When emerging brands strive to break into new retailers, consumer insights and data-driven storytelling is the key to success. Melinda’s Hot Sauce, the fastest-growing brand of 2024, has a compelling opportunity to expand its presence in the hot sauce category—particularly at Sprouts. By leveraging Numerator Insights and Verified Voices, Melinda’s can demonstrate its value to verified buyers and unlock significant category growth. Here’s how brands like Melinda’s can structure their retailer pitch to win shelf space and drive sales.

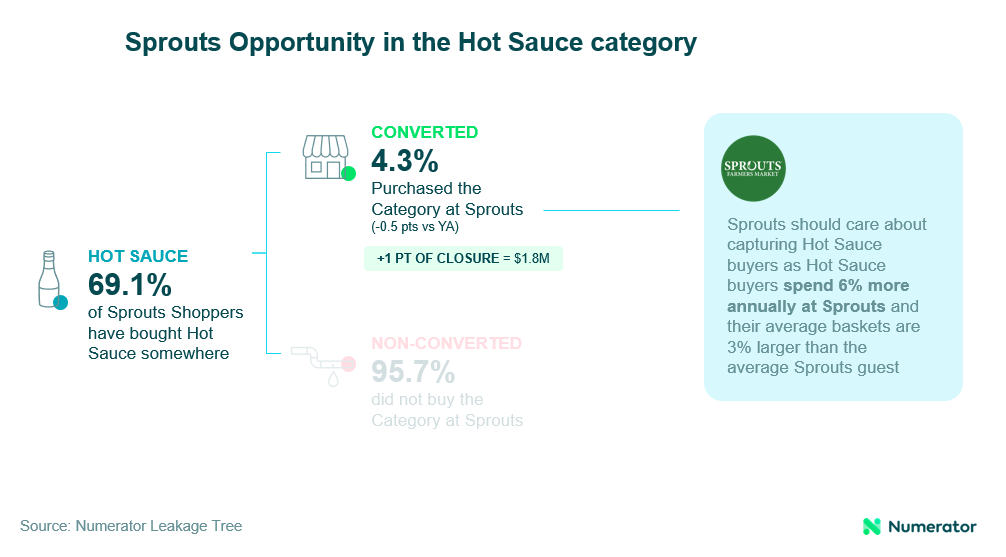

1. Showcase the retailer’s dollar opportunity in the category

For any retailer, demonstrating the size of the prize is the first step in making a compelling case. At Sprouts, nearly 96% of shoppers aren’t currently buying hot sauce, presenting a massive opportunity. Even a modest 1% increase in category conversion could generate $1.8 million in additional sales. With hot sauce buyers spending 6% more annually at Sprouts and having 3% larger baskets, there’s a clear financial incentive to capture these shoppers.

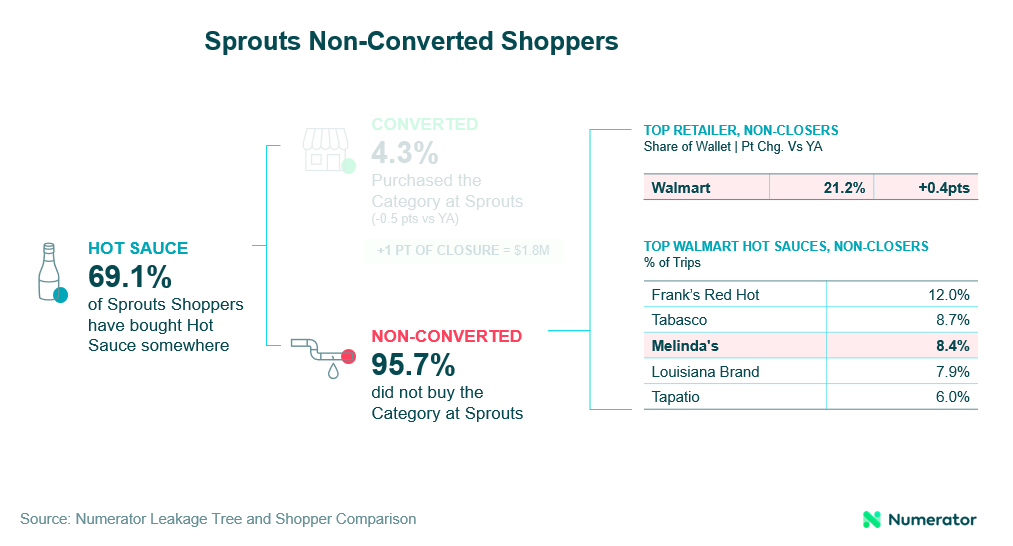

2. Quantify the impact of adding your brand to the category

Beyond highlighting category potential, Melinda’s must show how it can drive conversion. Sprouts’ current hot sauce buyers already spend $328K on Melinda’s, while shoppers currently not buying Melinda’s at Sprouts are spending $2.9M at other retailers. Walmart is stealing the greatest share of wallet at 21.2%, specifically with the percent of trips for brands such as Frank’s Red Hot (12%), Tabasco (8.7%), Melinda’s (8.4%), Louisiana Hot Sauce (7.9%), and Tapatio (6%).

