‘Twas one week ‘til Christmas and shipping was tight,

No time to be had to find that gift that’s just right.

But there in the aisle of that big box store

Was a gift card display that made my hopes soar.

But I paused for a moment, card in hand with some doubt,

Was this truly thoughtful, or the easy way out?

This poem captures a feeling many holiday shoppers know well: the tug-of-war between wanting to be thoughtful and needing to be practical, especially in the final days leading up to the holidays.

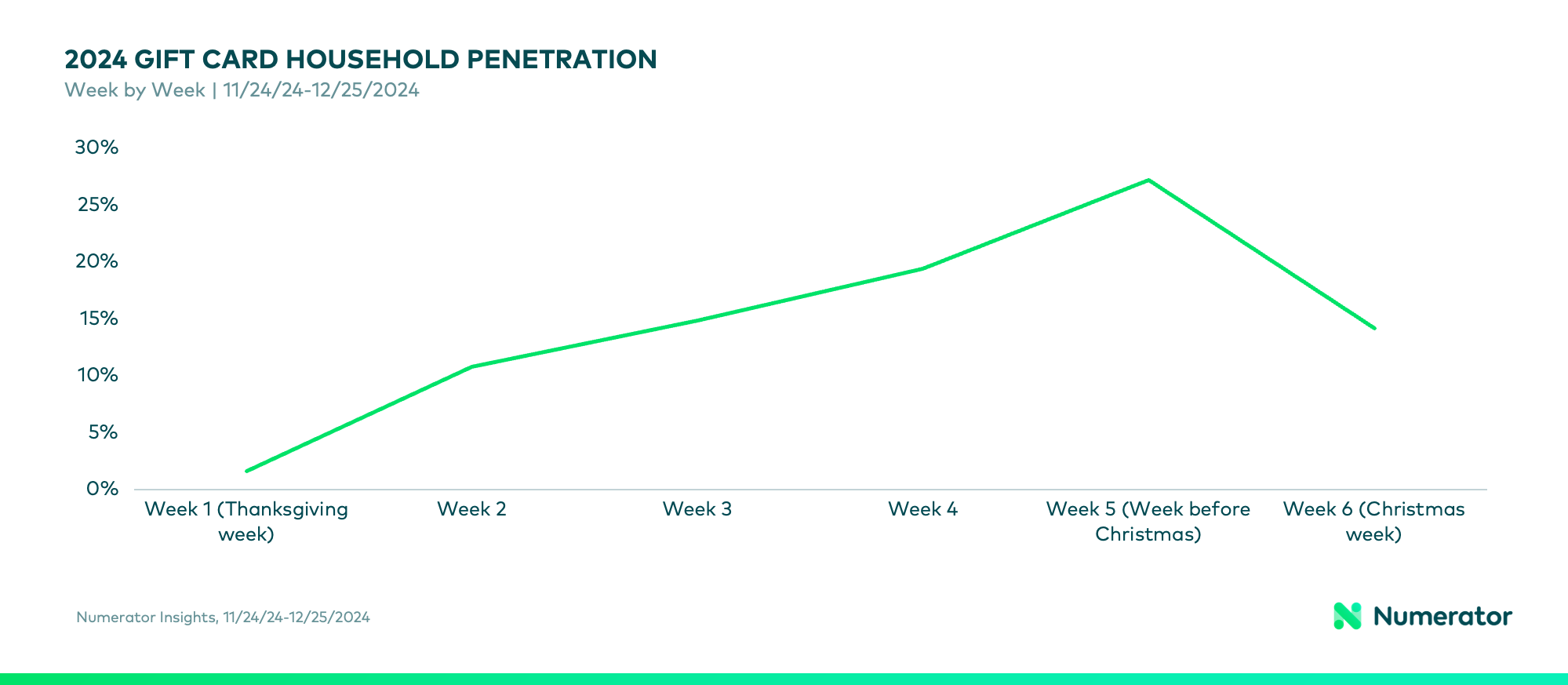

Purchase Data: The unsurprising spike in gift card penetration

As our consumer purchase data shows, that tension is exactly why gift cards continue to shine this time of year. The days leading up to Christmas are consistently the peak gifting window for gift cards— a time period when the emotional stakes are high and the clock moves just a little too fast.

