Consumer behavior is ever-evolving. Ongoing advances in technology and instant access to information continue to change how consumers spend and impact what brands they choose to buy. To compete with the digital marketplace, traditional retailers also need to innovate and evolve the private label products they stock on their shelves or risk being left behind.

Over the last year, Numerator Insights data shows direct-to-consumer (DTC) accounted for $5.5 billion in online purchases. Overall, eCommerce captured 12% of consumer spending, up 1.4% from 2018. Much of this shift is due to the increased purchasing power of Gen Z and Millennial shoppers, 34% of whom are heavily influenced by their interactions on social media, with close to 25% making weekly online purchases.

This presents retailers with a consumer attraction and retention challenge. Investing in the revamping of their existing private label brands succeeds in appealing to budget-conscious shoppers, but it isn’t enough to draw new, and younger, customers to their doors. How are big-box stores remaining relevant, getting buyers offline and into the aisles, and competing for brand loyalty?

Going Beyond Generic

Generic, “copycat” private label brands, like Target’s Up & Up or Albertsons Signature Select, offer solid competition against national manufacturer brands, but they don’t help a store stand out in a crowded field.

Retailers have risen to the occasion by launching new lines of premium private label brands. These premium brands are stand-alone products as opposed to simply being “copycat” alternatives to higher-priced name brands. Focusing on factors like quality ingredients and sustainability, retailers are heeding the call and responding to a changing consumer attitude that cares not just about value, but about the overall effect a product has in their lives and on the planet.

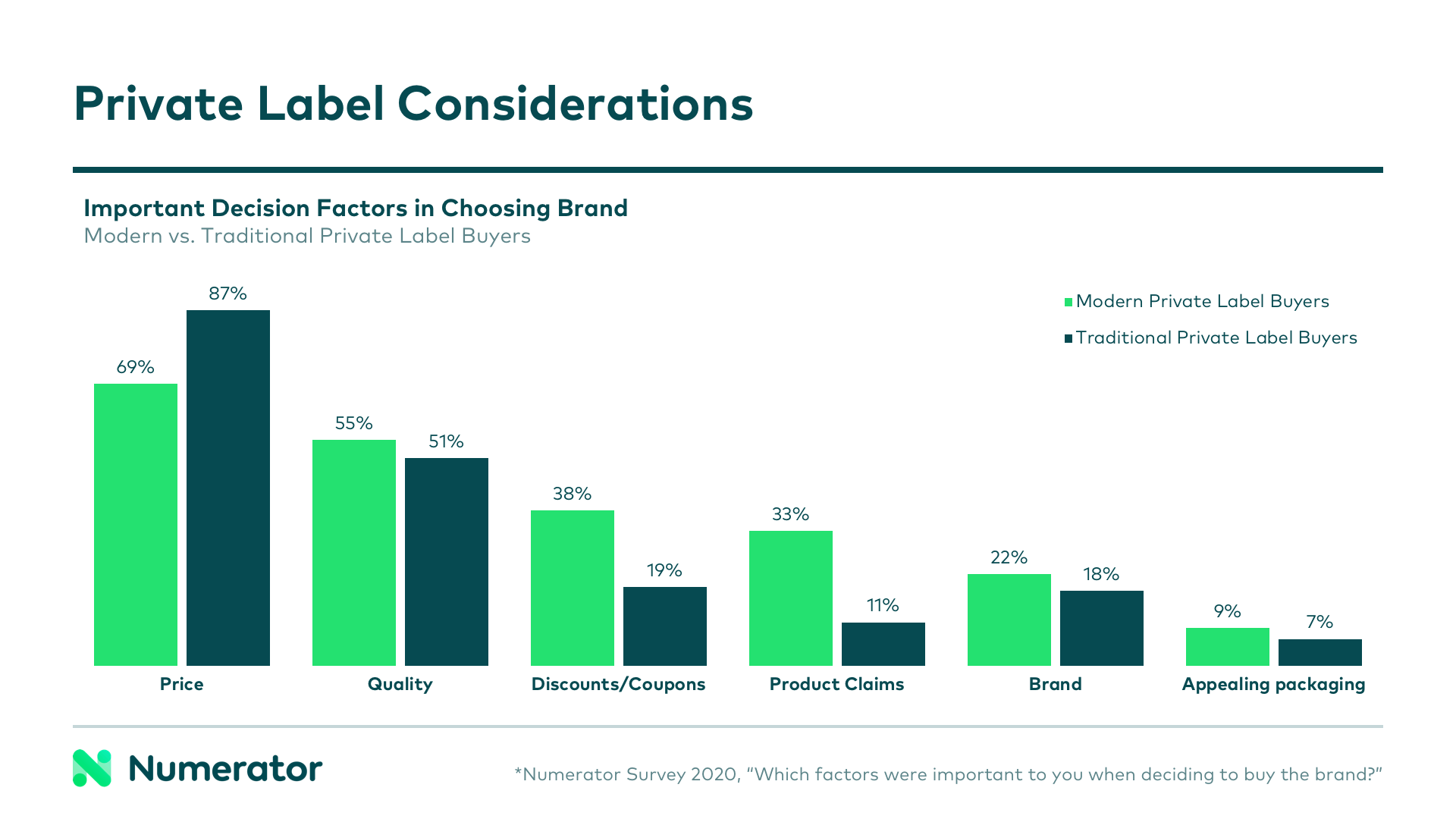

In comparing buyers of premium versus traditional (generic) private label brands, Numerator Insights data indicates that though price still plays a leading role of 68.9% when it comes to considering premium private label brand purchases, product claims have become a significant selling point as well. Topping traditional brands by 32.6%, product claims are now three times more likely to influence the purchasing decisions of a premium private label shopper.

