International trade policy has dominated the headlines in 2025, following the Trump administration’s rollout of sweeping tariffs earlier this spring. Subsequent pauses, amendments, and legal challenges have left some of these tariffs in limbo, while others have been implemented to various degrees. As trade discussions continue to evolve, shoppers—and the brands that serve them—are facing and bracing for price hikes, supply chain shifts, and modified consumer behaviors.

Numerator’s Tariff Sentiment Tracker collected survey responses from over 30,000 verified U.S. consumers between April and July 2025, serving as a bi-weekly consumer pulse check throughout the initial 90-day administrative pause. These insights, alongside earlier Numerator Verified Voices surveys on the topic, provide a comprehensive look at the progression of tariff awareness, concerns and reactions this year. *This article was originally published on February 13, with updates on April 10 and September 4, 2025. Unless otherwise stated, all topline figures shared below reflect an aggregate of the 30k Tariff Sentiment Tracker responses collected between April and July 2025.

Five Key U.S. Tariff Figures 2025:

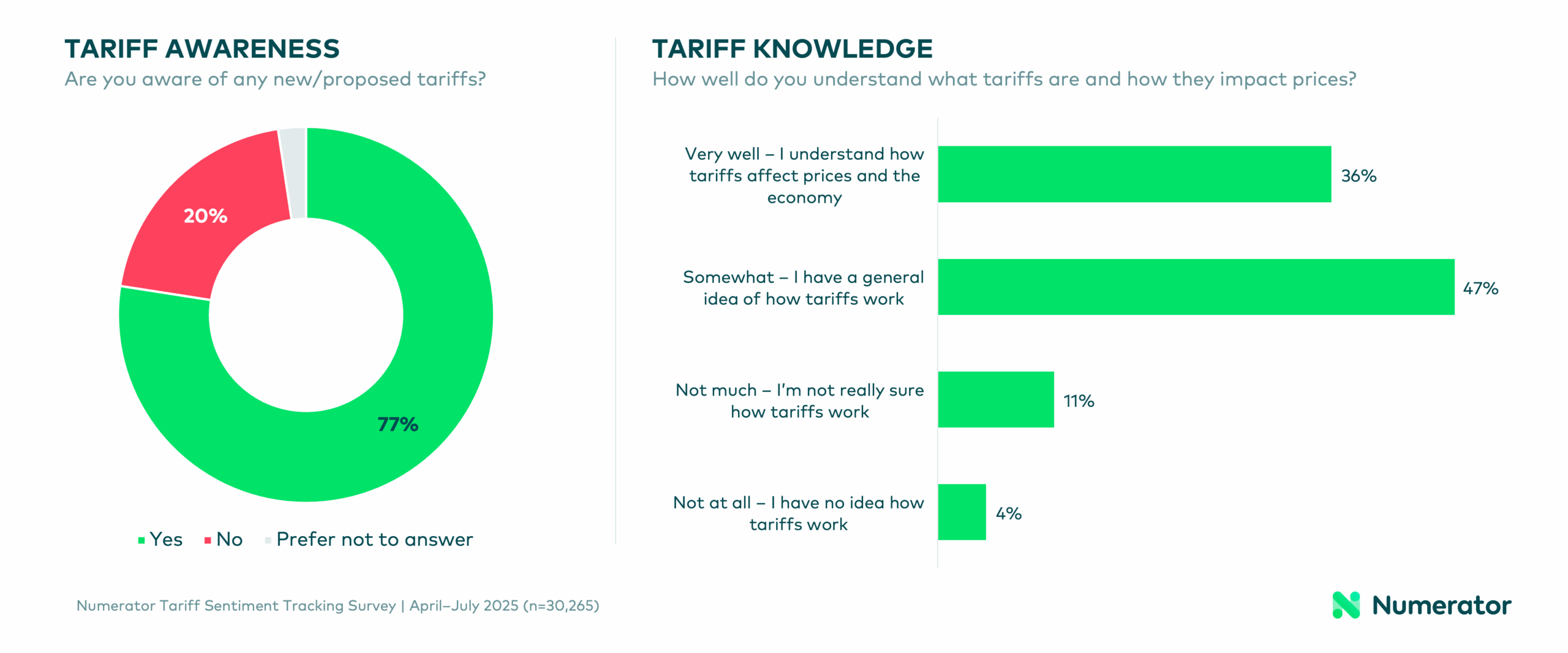

- 77% of U.S. shoppers say they’re aware of new or proposed tariffs

- 87% are concerned about the impact of tariffs on their finances or shopping

- 82% anticipate making changes to their shopping habits in response to tariffs

- 63% are worried about tariffs raising the price of everyday goods

- 42% will look for sales or coupons to offset tariff price increases

Consumers Track Tariffs Closely

What do U.S. shoppers know about tariffs?

Three-fourths of U.S. consumers kept tabs on tariffs this year, with awareness peaking in April following the initial “Liberation Day” announcement, before slowly falling to 71% by early July. Consumers seemed to grow accustomed to tariff updates, tuning out new news as the months progressed and the media focus shifted to new topics. Tariff understanding has been consistently mixed—about a third (36%) of shoppers claim to understand tariffs very well, while half (47%) have only a general idea of how they work and 15% have little-to-no understanding of the issue. Understanding has remained relatively stable over time.

Concern Surrounding Tariff Impacts

Are consumers worried about new tariffs?

