The onset of the COVID-19 pandemic caused a dramatic upswing in online sales, with online spending growing 51% in 2020. General Merchandise (GM) categories specifically saw 32% growth last year, a notable boost for a sector already popular among online shoppers well before the pandemic. And everyone wants to know: as consumers gradually resume their pre-COVID activities, is the surge in this sector here to stay?

To help answer this question, Numerator dug into our omnichannel consumer panel data to review the attitudes and behavior of consumers who made verified online purchases across several GM categories: Electronics, Home Improvement, Housewares, and Toys & Games. Understanding who the new buyers are behind this online growth, as well as how their spending patterns may change in the months ahead, will be essential for GM retailers hoping to retain them.

COVID Drives eCommerce Conversion Across Demographics

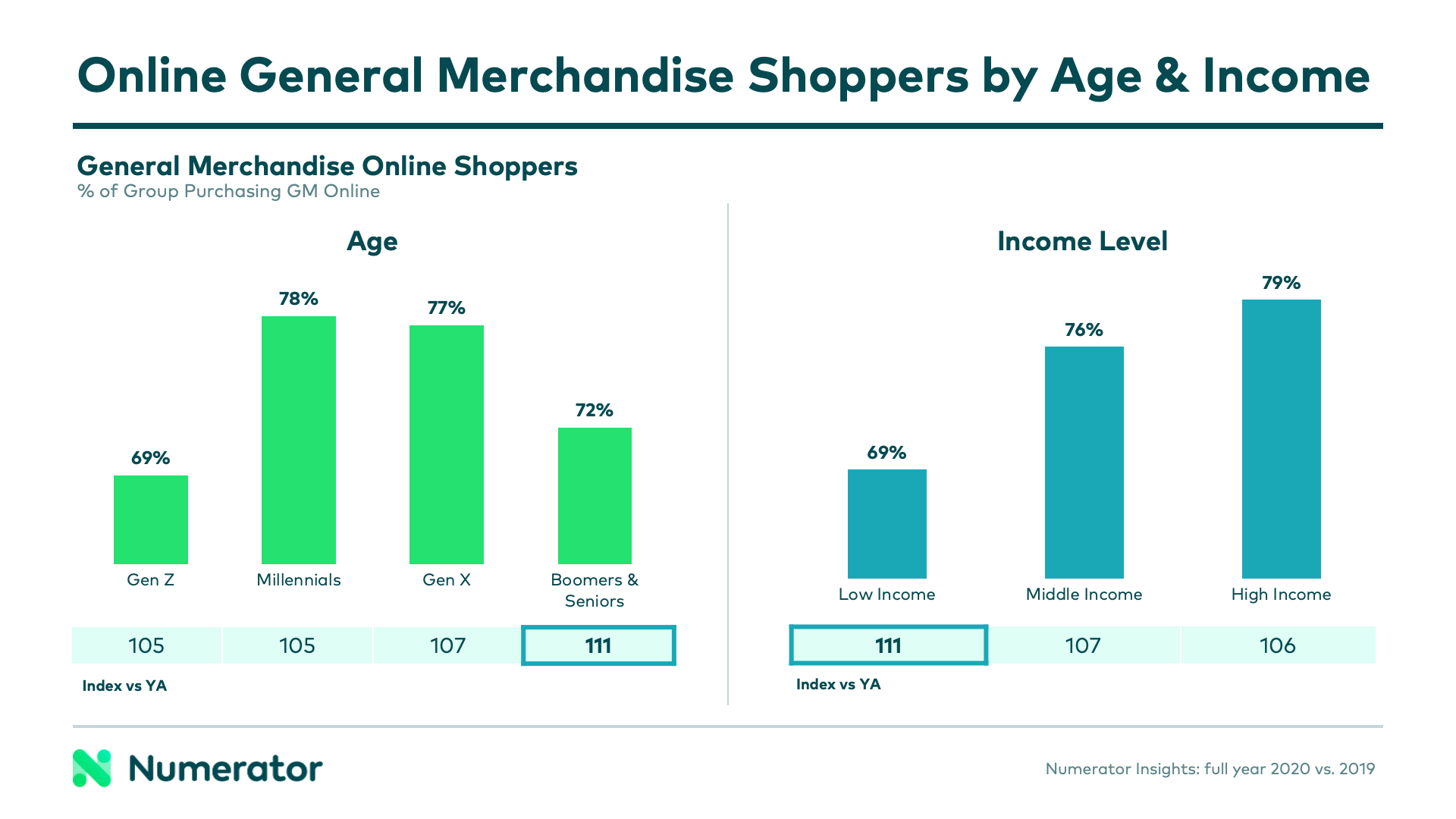

Who made the shift to online shopping over the last year? While a wide breadth of consumers across all demographic segments increased their online shopping, older and low-income households were the fastest converts to ecommerce. This was a significant shift among a group of consumers historically more reluctant to shop online.

The shift to online shopping opened up opportunities for GM retailers across several demographic segments. Mass retailers Target and Best Buy saw their online trips soar across all ages and income levels, even capturing some of Amazon’s shoppers. As a result, the GM sector continued to build on its previous online success.

