When activities outside the home were limited due to lockdowns, consumers sought out at-home hobbies to keep themselves occupied. One place consumers got most creative was in the kitchen. Over the past year, baking has become one of the most popular ways to pass the time during the pandemic. For brands and retailers serving this category, the aroma of growth in the baking aisle has been sweet and seasoned with opportunities to convert these consumers long-term.

With so many preheated ovens being prepped for homemade baked goods, pastries, and breads, Numerator dug into some doughy insights using our recently launched New Buyer Analysis Report. We uncover how extensive the gains have been, who the new buyers are, and recommend actions to keep these aspiring bakers coming back.

Baking on the Rise

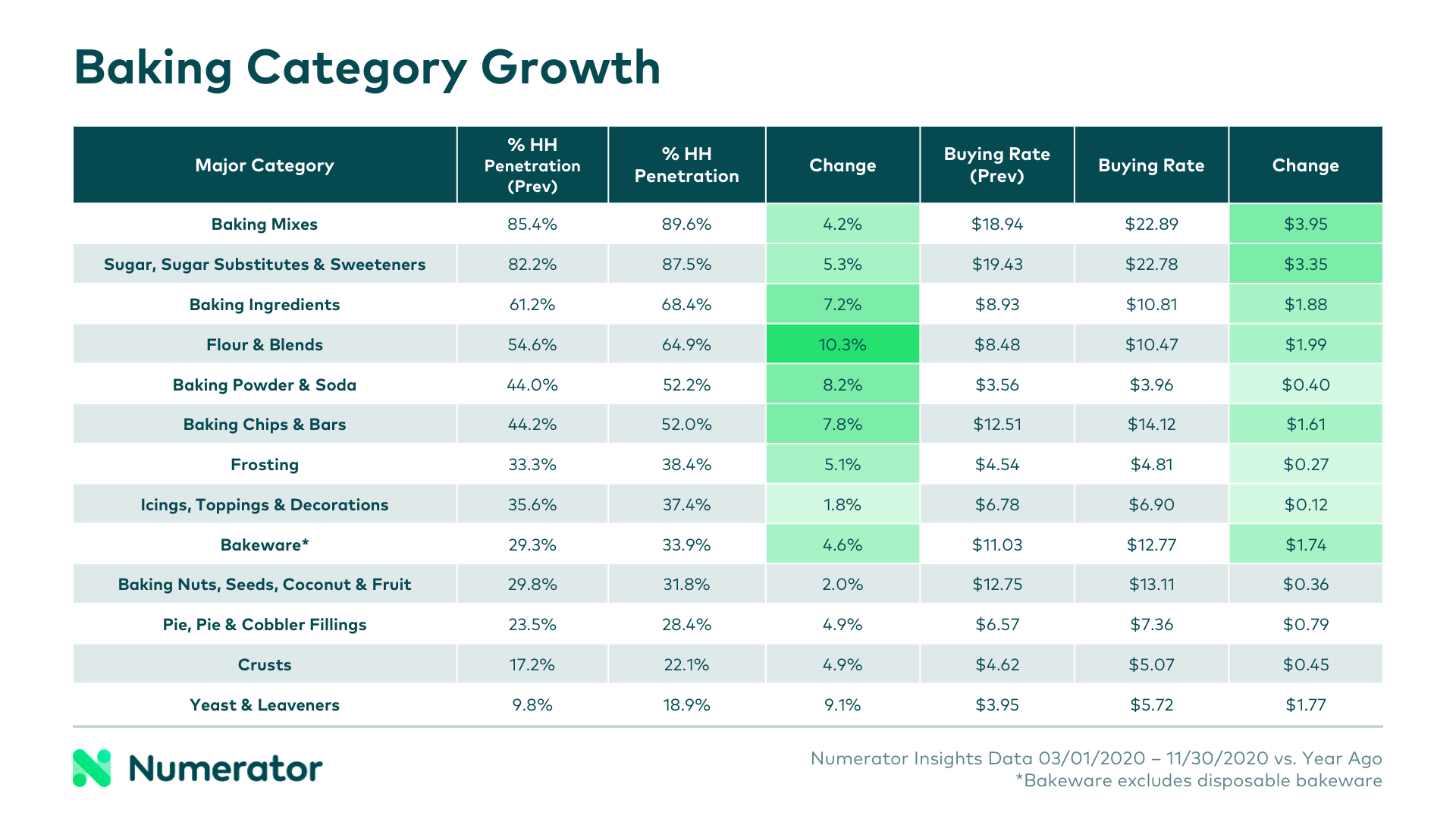

From flour to frosting, there’s been an increase in household penetration and buy rate across all of the main baking categories. Typically, a substantial increase in penetration means we’ll see a decrease in buy rate. The rise in both metrics across all baking categories emphasizes just how great the demand is for these items.

