With vaccinations on the rise and months of increasing out-of-home activities through the summer of 2021, a “return to normal” comes with some additional baggage: the return of cold and flu season. Across the country, we’re seeing an uptick in the sales of cold, cough & flu medications alongside an increase in COVID cases. What drives over-the-counter buying behaviors, and where are we seeing the most activity?

Following in the footsteps of hand sanitizer and toilet paper, cold, cough & flu medications were highly susceptible to early-COVID stockpiles. As consumers rode out their nest egg of meds through the pandemic and socially distanced themselves, overall sales of this medicine remained low. What trends are we seeing as sales of these products begin to rise in 2021?

A Different Type of Seasonal Trend

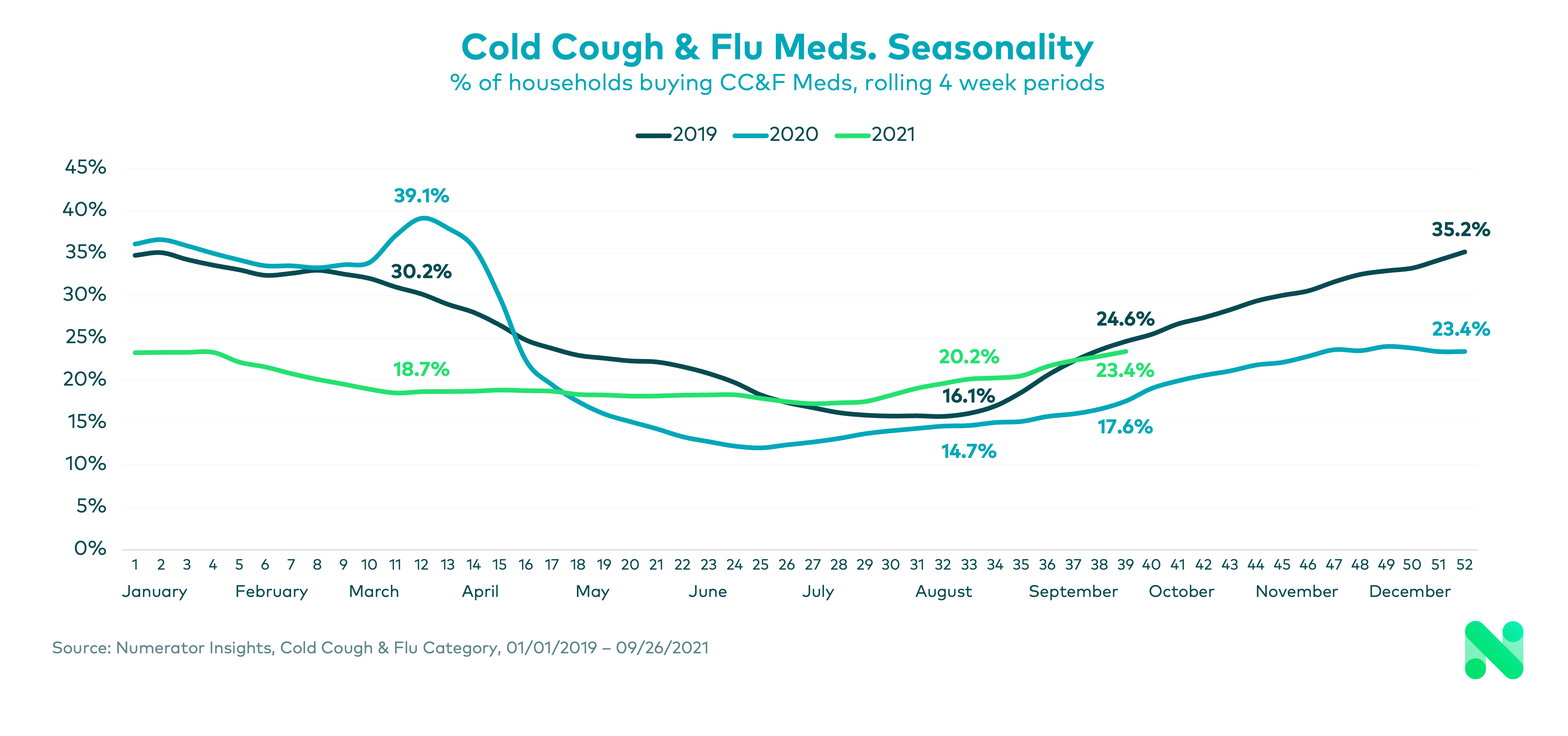

Prior to COVID-19, cold, cough & flu medicine sales aligned closely with the typical flu season: week-over-week growth starting in the fall and continuing into February. Precedented times were left behind with the first wave of the COVID-19 pandemic, and cold, cough & flu medicine saw household penetration climb to 39%– with buying rate up 16%– in March before plummeting and pacing below pre-COVID figures for the remainder of 2020.