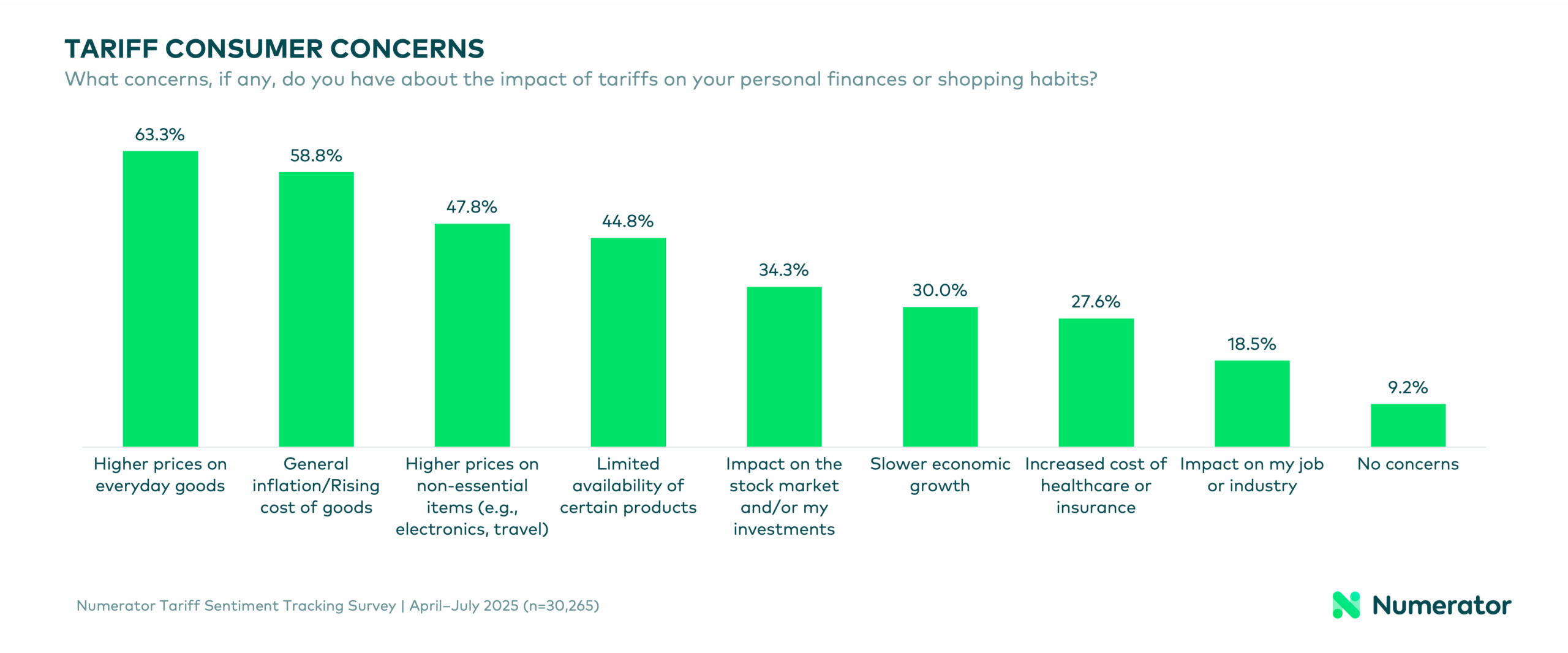

Consumers are feeling uneasy about the financial impact of tariffs. Over four-fifths (87%) express concern about how tariffs will affect their personal finances and shopping behaviors, a figure that’s held steady over time. Rising prices are the top concern; 63% of shoppers are worried about higher prices on everyday goods, 59% about general inflation, and 48% about higher prices on non-essential items. Shoppers also reported worries around limited product availability (45%), the impact on the stock market (34%) and slower economic growth (30%). Apart from stock market concerns, which peaked in April as the market dropped, many of these concerns held steady throughout the duration of our tariff sentiment tracking survey.