Gift cards are consistently the top gift that many consumers plan to give for Christmas— this year, 72% of consumers who intend to celebrate Christmas plan to give a gift card as a gift.

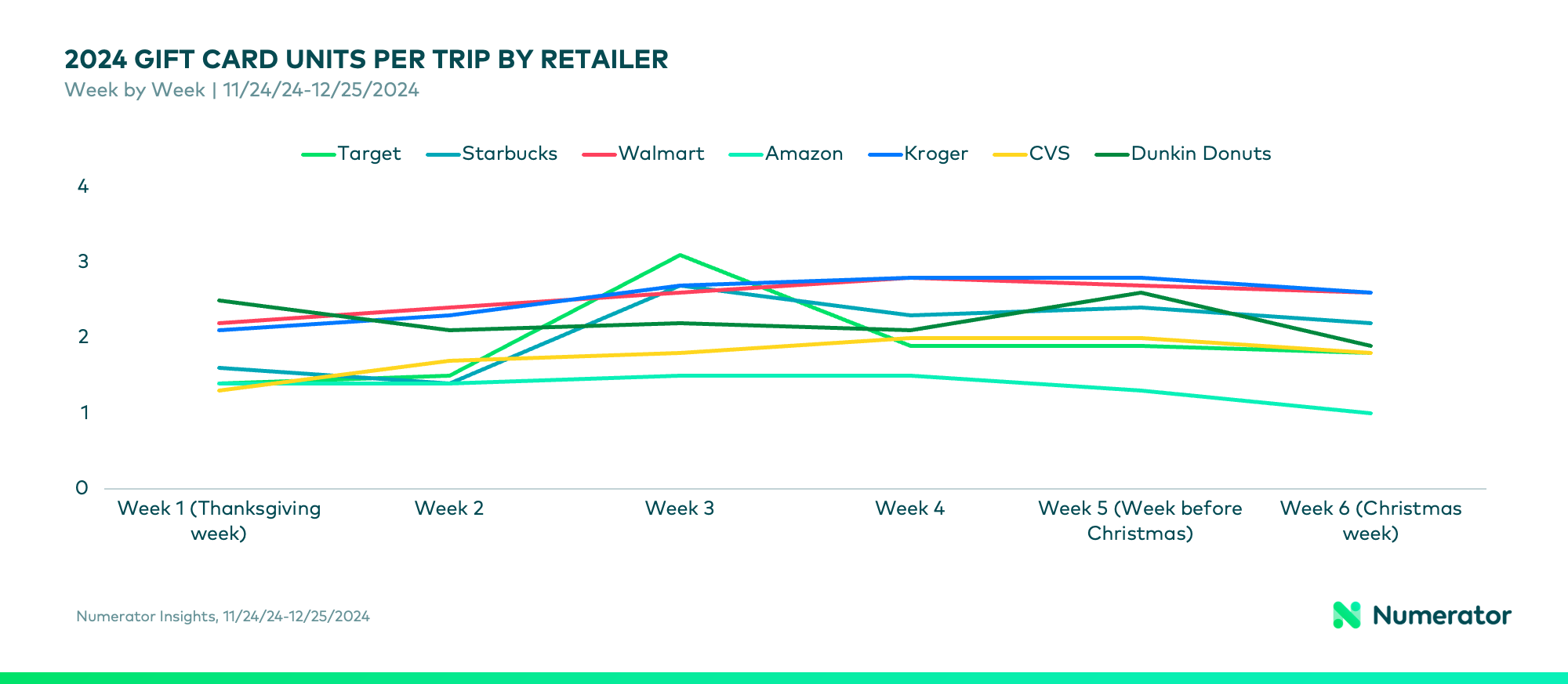

Not only do shoppers turn to gift cards more frequently that week, but some retailers see spikes in the number of cards purchased in a single trip. Target and Starbucks, in particular, experience a sharp uplift during Week 3 of December, likely driven by teacher gifts, coworker exchanges, and pre-holiday gatherings where small tokens of appreciation are customary.

