As the new year begins, many consumers participate in Dry January, a month-long commitment to abstain from alcohol. What began as a personal wellness challenge has evolved into a broader behavioral shift, with alcohol’s share of total beverage sales declining each January and rebounding more slowly than in years past. This change is driven not only by Dry January participants but also by heavier alcohol buyers reconsidering their long-term drinking habits.

To understand what’s behind this shift and whether it extends beyond January, Numerator surveyed more than 500 households that recently purchased beer, wine, ready-to-drink cocktails, or spirits. The study explores motivations for participation, changes in purchasing behavior, and the potential for lasting impact on beverage portfolios, occasions, and category mix throughout the year for alcohol brands.

How has Dry January Participation Evolved?

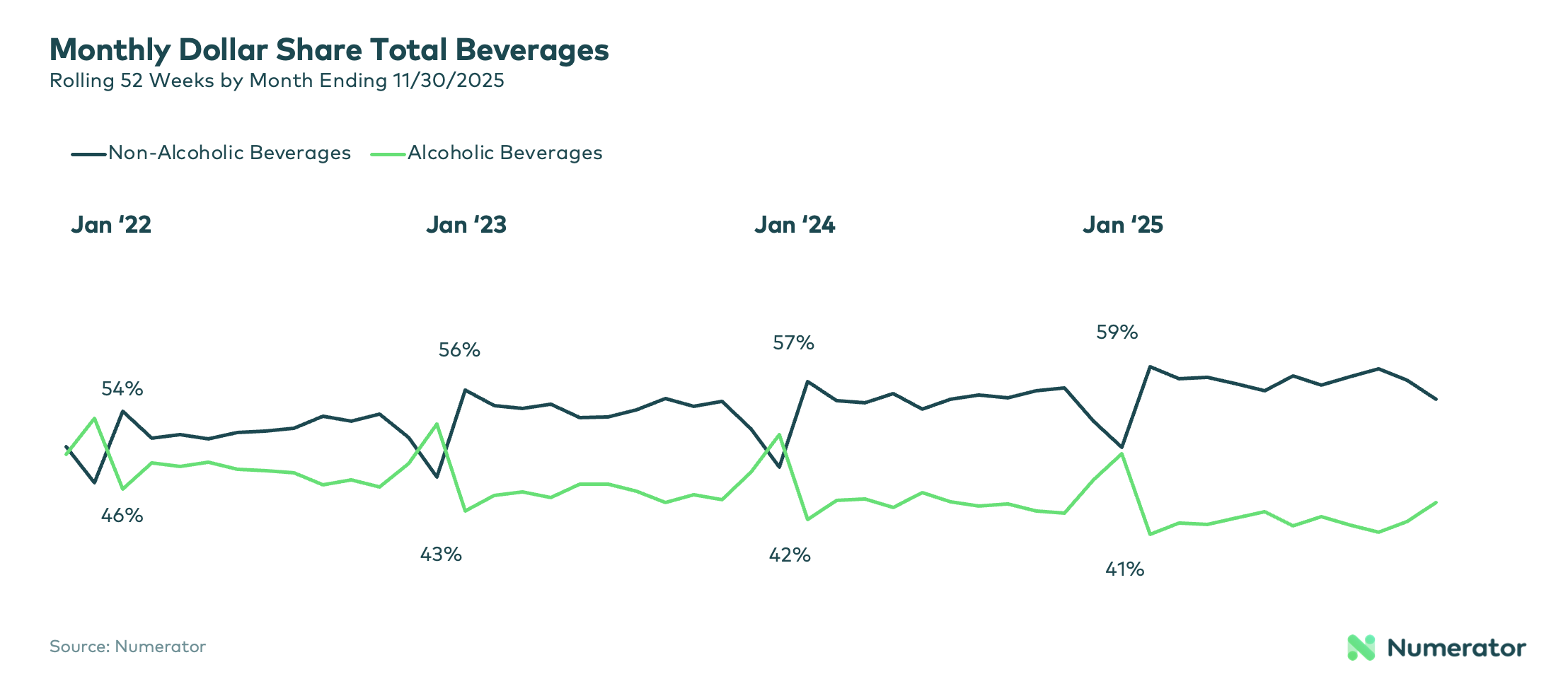

Over the past three years, Numerator has found that alcohol beverages have seen a consistent decline in share during January, down three percentage points overall, signaling a sustained lifestyle shift rather than a temporary post-holiday reset. This decline follows an already softer December, a slower rebound in the months that follow, and a widening gap between alcoholic and non-alcoholic beverages. Alcohol’s share of total beverage sales has steadily fallen from 46% in January 2022 to 43% in 2023, 42% in 2024, and 41% in January 2025, with a three-year average share of 44%.