Messaging Targets Quality Over Cost

Through these premium product lines comes the ability for retailers to evolve their advertising message and reach. By taking the importance of product claims into consideration, retailer-owned brands are now positioned in ads as equal to national brands. Rather than highlighting value, the messaging concentrates on the virtues of their products. Publicizing price has been replaced with promoting pride in how their products are made. This has allowed retailers to better leverage their social media exposure and digital advertising, reaching the right customers to powerful effect.

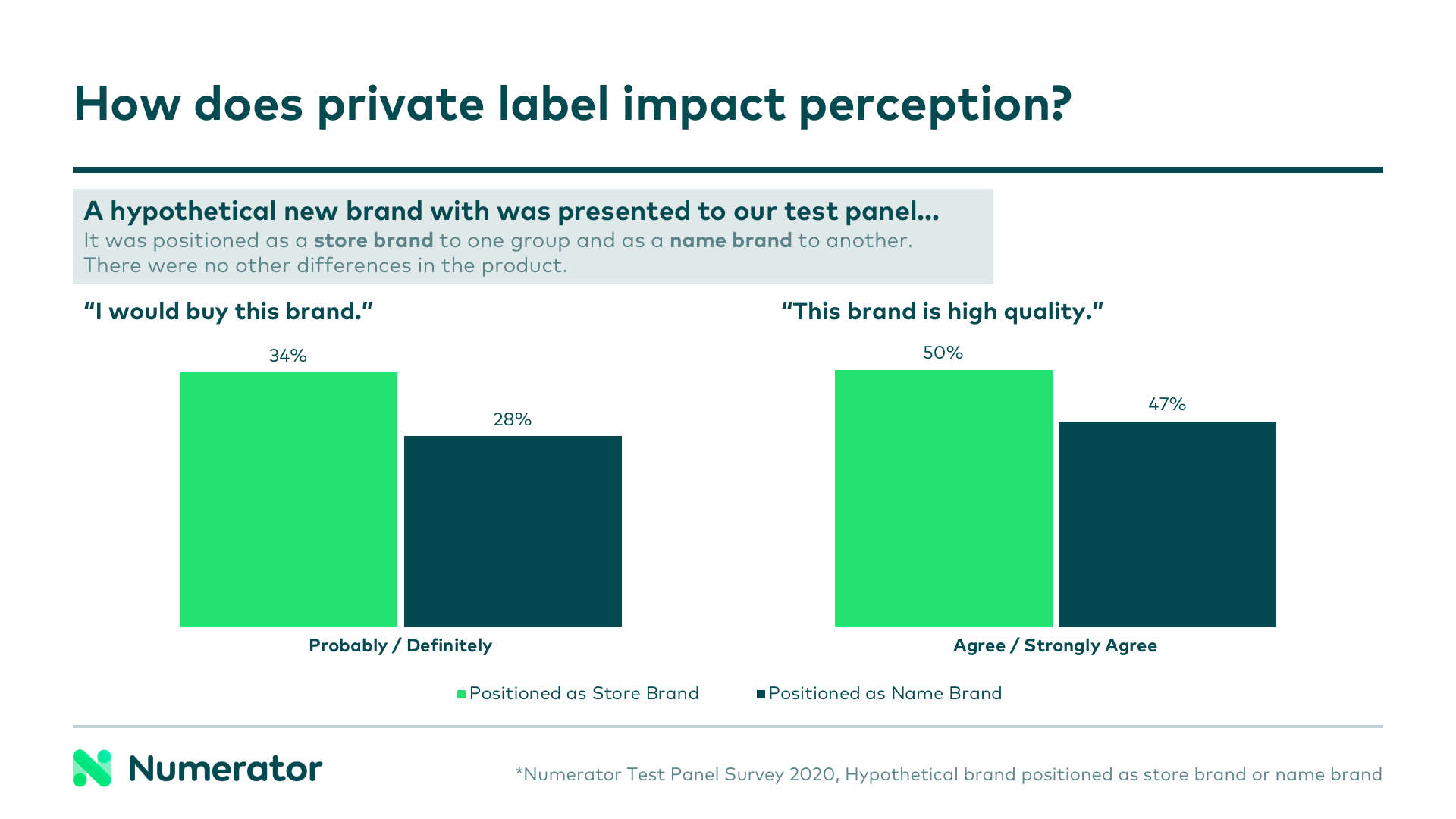

How powerful? A Numerator survey fielded to our test panel posed a fictional sustainable brand in front of two separate groups of shoppers. One group was told the product was being developed as a new, retailer-owned brand and would be carried only in that retailer’s store and marketed under their name. The second group was told the product was being developed by a national name brand to be carried in stores across the country and marketed under their name.