This behavior reveals something deeper about holiday shoppers: gift cards allow consumers to recognize each other and connect easily when the holiday season is at its busiest.

Verified Gift Card Buyer Feedback: More than an ‘easy’ option

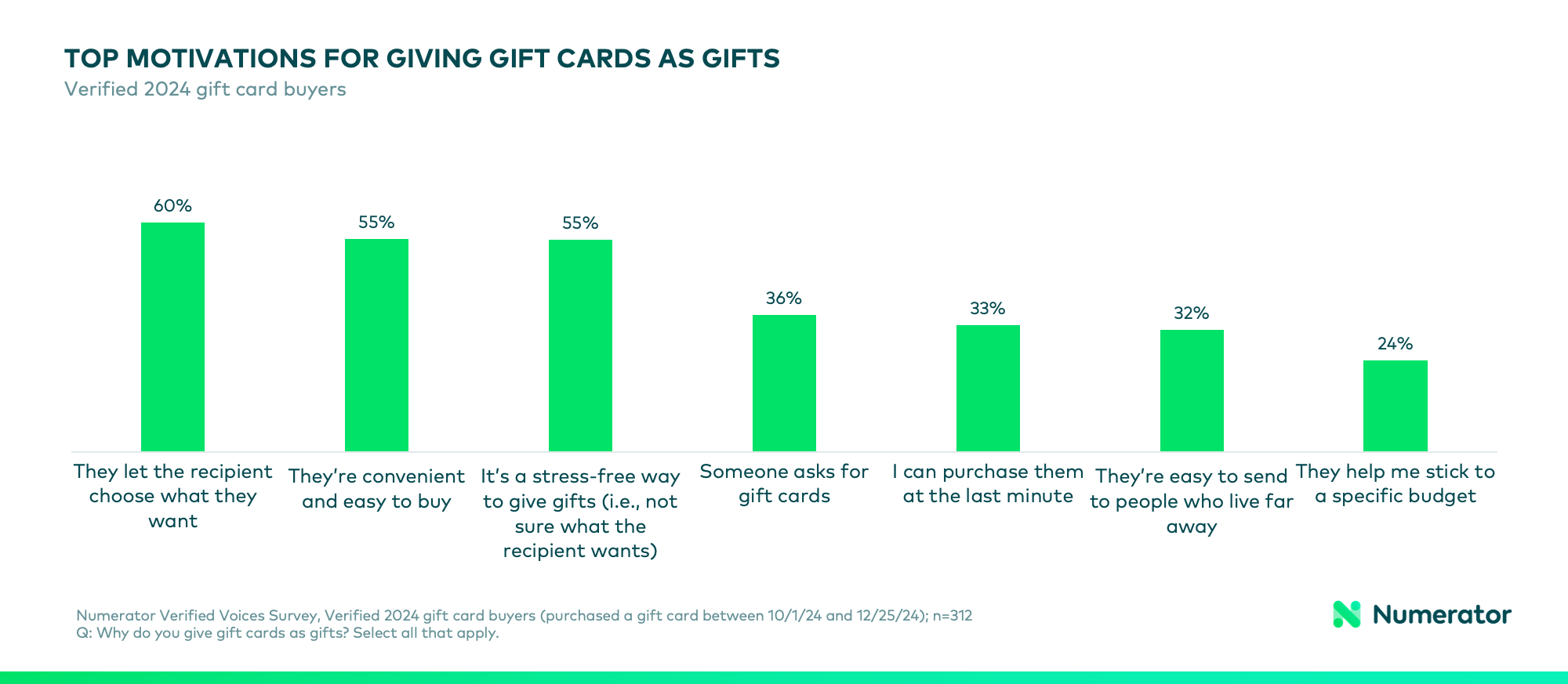

It’s tempting to think shoppers grab a gift card because they’ve run out of time. But the data — and the sentiment of verified 2024 gift card buyers— tell a richer story. Buyers see gift cards as:

- Stress-reducing (“I don’t have to worry about picking the wrong thing”): 55%

- Flexible (“The recipient can choose what they truly love”): 60%

- A good experience for both giver and receiver: 55%

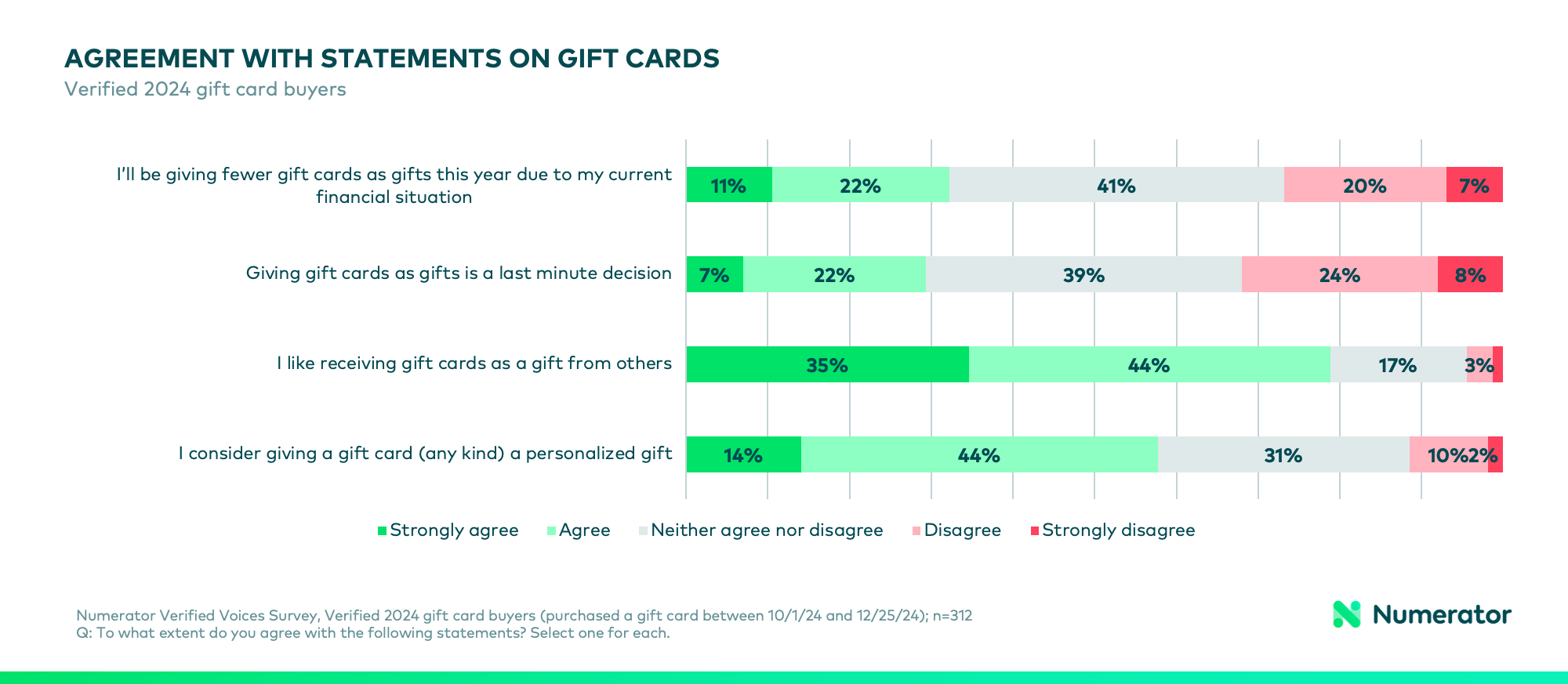

They also reject the idea that gift cards are impersonal. In fact, most shoppers consider them a personalized gift to give and to get, not simply a last-minute fallback.