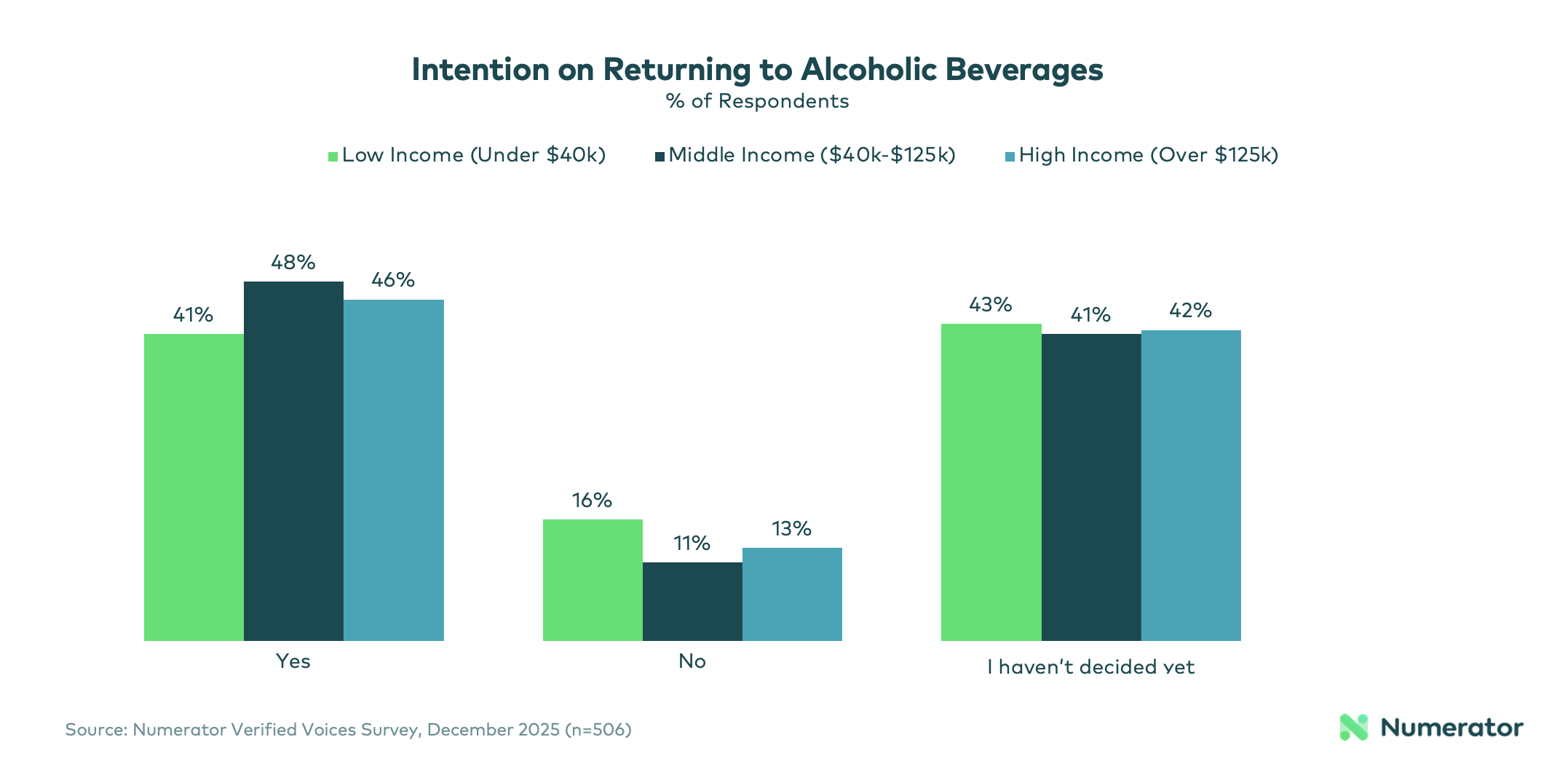

Looking ahead to 2026, Dry January participation is expected to grow, with more than one in four alcohol buyers planning to participate. Notably, 43% plan to join in for the first time. Over half (57%) are repeat participants, with the majority of repeaters (nearly nine in ten) successfully reducing or eliminating alcohol consumption during prior attempts. While nearly half of participants plan to return to alcohol after January, these patterns suggest evolving consumer expectations around moderation, balance, and choice post-event. For alcohol beverage brands, Dry January underscores the need to rethink portfolio strategy, occasion-based marketing and the role of low- and no-alcohol options to remain relevant throughout 2026.