The first quarter of 2021 was more of the same– households purchasing these meds remained relatively flat and well below both 2020 and 2019 levels. As reopening entered full swing in early July, households buying began to increase and surpassed pre-COVID levels for the first time in over a year.

The COVID Factor

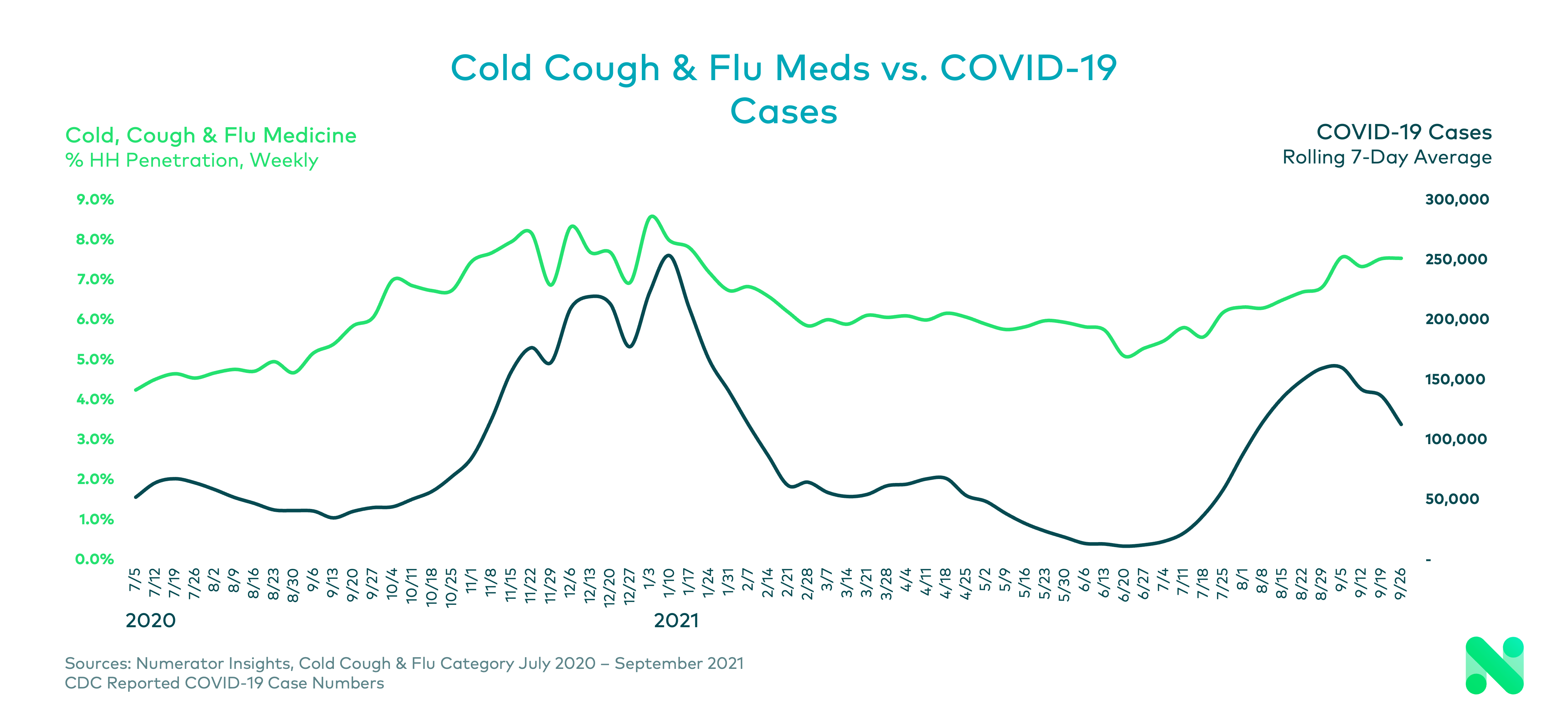

While flu season is historically easy to track, narrowing the scope to a weekly view makes it impossible to ignore the impact of ongoing COVID-19 waves. Now that many households seem to have depleted early-COVID cold, cough & flu med stockpiles, the correlation between these med purchases and COVID-19 cases has grown stronger. As it stands, COVID-19 cases seem to be a strong predictor of needs-based medication purchasing any given week or in the following two weeks. However, as cases have tailed off, cold, cough & flu meds still