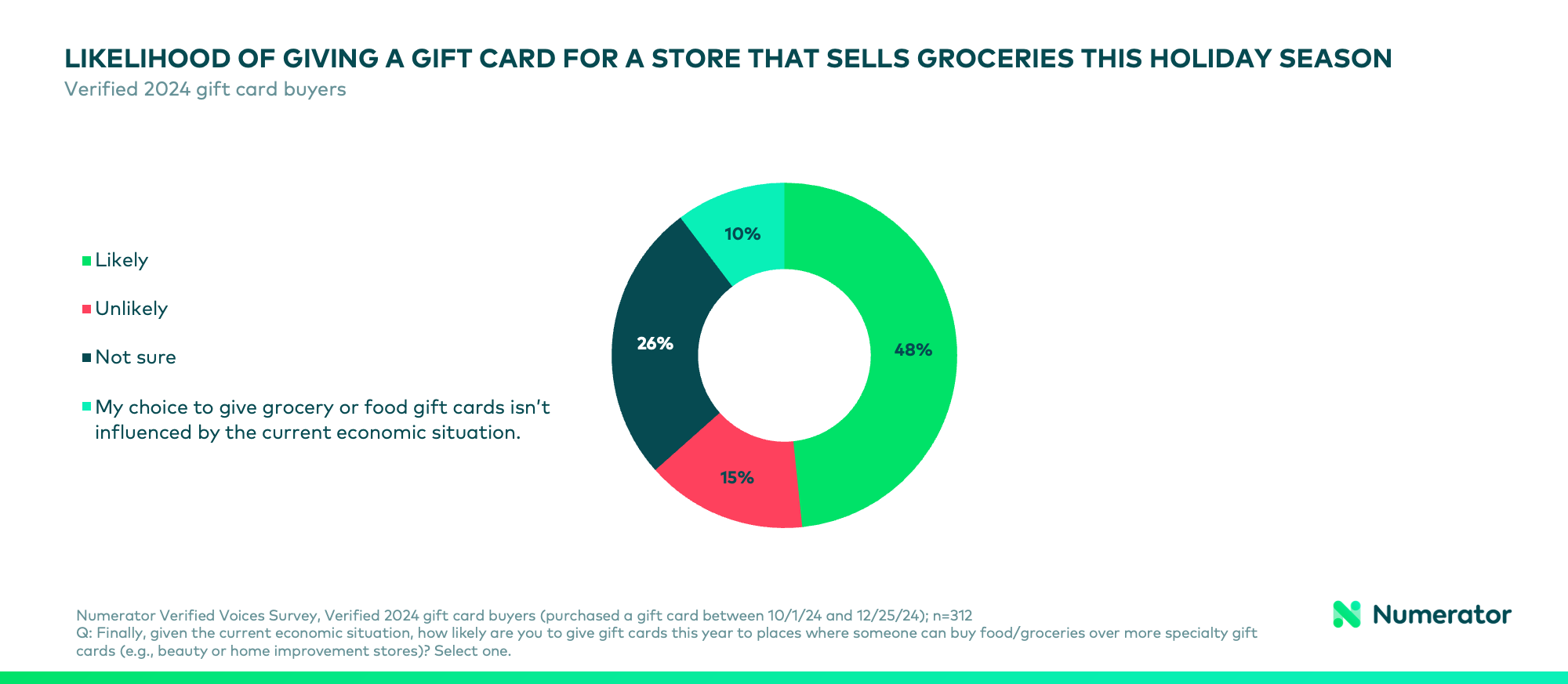

Consumer confidence in the economy remains at a four year low, which is impacting gift card buying behavior: some consumers plan to gift some financial relief for the holidays. Almost half of verified 2024 gift card buyers (48%) say they are likely to give gift cards this year to places where someone can buy groceries. Over 1 in 4 (26%) remained undecided on whether they’d give a gift card to a store that sells groceries.