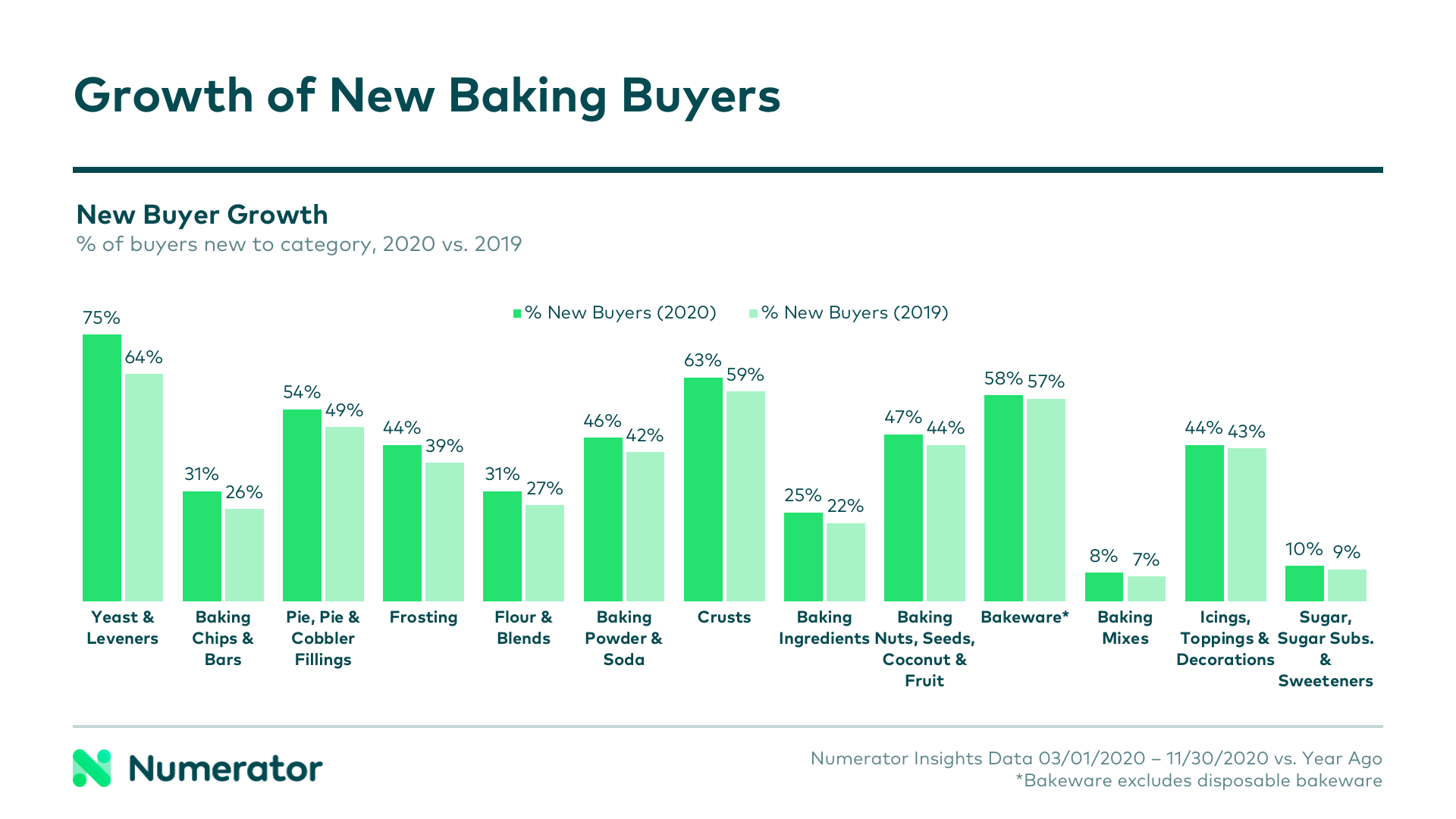

This is due to a rise in the number of new buyers honing their culinary skills and spending more across all categories. Yeasts and leaveners grew the most with an 11% net increase in new buyers when compared to a year ago, followed by baking chips and pie fillings at 5%. Even categories like baking mixes and sugar, that regularly experience high household penetration, saw an increase in new buyers.

New Cooks in the Kitchen

Kneading out additional details from the baking categories with the largest gains in new buyers, we find a few demographic groups are trying on their chef’s hat for the first time. Overall, these consumers are younger, skew toward being ethnically and racially diverse, and are often single. These new buyers likely have more time on their hands to experiment in the kitchen.

These consumers are also 20% more likely than average to dine out four or more times per week, an activity they’re unable to enjoy right now. As a result, they tend to need help with their cooking efforts. And, as a whole, they over-index on mobile usage, which means they’re more inclined to be influenced by social media and possibly seek out recipes online.

Converting the New Culinary Consumer

The baking aisle is likely to stay busy with safety protocols still in place across the country and consumers remaining close to home for the foreseeable future. This means brands and retailers will want to become acquainted with and appeal to their new buyers in order to be top of mind when these consumers fill their pantries for additional at-home recipe trials.

Numerator’s New Buyer Analysis report can help you do that. Our New Buyer Analysis is designed to identify shoppers who are new to a brand during a specific time and highlight how they differ from existing shoppers. These reports offer a detailed breakdown of new buyer demographics and an analysis of their pre- and post-category shopping behavior. It’s a valuable tool when developing marketing strategies both in-store and online.

To learn more about how your brand or category can benefit from Numerator data— including the New Buyer Analysis— please contact your Numerator Customer Success Representative, or get in touch with us today!