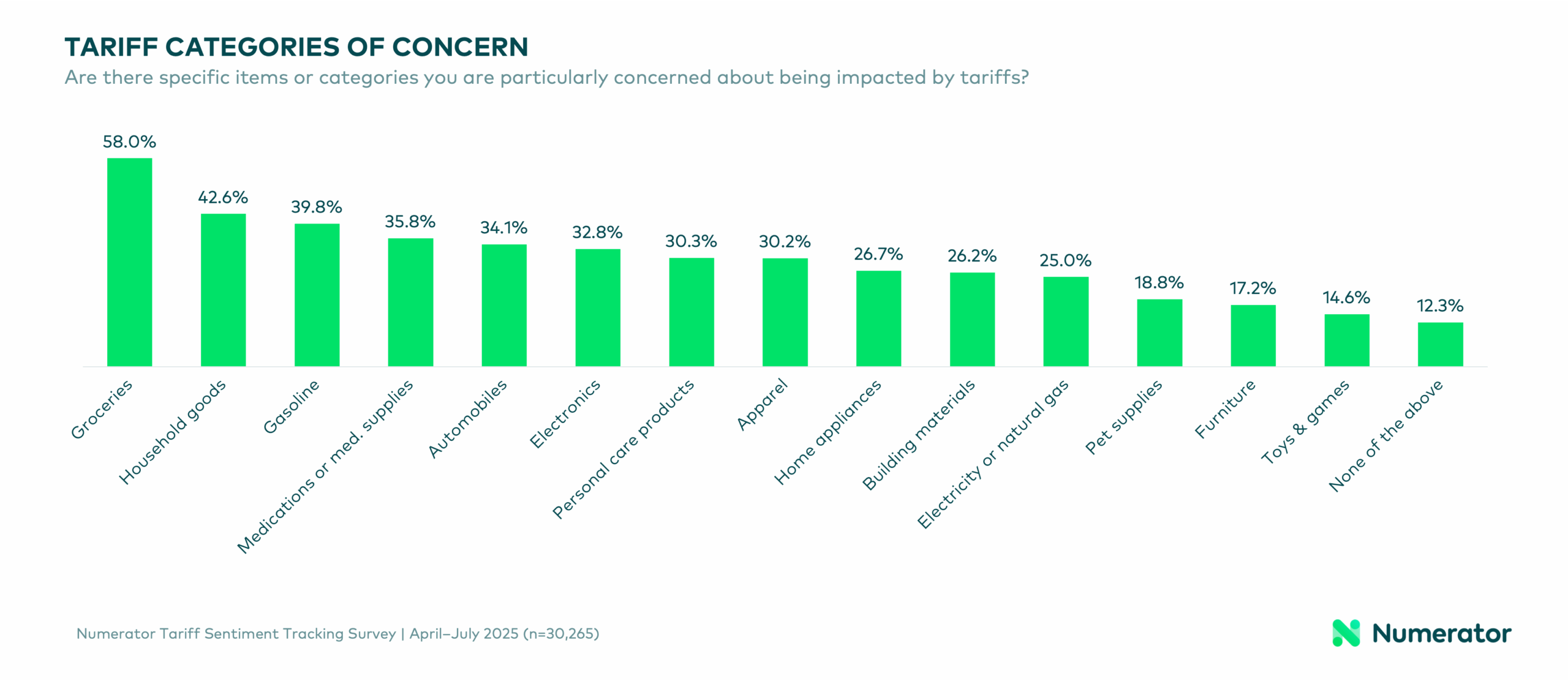

Shoppers worry most about tariff-related price increases in essential categories like groceries (58%), household goods (43%), gasoline (40%) and medications (36%). Pet supplies (19%), furniture (17%) and toys & games (12%) consistently ranked lowest for consumer tariff concerns, despite being relatively more at risk of impact than items like groceries, per Numerator’s Tariff Risk Index.

How do shoppers feel about tariffs and the economy?

As mentioned previously, stock market disruptions were a primary tariff-related concern in April, but stabilized somewhat as the market recovered from its early April drop. However, additional analysis from Numerator’s Economic Research team indicates that broad economic concern remains high. Over half (57%) of U.S. consumers believe tariffs will have a negative impact on the U.S. economy, and 77% are concerned about a recession within the next year.

Consumers are increasingly concerned about the impact of tariffs, both on their own finances and the overall economy. This is not just a partisan issue. Consumers across the political spectrum are becoming increasingly concerned. Changes in consumer sentiment are a leading indicator for changes in purchasing behaviors, and if consumers remain this pessimistic about the future of the U.S. economy, we can expect cutbacks in consumption going forward and a potential recession later this year.” —Dr. Leo Feler, Chief Economist, Numerator. (April 2025)

Tariff-Induced Trade-Offs

How will tariffs impact shopping behaviors?