Verified Gift Card Buyer Feedback: Finding meaning in flexibility

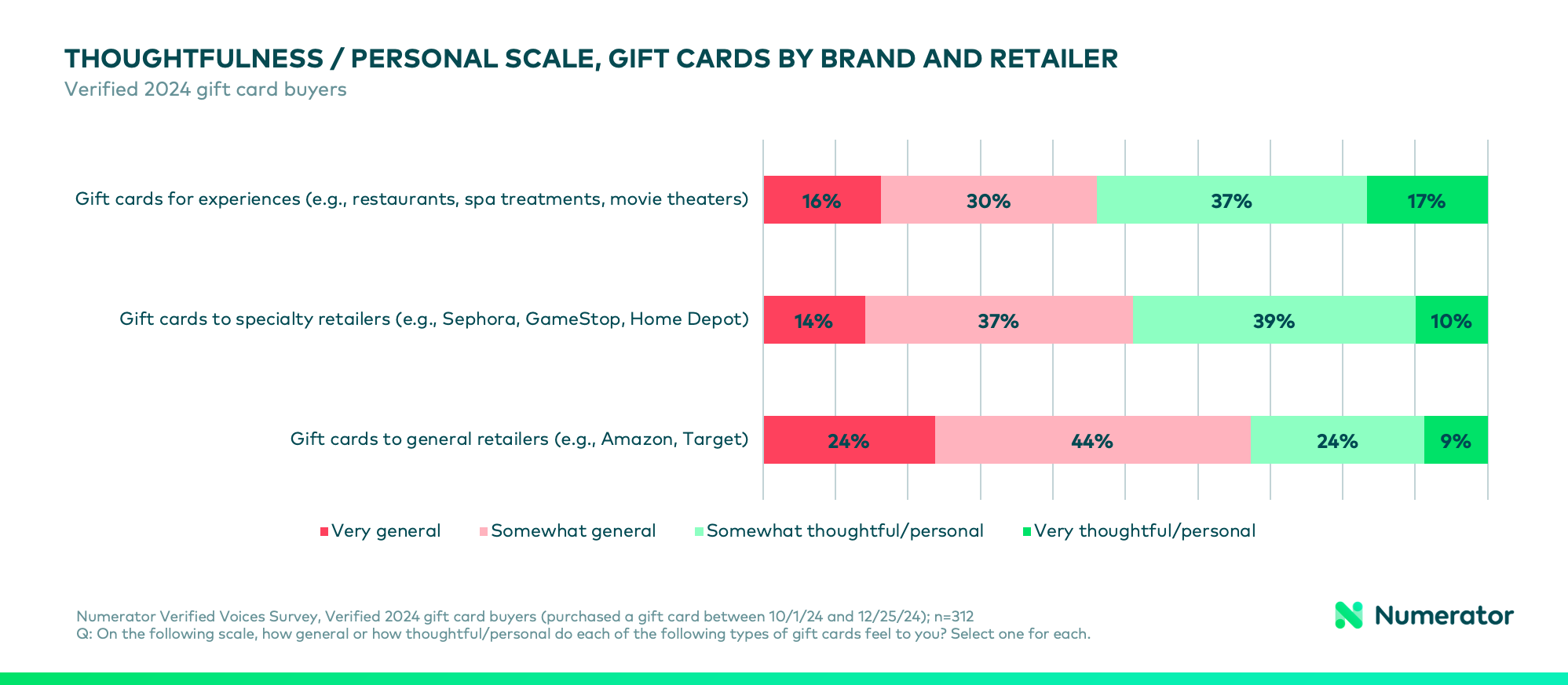

Among the wide range of gift card types available in stores and online, shoppers have clear perceptions about what feels meaningful:

- Experience-based gift cards (restaurants, salons, movies) are seen as the most thoughtful

- Specialty retailer gift cards (beauty, gaming, home improvement) strike a balance between personal and practical

- Big box or Amazon-style cards are viewed as more general — but still hugely valued for their flexibility

