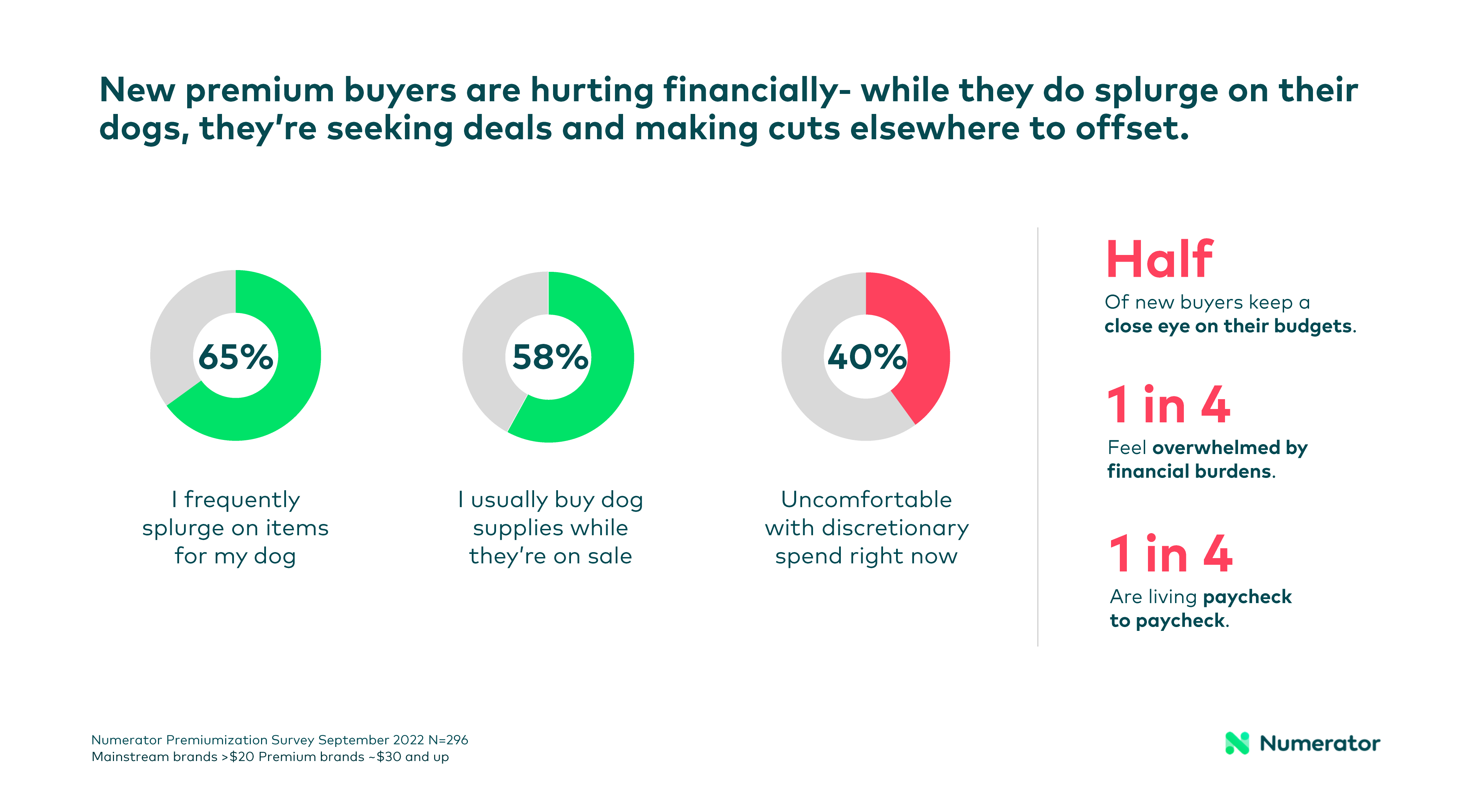

In 2022, nearly one-quarter (23.5%) of premium dog food buyers were new, and over half (55%) of those new premium buyers were also new to the dog food category entirely. These new premium buyers tended to be more diverse, younger, lower-income shoppers compared to existing premium dog food buyers. And while they are willing to splurge on their dogs, they are hurting financially—1 in 4 feel overwhelmed by financial burdens or are living paycheck to paycheck, which makes them more likely to seek out deals and make cuts elsewhere.

Why are premium dog food shoppers—who are struggling financially—spending more to feed their furry friends? It all comes back to quality. 70% of new premium buyers considered their purchase an upgrade, and their top motivations for trading up included wanting to feed healthier food to their pet (17%) and wanting what’s best for their furry companion(s) (15%).

Premium Hair Appliances: great hair, no care (about cost)

COVID accelerated household penetration across mainstream and premium brands in the Hair Appliances category, but premium brands are driving the most category growth—spend per unit is up double digits vs 2019.