Who Participates in Dry January?

Who joins in on Dry January carries meaningful implications for beverage alcohol brands. Numerator’s demographic data indicates they are more likely to be Millennials or Gen X, Hispanic or Asian, and part of larger households with children. Participants also skew significantly heavier in alcohol purchasing than the average buyer, making more than twice as many trips per year (117 vs. 54) and spending substantially more annually ($4,260 vs. $1,284). As a result, Dry January is increasingly attracting high-value consumers whose behaviors can materially impact brand sales.

Motivations in joining Dry January are largely health-driven, with 47% looking to start the year on a healthier and more financially stable note, 32% participating to prove they can abstain, and 30% aiming to save money. These motivations signal that moderation, not elimination, is often the goal. Brands will need to consider what premiumization strategies are in line to drive up spend when frequency declines.

Additionally, 13% plan to cut back on alcohol even after January and 42% undecided about returning. Brands that fail to engage these consumers during and after Dry January risk losing long-term share as habits evolve.

Does Dry January Unlock Opportunities for Other Beverage Categories?

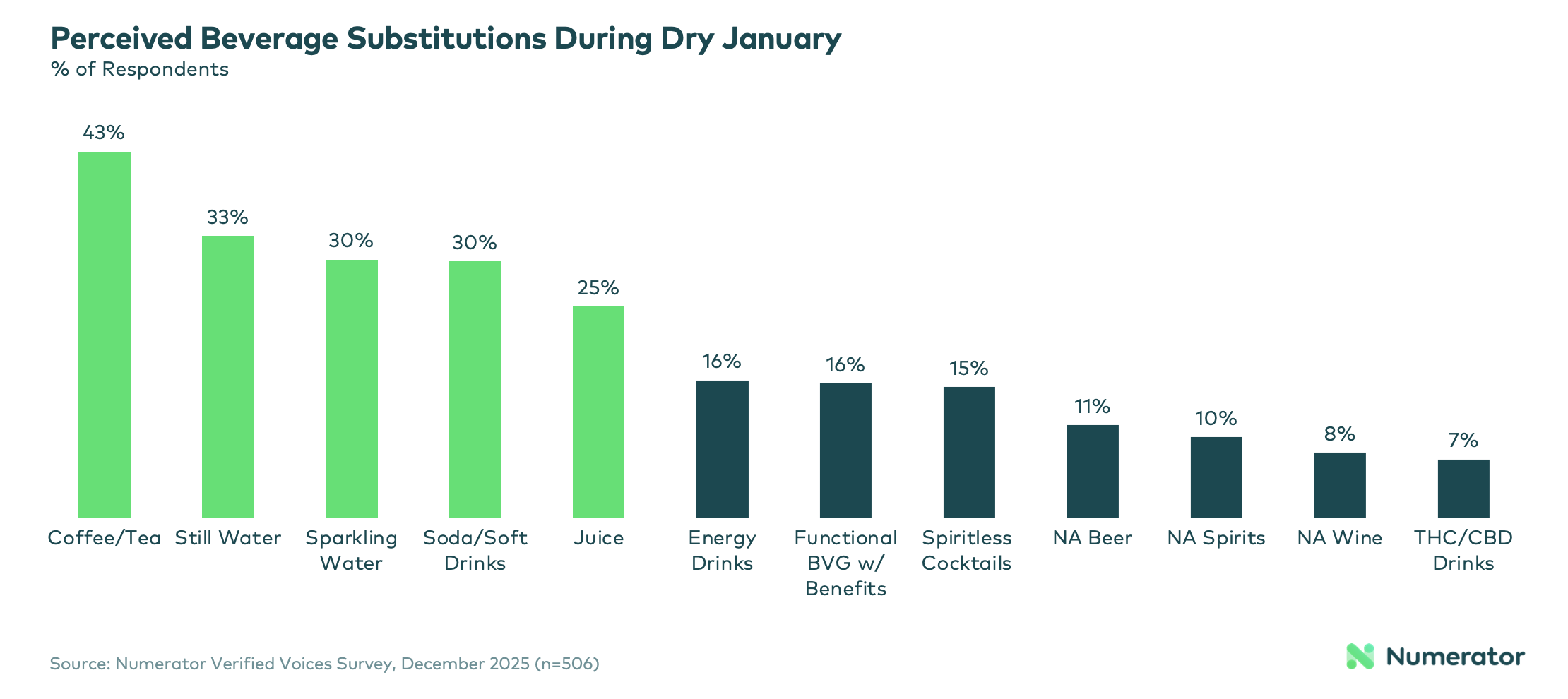

Dry January creates a strong opportunity for functional and non-alcoholic beverages as consumers shift their purchasing behavior and seek alcohol alternatives. In Numerator’s Verified Voices research, more than one-third of participants plan to maintain their usual routines while simply cutting out alcohol, meaning the need for beverage replacements remains. During this period, consumers most often turn to coffee and tea (43%), still water (33%), sparkling water (30%), soda and soft drinks (30%), and juice (25%).

These categories have consistently gained share of total beverage sales each January as shoppers prioritize healthier, non-alcoholic options over the past three years. The shift presents a meaningful opportunity for brands to align with wellness-driven resolutions and capture incremental demand. The opportunity extends beyond January as many participants plan broader lifestyle changes, including exercising more (39%), eating out less (23%), purchasing non-alcoholic beverages for occasions where they previously consumed alcohol (21%), and shifting the types of social activities they engage in (21%).

Beyond physical wellness, nearly three in ten consumers say they plan to participate in a “no-spend” month or focus on budgeting as inflation takes hold. For beverage alcohol brands, this shift highlights the need to stay relevant during Dry January rather than disappearing from the occasion. Emphasizing low- and no-alcohol options, supporting moderation, and aligning messaging with wellness and everyday routines can help brands maintain connection with consumers and capture demand that increasingly extends beyond January.