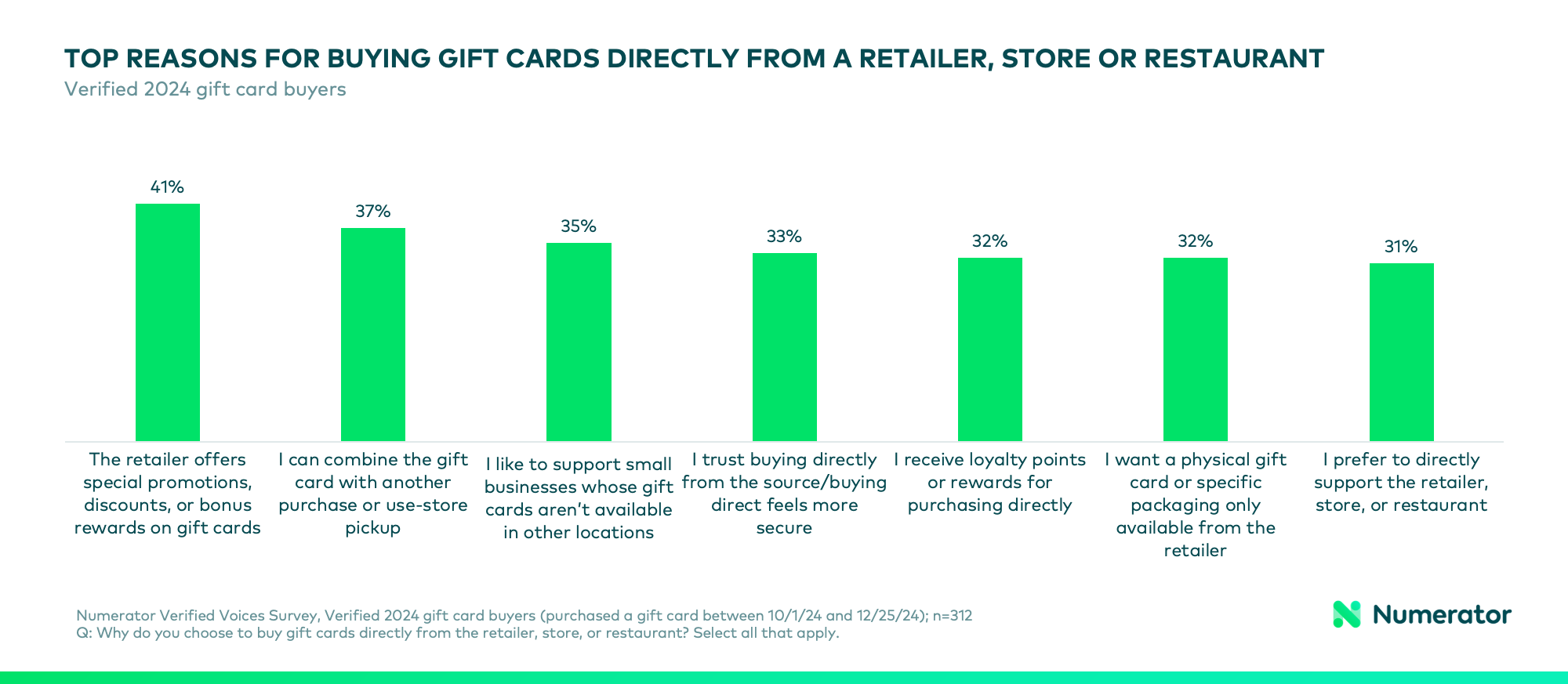

Verified Gift Card Buyer Feedback: Gift cards as drivers of retailer choice

Since big box retailers often carry dozens of third-party options, shoppers can personalize the gifting experience even within a single store trip. Because gift cards are sold online, at mass retailers, drug stores, grocery stores, restaurants, and even convenience stores, the decision of where to buy becomes an exercise in retailer choice.

Shoppers may choose a store because:

- They’re already running errands there (37%)

- It carries multiple brands in one spot (32%)

- They trust the retailer to provide a good selection of valid gift cards (33%)

- They can buy both physical gift cards for a more tactile gifting experience (32%)

- There are bonus-card incentives that stretch their budget (32%)

In other words, the retail environment serves its own purpose as part of the gifting experience, ensuring that shoppers can buy the gift cards for the brands they want in the format they want.

At the end of the day, the doubts in our poem resolve into a familiar truth: Gift cards are meaningful because they allow shoppers to give something the recipient truly wants. In a busy, often stressful season, flexibility can be its own gift.

Ready to unwrap more holiday insights?

Numerator provides the most comprehensive view of consumer purchase behavior— across all retail channels and categories— with the ability to quickly and accurately survey consumers based on their verified purchase behavior to understand why consumers make the purchases they do. As we wrap up the 2025 holiday season and retailers and brands begin their 2026 planning, understanding how your stores or brands performed compared to competitors and the why behind your verified buyers’ purchases they did is a great start. Drop us a line to learn more.