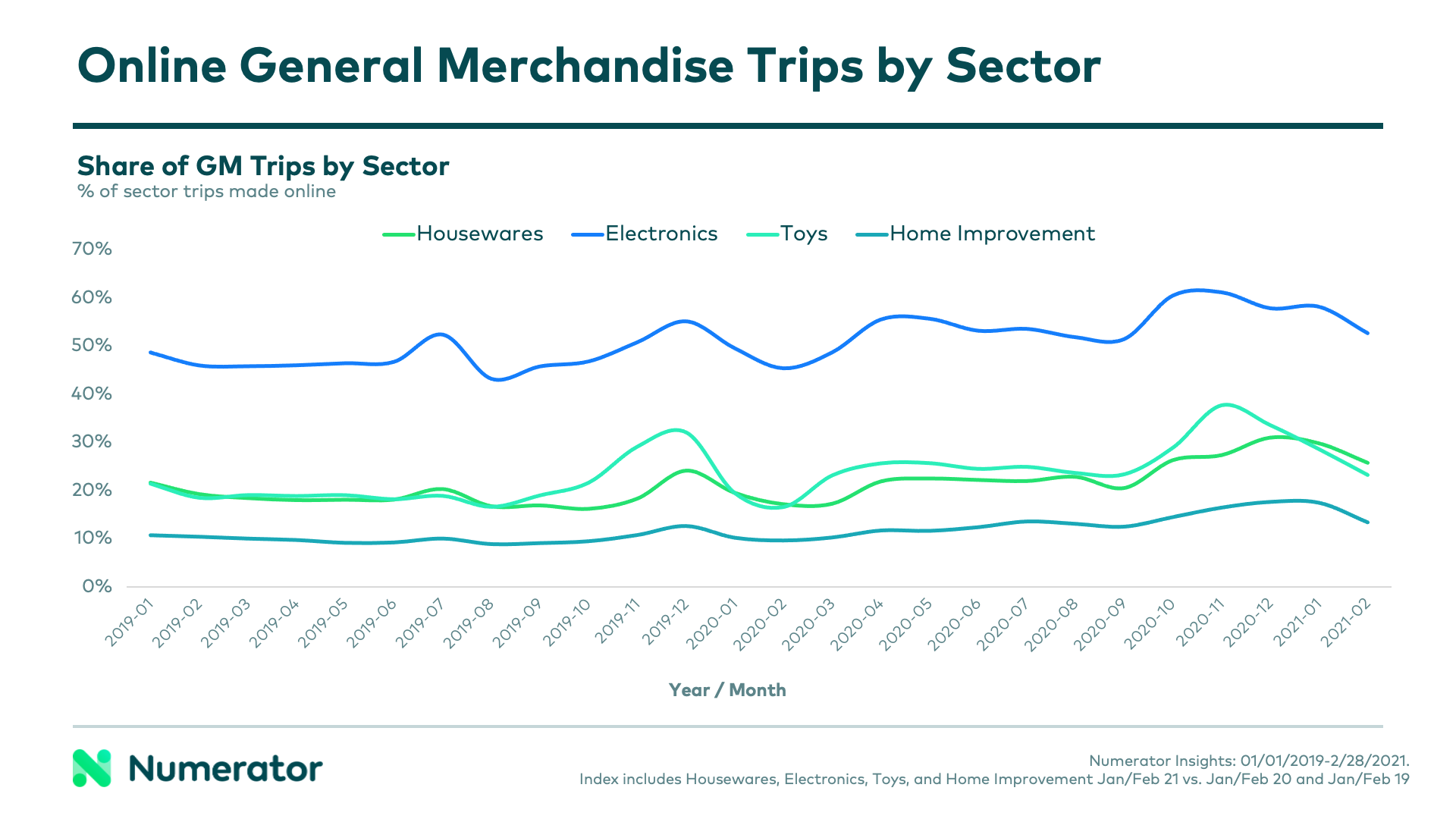

General Merchandise Online Winning Streak Sticks

After a steady rise in past years and a 2020 pandemic boom, online trips remain high for General Merchandise categories in 2021, indicating lasting change and a new normal for the sector. However, the degree of “normal” will differ by category. To date in 2021, buyers of Housewares and Video Games have continued pursuing online avenues for their purchases, while buyers of high-end Electronics and Toys are beginning to move back to brick-and-mortar stores. Home Improvement buyers fluctuate depending on the item; tools tend to be more popular online purchases, while paints and primers are more often bought in-store.