continue to grow– indicating that, while COVID-19 cases have a noticeable effect, non-COVID illnesses continue their influence as well.

Warm Weather, Cold Insights

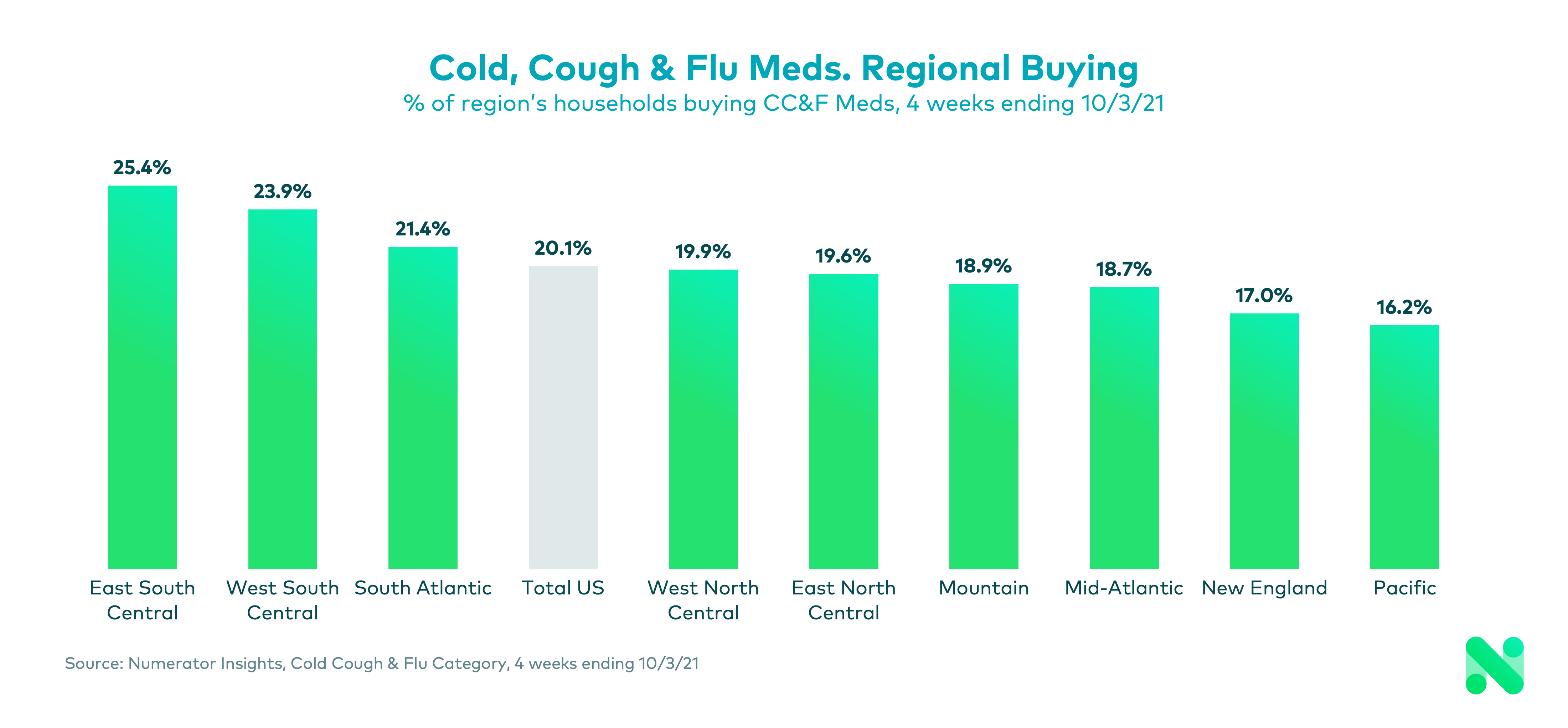

Nature tends to have one of the best deterrents when it comes to flu season– warm weather. However, shopper trends moving into this fall tell a different story. When looking at the uptick in cold, cough & flu med purchases, there’s a particularly southern slant to the data alongside that region’s rising COVID cases. In the four-week period ending October 3, one-in-four households from the East South Central region (KY, TN, AL, MS) purchased cold, cough & flu medications– 5.3 points higher than the US as a whole. This trend bleeds into the neighboring West South Central and South Atlantic regions, who are also seeing nearly a quarter of consumers buying in that same span.