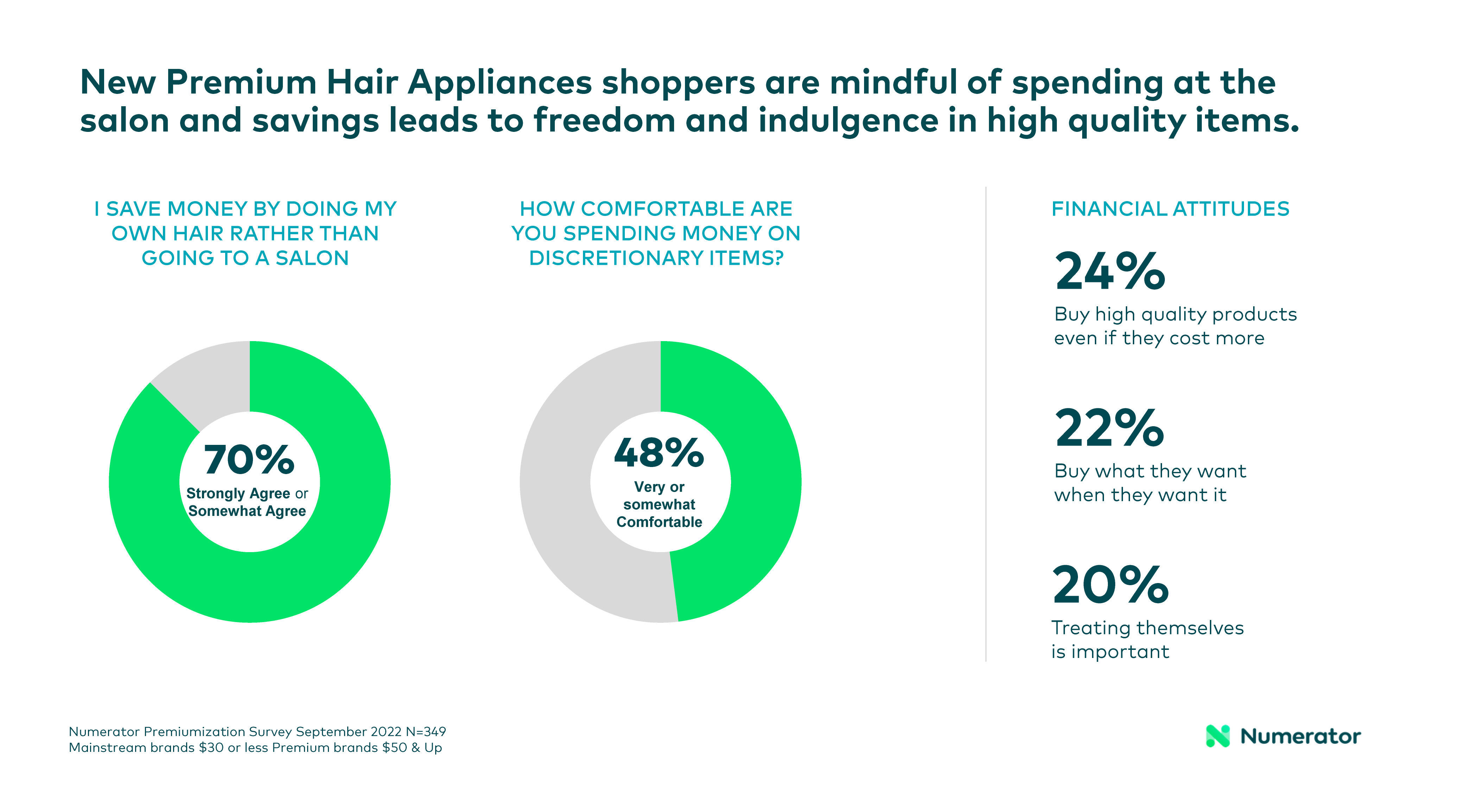

Most shoppers who purchased a premium hair appliance in 2022 were new. Overall, high-income (over $80k) Millennials are the primary purchasers of premium hair appliances, but these new buyers skew slightly older and more suburban. They are mindful of spending at the salon—70% said they save money by doing their own hair—but they enjoy indulgences—1 in 5 believe treating themselves is important.

Both new and existing premium hair appliance consumers acknowledge their products as a good investment that will outlast cheaper counterparts. 21% of premium hair appliance buyers trade up to avoid having to replace mainstream brands frequently, and 13% said their top reason for purchasing a premium hair appliance was because it was less damaging to their hair.

Premium Spirits: searching for a top shelf taste

While household penetration and buy rate may have peaked during COVID, spend in the Spirits category has remained elevated since 2019. Yet, over time, spirits shoppers have become more exclusive to premium brands, which has shown in all areas—premium brands have grown percentage of trips (+4.4%), households (+5.1%), and spend (+4.0%) since 2019.

