*Note: These insights are from 2020. Read our 2021 Back to School blog to learn more about shopper intentions, or check out our 2021 Back-to-School Tracker for the latest insights into the shopping, advertising, and promotional activity.

—

We shed light on this topic in a recent webinar exploring current consumer attitudes and spending behavior in top BTS categories. This back-to-school season is unlike any other, and sales have been understandably softer than in previous years. We’ve seen shoppers adjust what they’re buying, how they’re buying it, and when they’re buying, extending the season as they await further details on what supplies they’ll need for the new school year.

Parents Pausing on Buying Back-to-School Supplies

One of the biggest reasons this back-to-school season is so unique is because for the first time, the need for back-to-school staples like notebooks, pencils and crayons is not a given. Whether schooling is online, in person, or a hybrid of both methods will dictate what types of supplies are needed. And with many districts delaying decision making, parents are delaying their purchases until they then have a clearer picture of what supplies they’ll need in order to comply with their district’s educational plan.

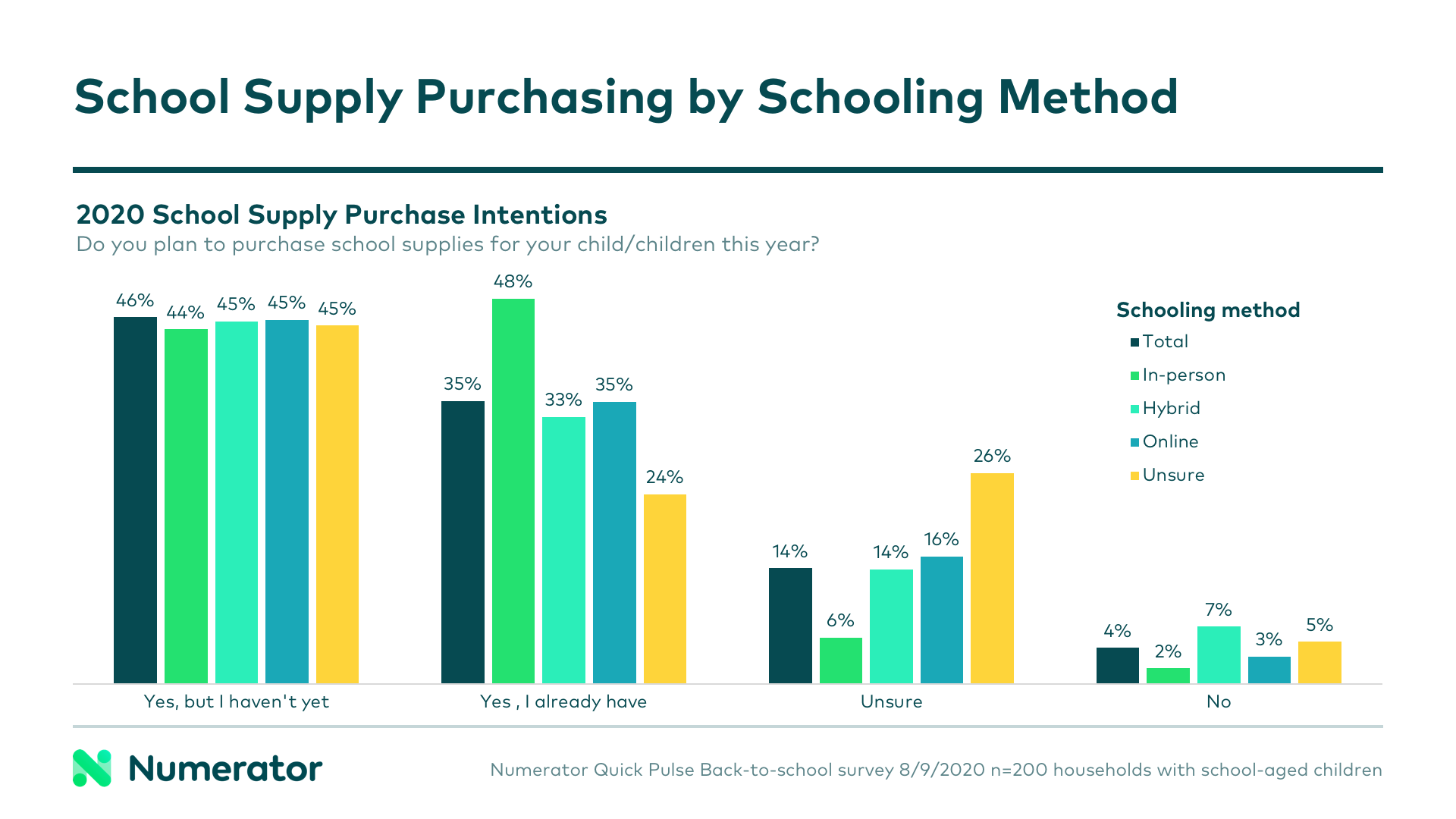

As of August 10, a Numerator survey of households with school-aged children revealed almost half of these households either planned to or had already purchased school supplies, some holding off due to the ambiguity around district decisions. However, one in five households shared they may not purchase any supplies at all this year. Among families who knew their children would be resuming in-person learning, purchasing was higher— about half (48%) had already purchased supplies. However, as we’re seeing across the country, many schools who resumed in-person classes are already reverting back to online options after extensive COVID outbreaks, meaning new and different supplies may need to be purchased.