Cold, Cough and Who?

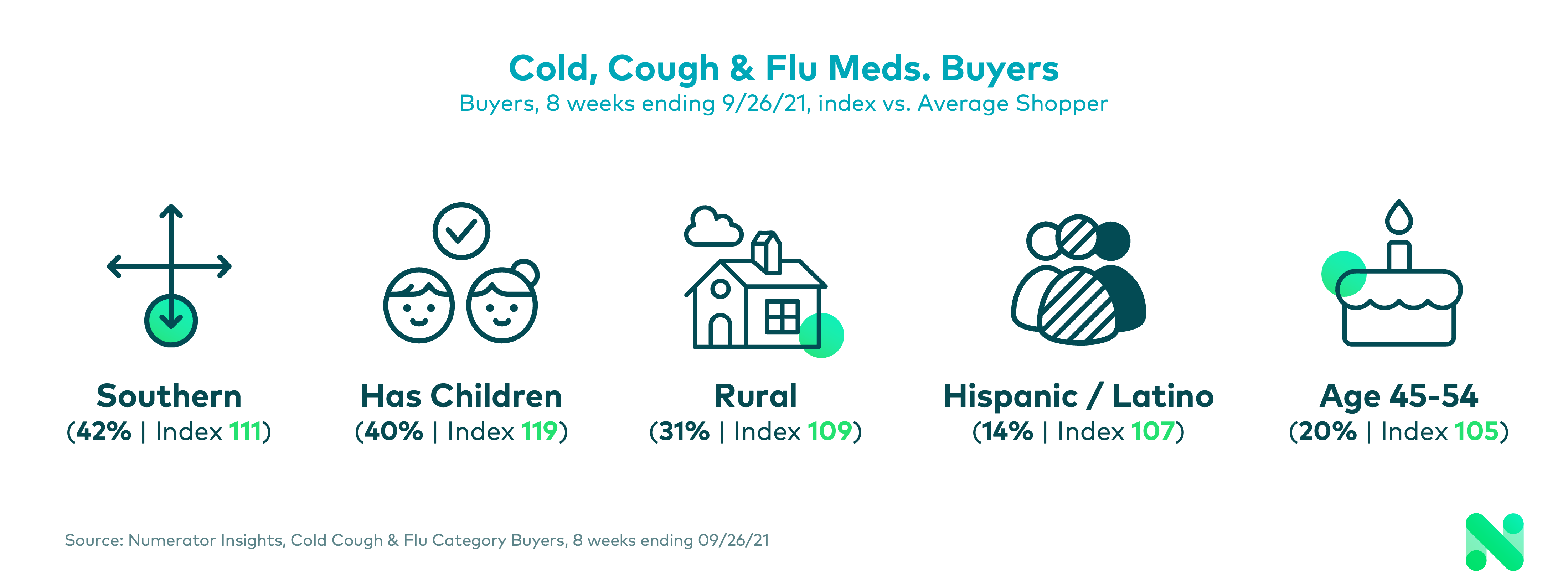

Diving deeper than the regional top line, shopper insights shine a light on the cold, cough & flu buyer to see where certain demographics are outpacing others. When it comes to consumers buying these meds, the last two months paints a picture of Southern, rural households with children. These shoppers are showing elevated spending in the Drug channel over the same time frame, likely driven by their purchases in this category. Unvaccinated consumers are also more likely to fall under this cold, cough & flu purchasing umbrella, over-indexing (110) in comparison to the general population.

Looking Ahead

As the nation navigates fluctuating COVID-19 cases alongside the fall & winter flu season, it will remain important for brands & retailers to stay on top of case trends in order to navigate accompanying demand fluctuations. For more information on how your brand is impacted, reach out to your Numerator consultant or get in touch with us today.