In the week leading up to St. Patrick’s Day, it’s no surprise that Irish liquor and beer brands like Jameson and Guinness experience a significant increase in sales. Retailers promote these brands heavily in the lead-up to the holiday, keeping Irish brews top o’ mind for buyers. But just how much does St. Patrick’s Day impact these Irish brands, and who are the lads and lasses purchasing Irish beverages? We took a look at Numerator Promotions and OmniPanel data to find out.

Guinness and Jameson were the top promoted alcohol brands the week of St. Patrick’s Day 2018, according to Numerator Promotions data. Guinness had a 12.4% share or voice for beer promotions, and Jameson dominated whiskey promotions with a 28.9% share of voice. For both brands, this share of voice was roughly 1.5x higher than it was in preceding weeks. Share of wallet followed suit, with Guinness and Jameson each experiencing significant share bumps within their respective categories (3.6x and 2.3x vs. week prior).

Though Guinness and Jameson buyers only make up 6.3% of US households, they account for 17.5% of annual alcohol spend, making their importance to the category undeniable. While the average buyer spends about $310 per year on alcohol, the average Guinness or Jameson buyer spends closer to $750, attributed both to more frequent trips and a higher spend per alcohol item.

Guinness and Jameson over-index with Millennials, males and high-income or urban households. Buyers of these Irish beverages are far less likely to purchase their alcohol at mass retailers, opting instead for liquor stores or grocery chains, perhaps in search of higher-end or specialty alcohols.

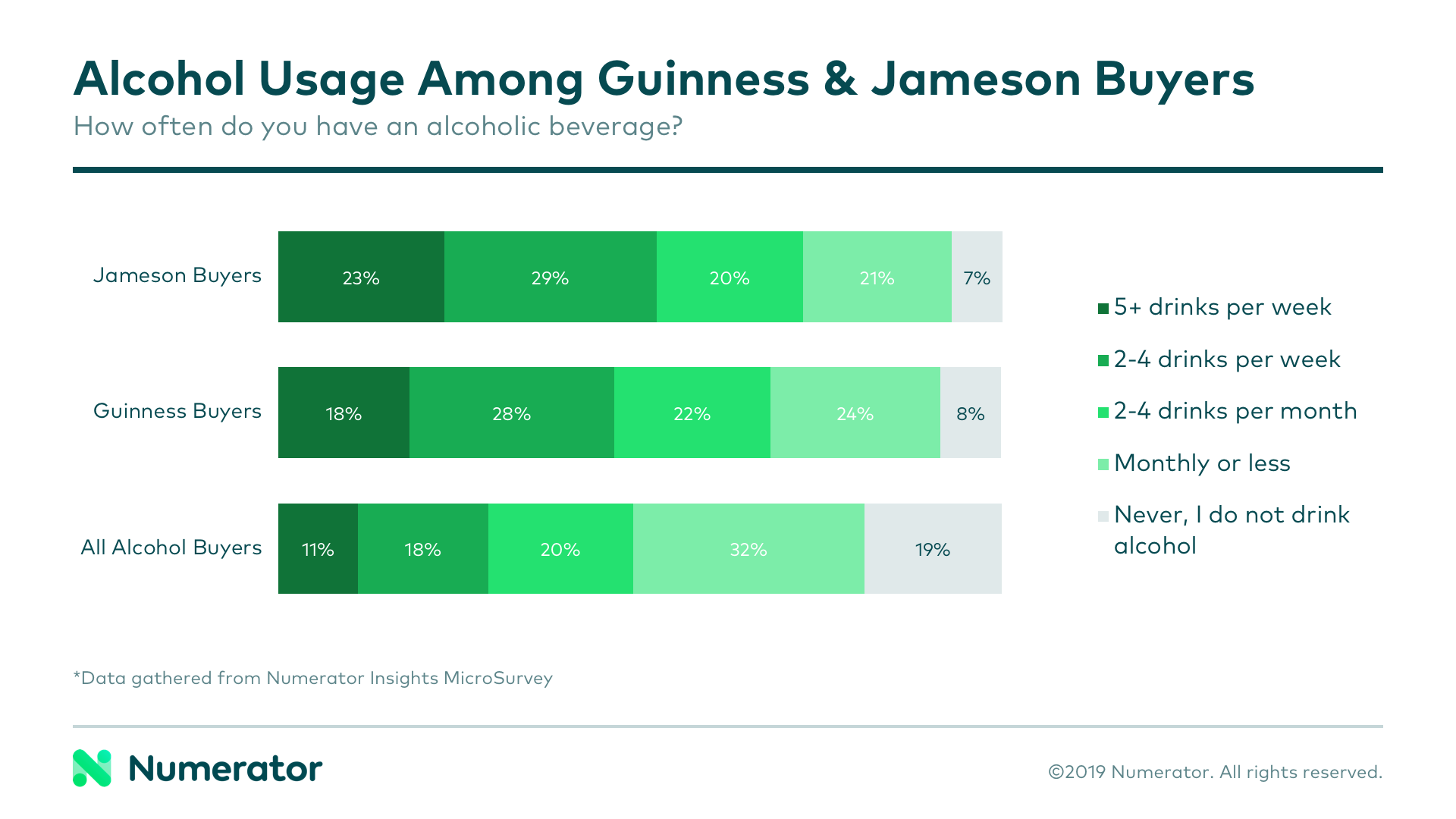

Thanks to Numerator MicroSurvey data, we can segment these buyers further by their alcohol usage and attitudes. For example, we’ve found that Jameson buyers drink more heavily than the average alcohol buyer, with 23% of the group indicating they consume 5+ alcoholic beverages per week, compared to 11% of average alcohol buyers. On the opposite end of the spectrum, 8% of Guinness buyers claim to “never drink alcohol.” The lower rate of non-drinkers among Jameson and Guinness buyers may suggest that shoppers are less likely to splurge for higher-end alcohols if they don’t plan to consume the drink themselves.