Lunch and Snack Staples are Must-Haves

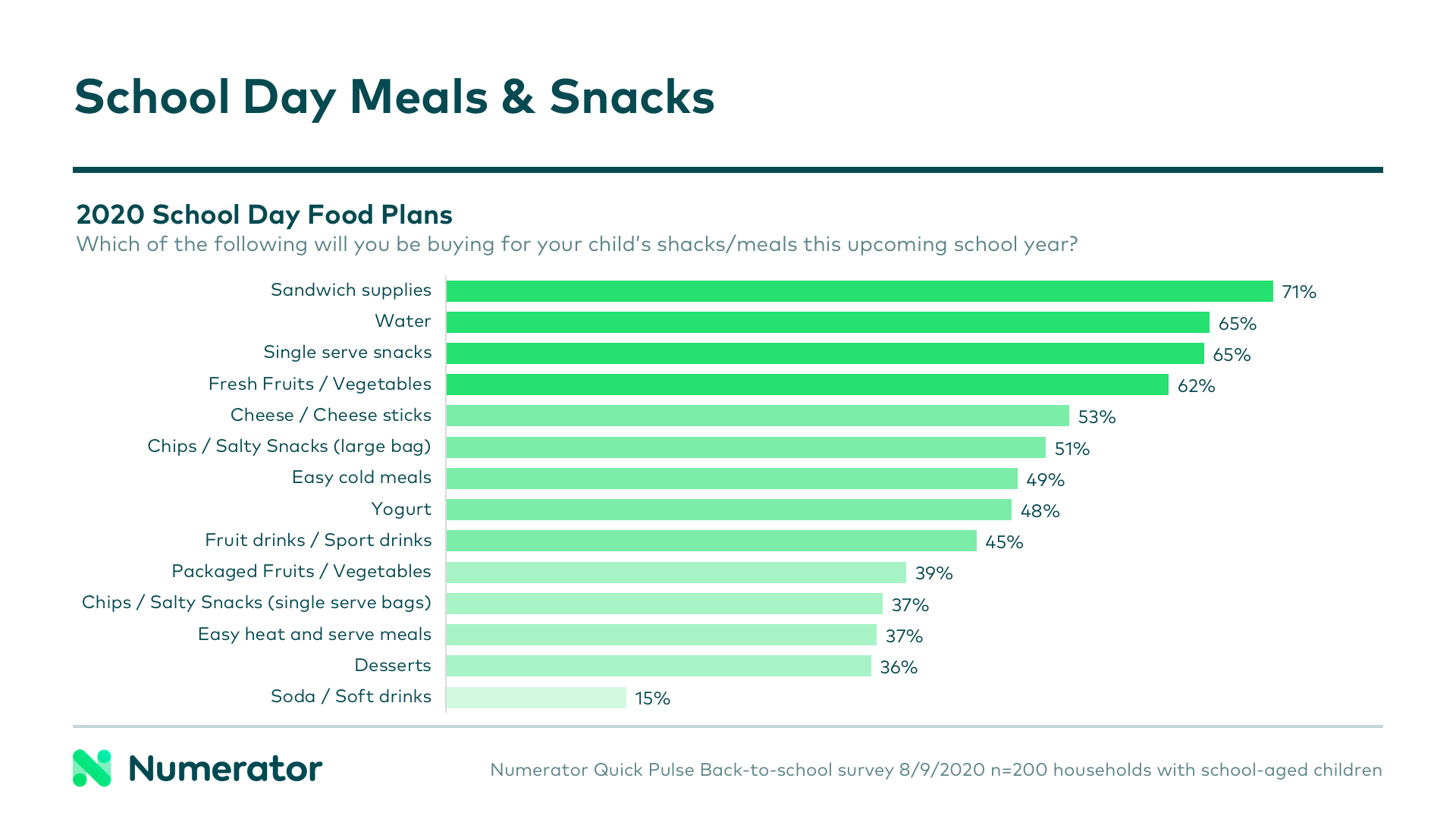

Regardless of whether learning takes place at home or in the classroom, meal planning is still a priority and one point of certainty for parents. Even in cases where hot lunches will be provided for in-person schooling, 46% of shoppers shared they’ll still be providing lunch and snacks for their children.

This means parents will continue looking for simple solutions to keep their kids fed as they learn. Households are leaning heavily on sandwich staples, bottled drinks, and single-serve snacks like chips, cheese sticks, and fruits and vegetables. Being well-stocked in these areas and focusing on minimizing mealtime pain-points will serve retailers well throughout the school year.