Dry January’s Impact Among Key Cohorts: Are There Additional Lifestyle Changes?

Dry January participation and behavior shifts can vary significantly by demographic group. Numerator data shows that among Gen Z and Millennials, 33% plan to participate in Dry January and many also plan to return to alcohol, but their January behaviors differ notably from the general population. Nearly half (49%) are more likely to purchase THC, CBD, or tobacco products, 29% are more likely to buy non-alcoholic alternatives, 18% plan to exercise more, and 16% expect to change their social activities to include fewer alcohol-focused occasions.

Gen X consumers show a different pattern, with 11% more likely than the general population to maintain their current lifestyle while simply cutting out alcohol. Boomers skew even more toward minimal change, with 48% more likely to change nothing about their lifestyle other than eliminating alcohol during January, though 12% may increase purchases of non-alcoholic alternatives.

Hispanic consumers show similar behavioral shifts but are less likely to return to alcohol, with 34% planning to participate in Dry January, 53% more likely to eat out less, 37% more likely to consume CBD products, and 28% more likely to change social activities to reduce alcohol presence compared to the general population.

Lower-income households may be the most impacted, with 30% planning to participate in Dry January; within this group, consumers are 41% more likely to consume more CBD products, 33% more likely to consume more THC products, and 17% plan to reduce social activities to avoid alcohol-heavy settings.

For beverage alcohol brands, these segment-specific shifts reinforce the need for differentiated strategies. Tailoring messaging, formats, and portfolio offerings by age, income, and ethnicity can help brands stay relevant as consumers temporarily or selectively step away from alcohol.

Conclusion

Understanding how Dry January participation is evolving—and how it influences shopping behavior across beverage categories—is critical for brands navigating a changing alcohol landscape. As participation grows beyond light drinkers to include heavy alcohol buyers and varies meaningfully by age, income, and ethnicity, Dry January increasingly reflects broader shifts toward moderation, wellness, and choice rather than a short-term reset.

These behaviors extend beyond January, shaping beverage substitution, occasion usage, and portfolio expectations throughout the year. Brands that adapt by aligning offerings, messaging, and innovation with consumers’ wellness-driven goals and segment-specific behaviors will be better positioned to retain relevance, capture incremental demand, and build long-term loyalty. Reach out to Numerator for a custom analysis to understand how your brand is performing during Dry January and what these trends mean for your portfolio moving forward.