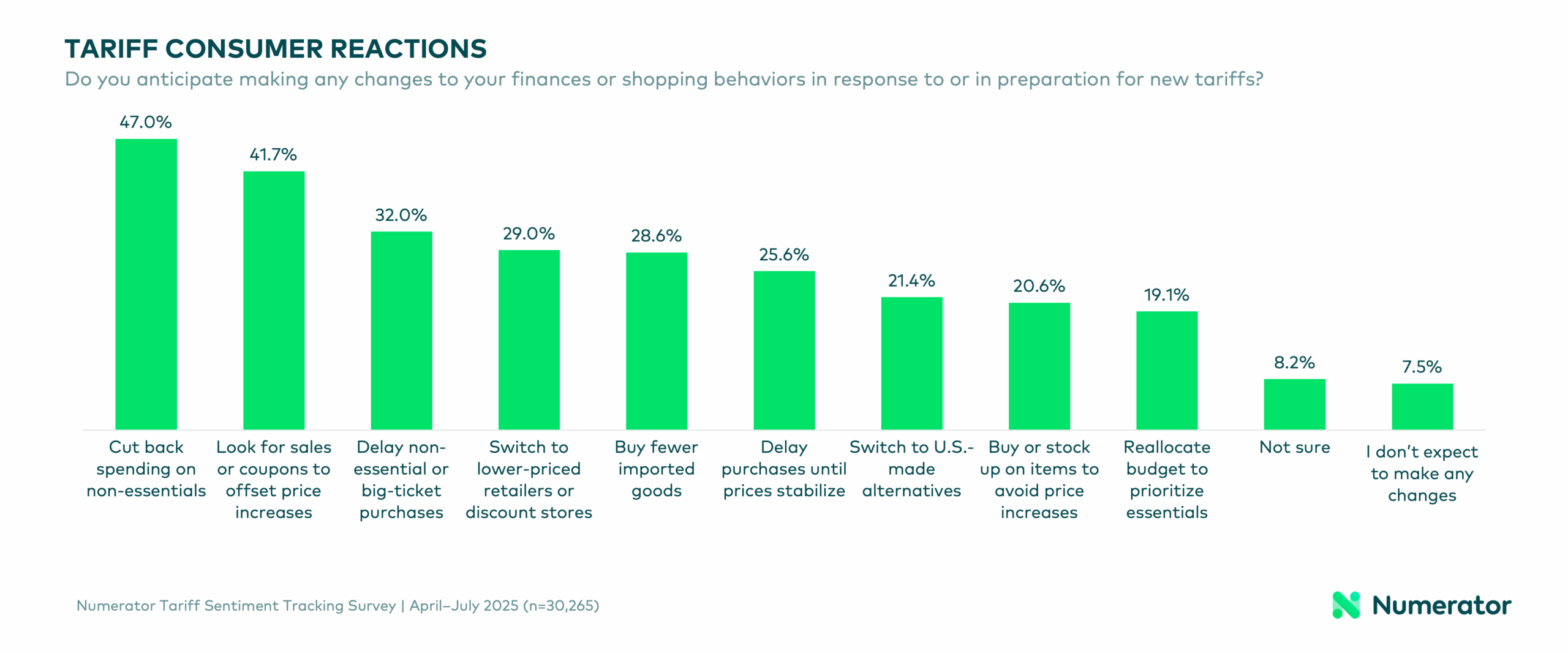

Four-fifths of shoppers (82%) anticipate making changes to their finances or shopping behaviors in response to or in preparation for new tariffs. The most popular reactions are cutting back on non-essential spending (47%), looking for sales or coupons to offset price increases (42%), delaying non-essential or big-ticket purchases (32%) or switching to lower-priced retailers or discount stores (29%). Another 29% plan to buy fewer imported goods, and 21% will switch to U.S.-made alternatives.

Shoppers Torn On Tariff Policy

Do U.S. shoppers support the new tariffs?

Previous Numerator research from earlier this year showed that two-fifths of American consumers (41%) think tariffs in general have pros and cons depending on how they’re implemented, while a quarter (25%) think they’re harmful and just under a quarter (23%) think they’re helpful. Many Americans (60%) also believe opinions on tariffs are largely shaped by political affiliation. Our latest figures from the Tariff Sentiment Tracking survey exemplify this split: 32% support the current tariffs, 22% feel neutral or have no opinion, and 45% oppose. Opinions are stronger on the negative side, with those who “strongly oppose” outnumbering those who “strongly support” 30% to 13%.

Tariff Considerations for Businesses

How can brands, manufacturers and retailers respond to tariffs?

Shoppers are keeping a close eye on prices right now, meaning sudden spikes could drive them to competitors. If price increases are unavoidable due to new tariffs, companies should implement them gradually to minimize consumer pushback. Running targeted promotions or loyalty rewards can also