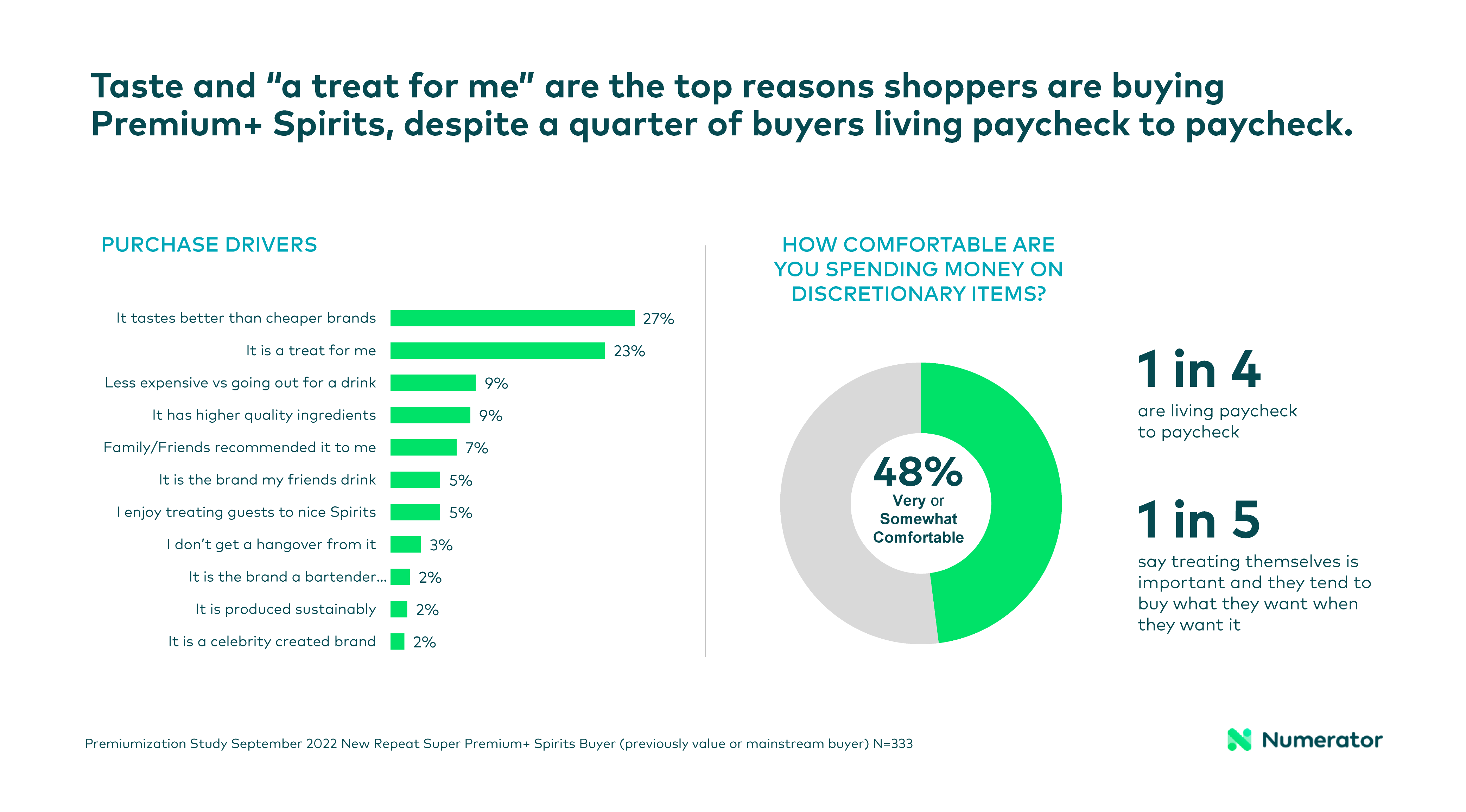

In 2022, premium spirits buyers included 65% existing buyers and 35% new buyers. These new purchasers represented an additional 5.9M households, and they were younger, lower income, and consumed fewer alcoholic beverages in general compared to existing buyers. New premium buyers stated their top reasons for purchase were better taste (27%), treating themselves (23%), and buying premium spirits is less expensive than going out (9%).

While treating themselves is a top motivation for premium spirits shoppers, 1 in 4 are living paycheck to paycheck. But these shoppers are aware of their increased spending and are cutting back in other ways, spending less on occasions outside the home—including eating out, entertainment, and vacation—to better afford their spending habit changes.

Premium or Bust: learn more

Across categories premium brands are growing and attracting new shoppers, however premium buyers can represent both opportunity and risk depending on their motivations, financial means, shopping behaviors, and perceptions of quality and value.

Understanding the role of premiumization in your category, along with shoppers’ profiles and motivations, can help target the marketing, messaging, and positioning of your brand to reach these premium buyers as inflation continues and brands compete for basket space.

If you’re interested in diving deeper, check out our on-demand webinar for a closer look into the trends outlined in this article, with more insights into shoppers’ new and sticky premium behaviors. To learn more about your specific brand or buyers, get in touch with us today.