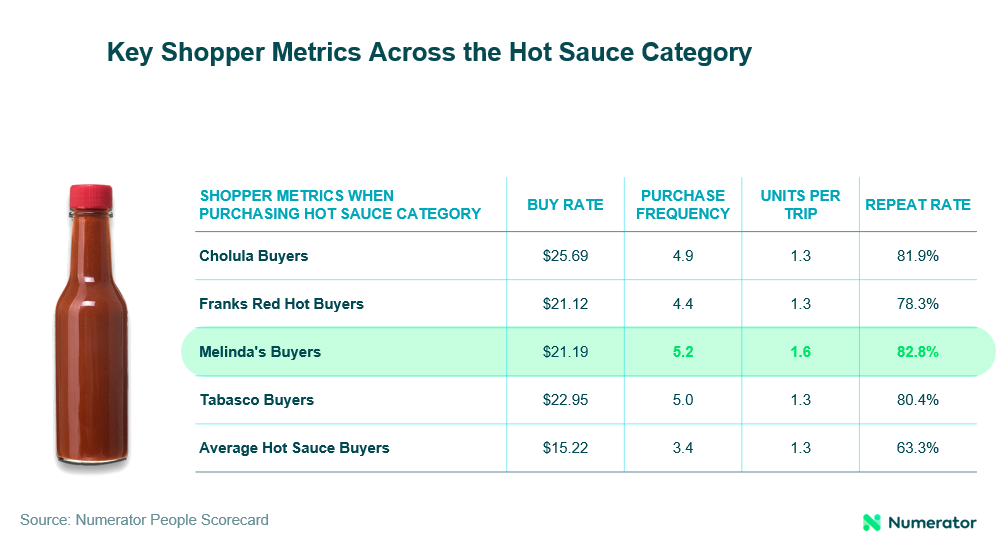

3. Highlight your buyers’ category engagement vs. the competition

A key differentiator for Melinda’s is the brand’s highly-engaged consumer base. Compared to the category leader, Melinda’s buyers spend more per trip, shop more frequently, and demonstrate higher repeat purchase rates. By bringing in a brand with strong loyalty, Sprouts can fuel long-term category growth while appealing to highly active shoppers.

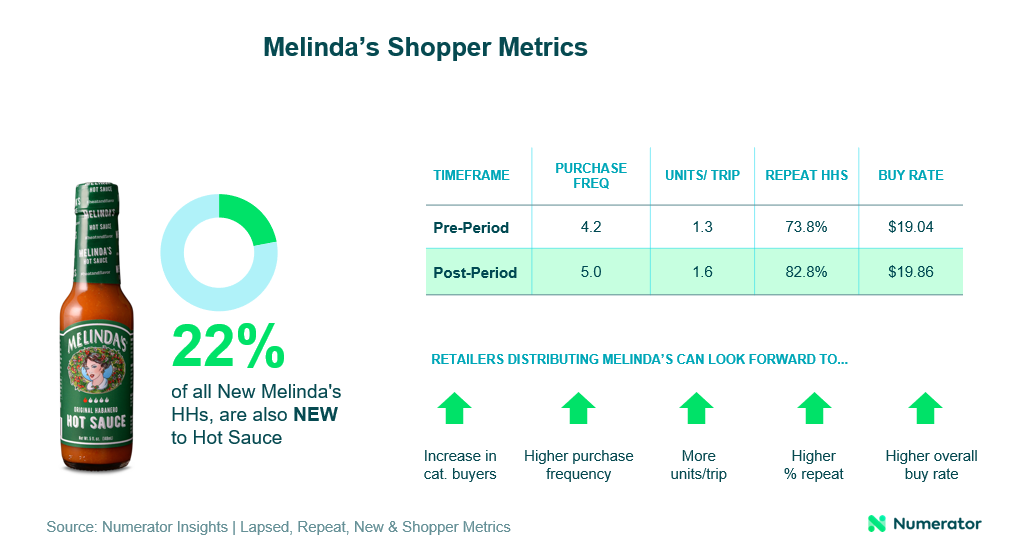

4. Prove the incrementality your brand will bring to the category

Retailers need reassurance that adding a new brand won’t simply cannibalize existing sales. Melinda’s offers true category expansion: 22% of new Melinda’s buyers are also new to the hot sauce category, and their total category spend increases by 4% once they start purchasing the brand. These insights prove Melinda’s can bring new buyers to Sprouts and boost overall category revenue.