be a bridge strategy to retain price-sensitive shoppers. Companies should consider monitoring sentiment and switching behaviors through surveys and verified purchase data to ensure their strategies are on track, course-correcting as needed. Exploring alternative materials sourcing from non-tariffed countries and evaluating domestic production feasibility will also set up businesses for future tariff resilience.

Keeping Tabs on Trade Policy

As tariff uncertainty lingers, consumer shopping habits will continue to evolve. Businesses that proactively adjust pricing strategies, marketing messages and supply chains will be better positioned to retain consumer trust and minimize revenue disruptions. Whether through smart promotions, highlighting U.S.-made alternatives, or adjusting sourcing strategies, the key to thriving in a tariff-heavy landscape is adaptability.

Although general sentiment has plateaued, major changes to tariff policy have the potential to move the needle again on consumer tariff perspectives. Additionally, more nuanced trends will emerge in specific categories or industries heavily impacted by tariffs, making verified buyer surveys all the more valuable. Numerator is offering a Tariff Instant Survey Template with sector benchmarks for clients looking to go deeper into tariff impacts for their brand or category. Quickly assess how tariffs are affecting your consumers and compare your survey data to sector averages with this survey offering. For more information on how to safeguard your business against tariffs, reach out to our team of experts who can provide you with more targeted insights and recommendations specific to your organization’s needs.