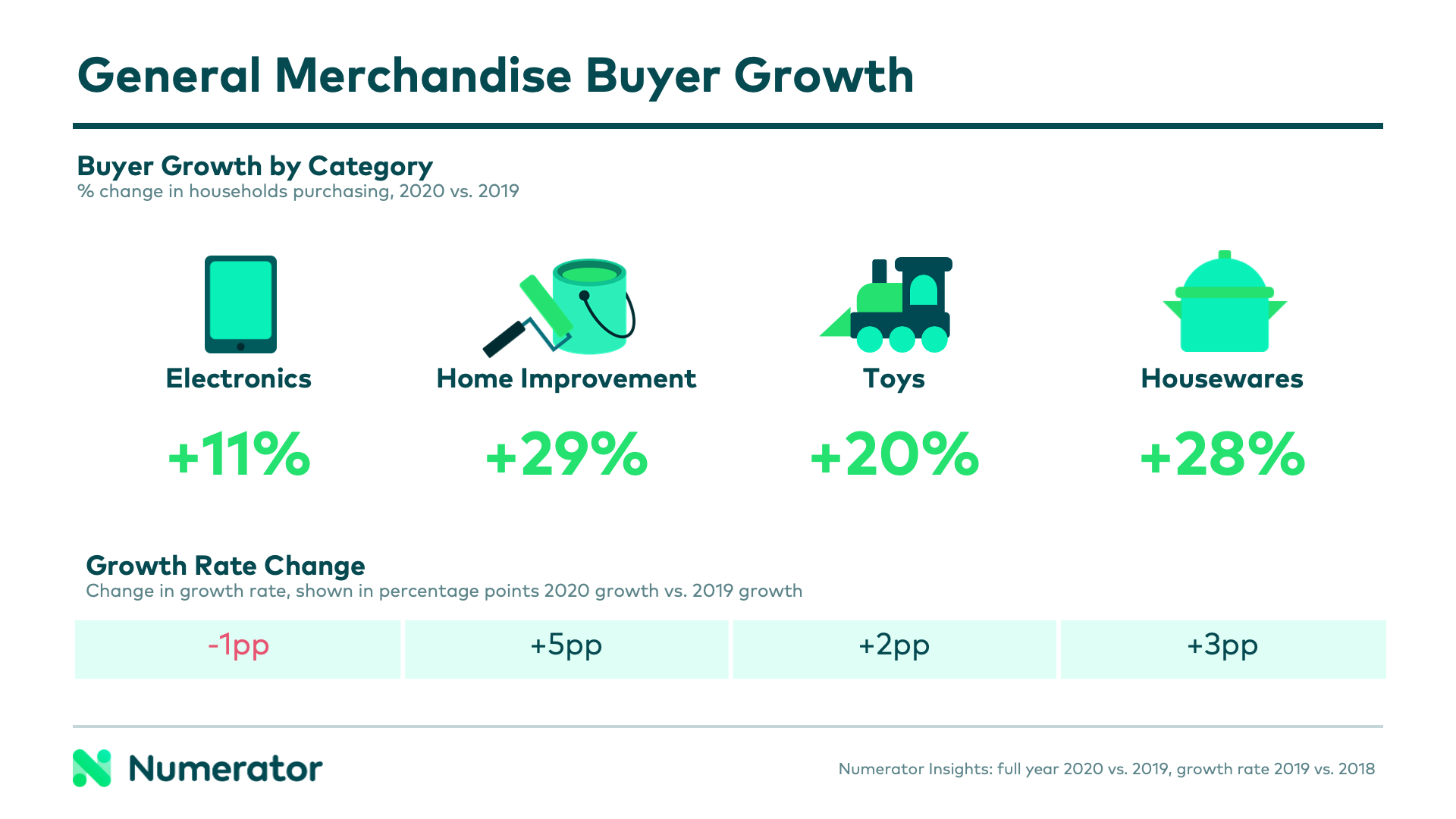

New shoppers Shake Up the General Merchandise Scene

While existing buyers increased their online trips, an influx of new online buyers became a key source of steady sales growth in GM categories in 2020. Electronics, which were already heavily purchased online, saw the lowest number of new buyers with 11% growth, while Home Improvement and Housewares each saw online buyers increase nearly 30% in 2020 vs. 2019.

These new arrivals to the online scene brought with them new perspectives, including a general preference for in-store shopping versus online. New online GM buyers were 20-57% more likely to characterize online shopping in general as “not enjoyable” compared to the average shopper; this varied across groups, with new electronics buyers holding the least favorable view of online shopping. This affinity for brick-and-mortar stores suggests a greater likelihood that they’ll return to in-store shopping post-pandemic, though it’s unlikely to happen quickly.

In fact, the switch back to brick-and-mortar is likely to be a slow one for all shoppers. Nearly 80% of consumers surveyed across all GM categories expect their online spending to either increase or remain the same over the next year.