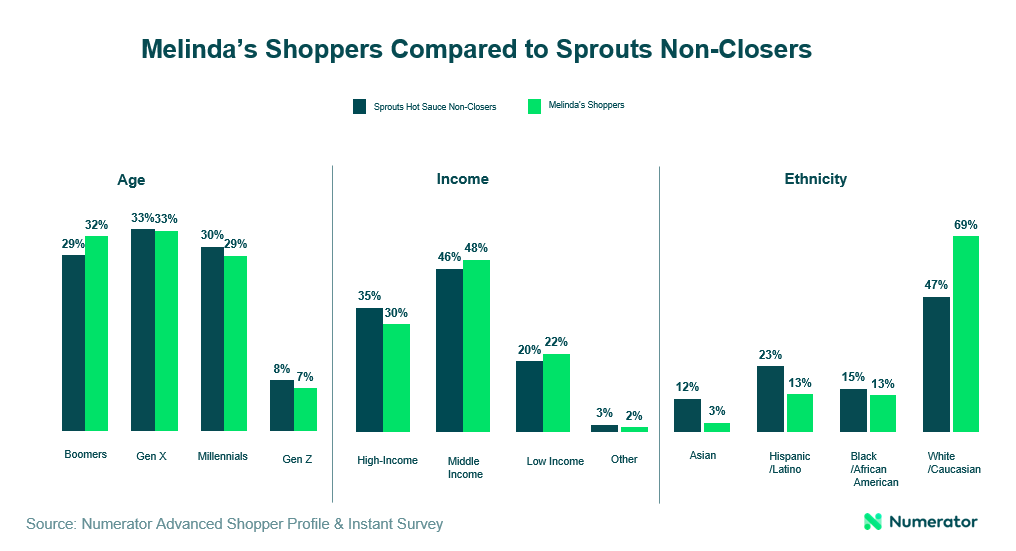

5. Demonstrate how your shopper base aligns with the retailer’s

Retail buyers want products on the shelf that resonate with their existing shopper base. Melinda’s shopper demographics align closely with Sprouts’ hot sauce non-closers—primarily Gen X, middle-income, and white/caucasian households. This portrays that adding Melinda’s on the shelf will be an easy transition for current Sprouts shoppers, minimizing friction in adoption.

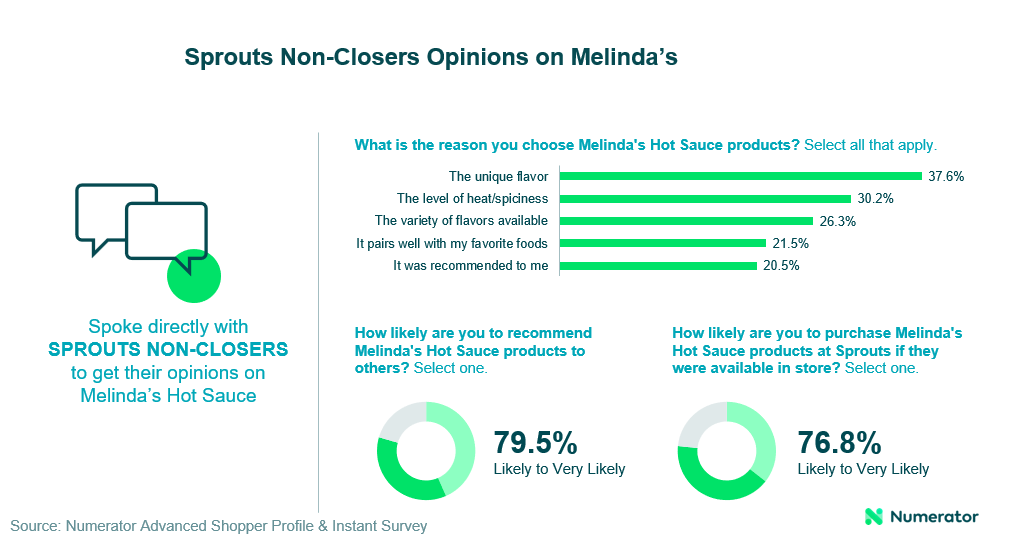

6. Survey Non-Closers for direct feedback on your brand

Beyond purchase data, direct feedback from verified consumers also strengthens the case for Melinda’s placement at Sprouts. Melinda’s has a clear and unique value proposition, with shoppers choosing the brand for the unique flavor (37.6%), the level of heat/spiciness (30.2%), and the variety of flavors available (26.3%). Over three in four surveyed Melinda’s buyers indicate they would purchase the brand at Sprouts if available, and nearly 80% would recommend it to others. When a brand enters a retailer with built-in demand, it reduces the risk for buyers and sets the stage for success.

Winning at retail with data-driven storytelling

For brands looking to break into new retailers, this step-by-step guideline provides a roadmap for success. By leveraging real consumer insights, highlighting incremental value, and aligning with retailer priorities, brands can make a compelling case for shelf space centered on verified consumer behavior.

Ready to craft a winning retailer pitch with Numerator Insights and Verified Voices? Reach out to hello@numerator.com to start the conversation today.