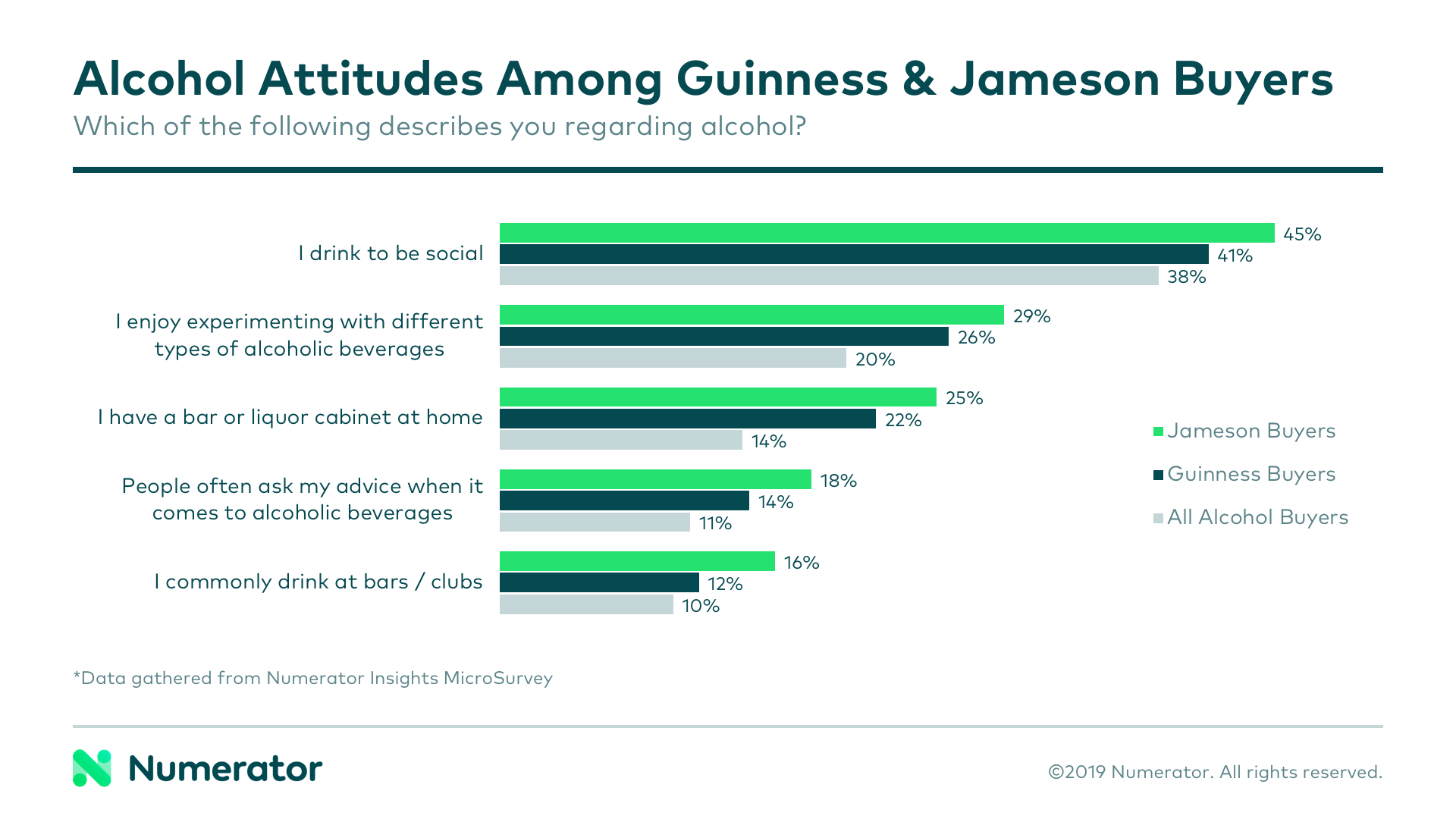

In addition to having higher rates of alcohol consumption, Jameson and Guinness buyers are also more likely to integrate alcohol into their social lives and to have positive attitudes towards the intoxicating drink. They are significantly more likely to drink socially, to enjoy experimenting with different types of alcohol and to have a bar or liquor cabinet in their homes.

Irish brands may be the lucky ones this upcoming St. Patrick’s Day, but with insights from Numerator, you can make your own luck! Contact us today to learn how Numerator can help your brand find your own pot of insights gold.