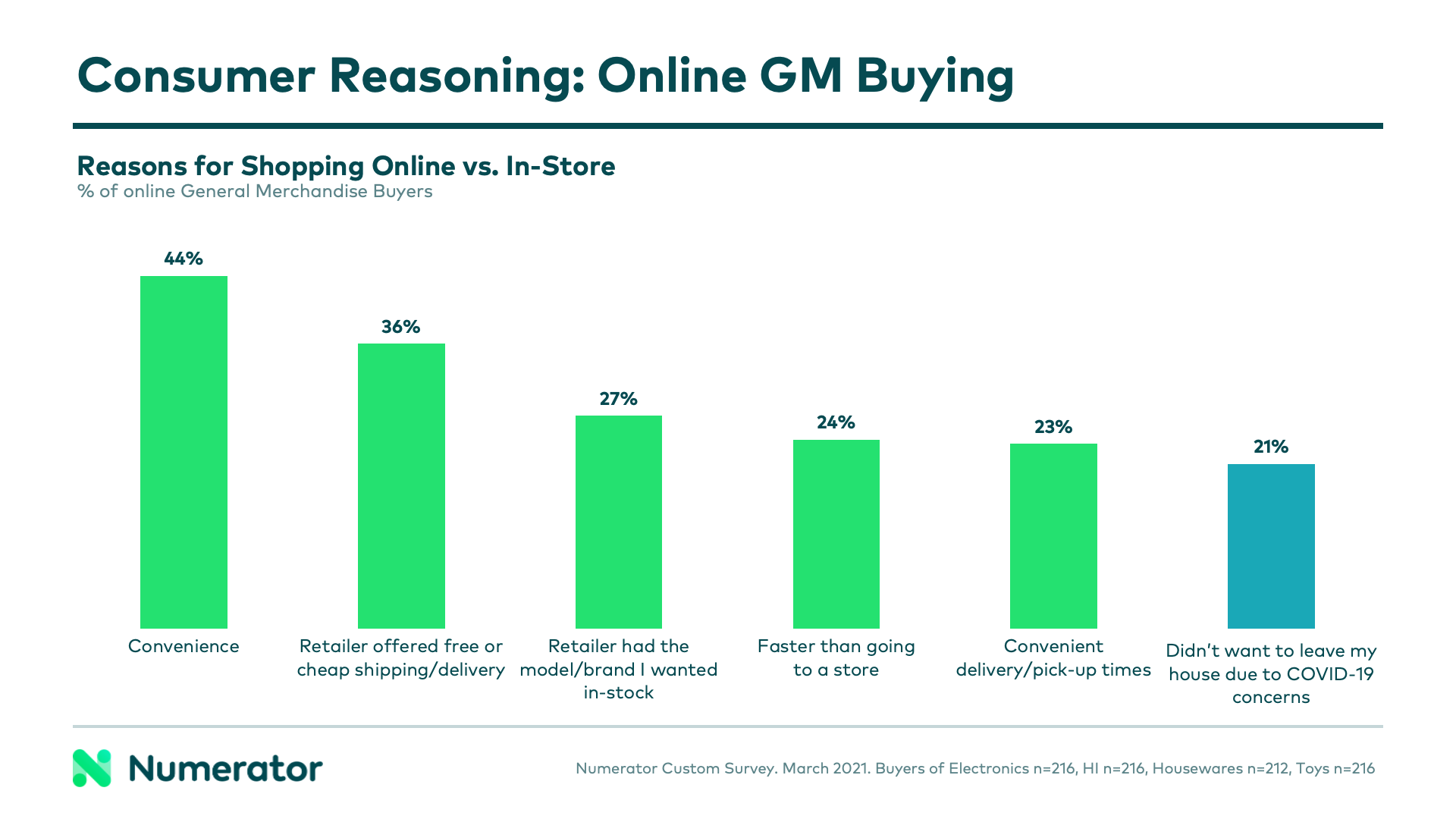

Convenience Keeps Consumers Online Post-COVID

COVID may have driven consumers online in 2020, but 44% say it’s convenience that keeps them there today. To keep pace with the ongoing demand, GM retailers will want to stay focused on competitive pricing, product availability, and an effortless experience in order to retain the new online shoppers they’ve gained. Perks such as free shipping and shortened delivery times will also resonate with consumers. Continuing to invest in Buy Online, Pick-up in Store (BOPIS) options will also be worthwhile. This alternative could help bridge the gap as consumers slowly return to their regular pre-COVID routines.

Looking Ahead

Given the appeal of online shopping, the GM sector is likely to continue seeing elevated ecommerce sales for the foreseeable future. As shoppers adapt to a post-COVID routine and return to in-store behaviors, retailers will need to tailor their strategies to fit consumers’ current needs and preferences.

For more information on this topic and additional views into GM’s shift online, download the full report: General Merchandise Online Growth During COVID. To learn more about how your specific brand or category has been impacted by omnichannel shifts, contact your Numerator Customer Success Representative or get in touch with us.