The results showed shoppers not only had a 3% better perception of the quality of the retailer-owned brand, they indicated a 6% greater likelihood of buying that brand over the name brand.

The Rise of the Premium Private Label

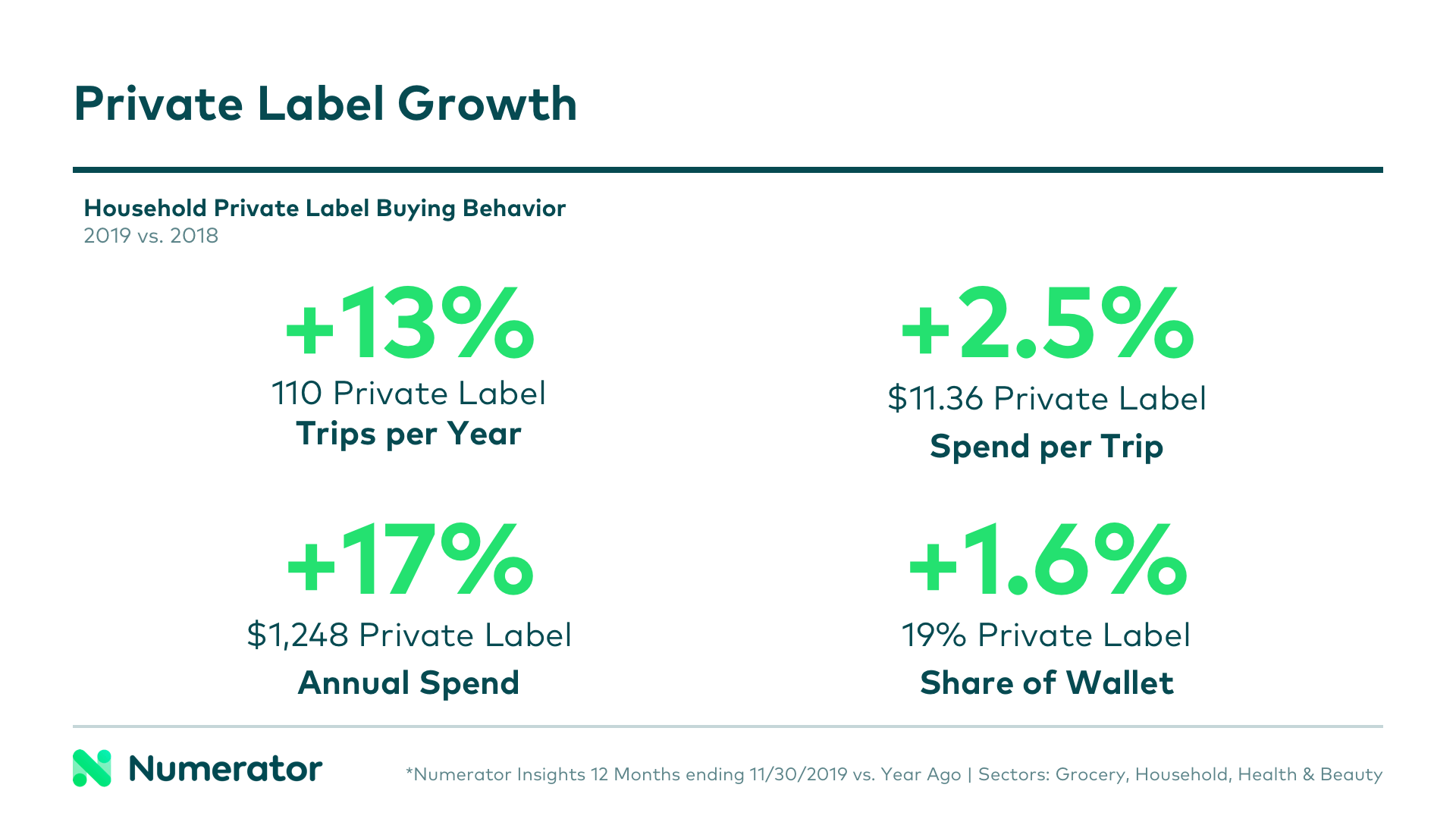

Consumer reaction to this retailer reinvention has been impressive. In categories across the board, from grocery and household to health and beauty products, retailers experienced an increase of 13% in store trips and 17% in spending on private label brands over the last year.

With this new breed of quality-driven consumers on the rise, retailers have proven themselves able to evolve by recognizing and meeting their buyer’s needs and desires. In Part 2 of this story, we’ll examine one retailer’s success in attracting a wider range of shoppers using a multi-pronged approach with both their generic and premium private label brands.