Lessons Learned: Unpacking Back-to-School Sales Softness

As with many consumer purchases during the pandemic, back-to-school shopping has moved online. Shoppers are also buying smaller, one-off purchases rather than in bulk school supply hauls as they have in past BTS seasons. Additionally, since most children have been home since spring, many parents have already stocked up on art supplies and electronics in order to manage at-home learning and to keep their kids entertained.

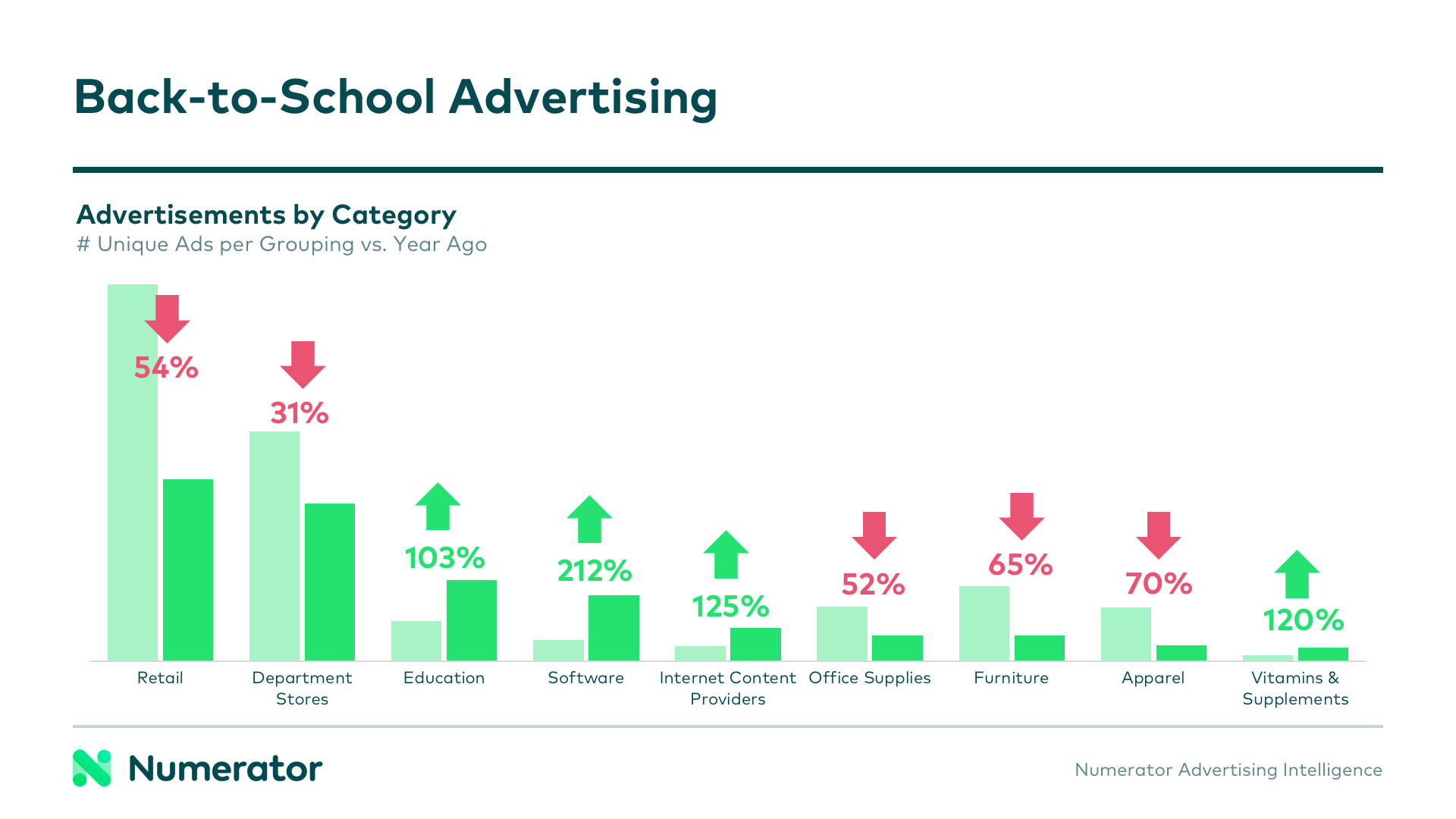

In response to tempered demand and uncertainty, brands and retailers have made a shift in their marketing. Instead of the usual back-to-school promotional and advertising campaigns, messaging now emphasizes low prices and tools that enhance creativity, virtual learning, and staying healthy. While traditional BTS brands and retailers have pulled back marketing activity dramatically, newer categories such as software, internet content providers, and vitamins & supplements are all seeing an increase in back-to-school advertising.

Planning Ahead: Preparing for an Extended Back-to-School Season

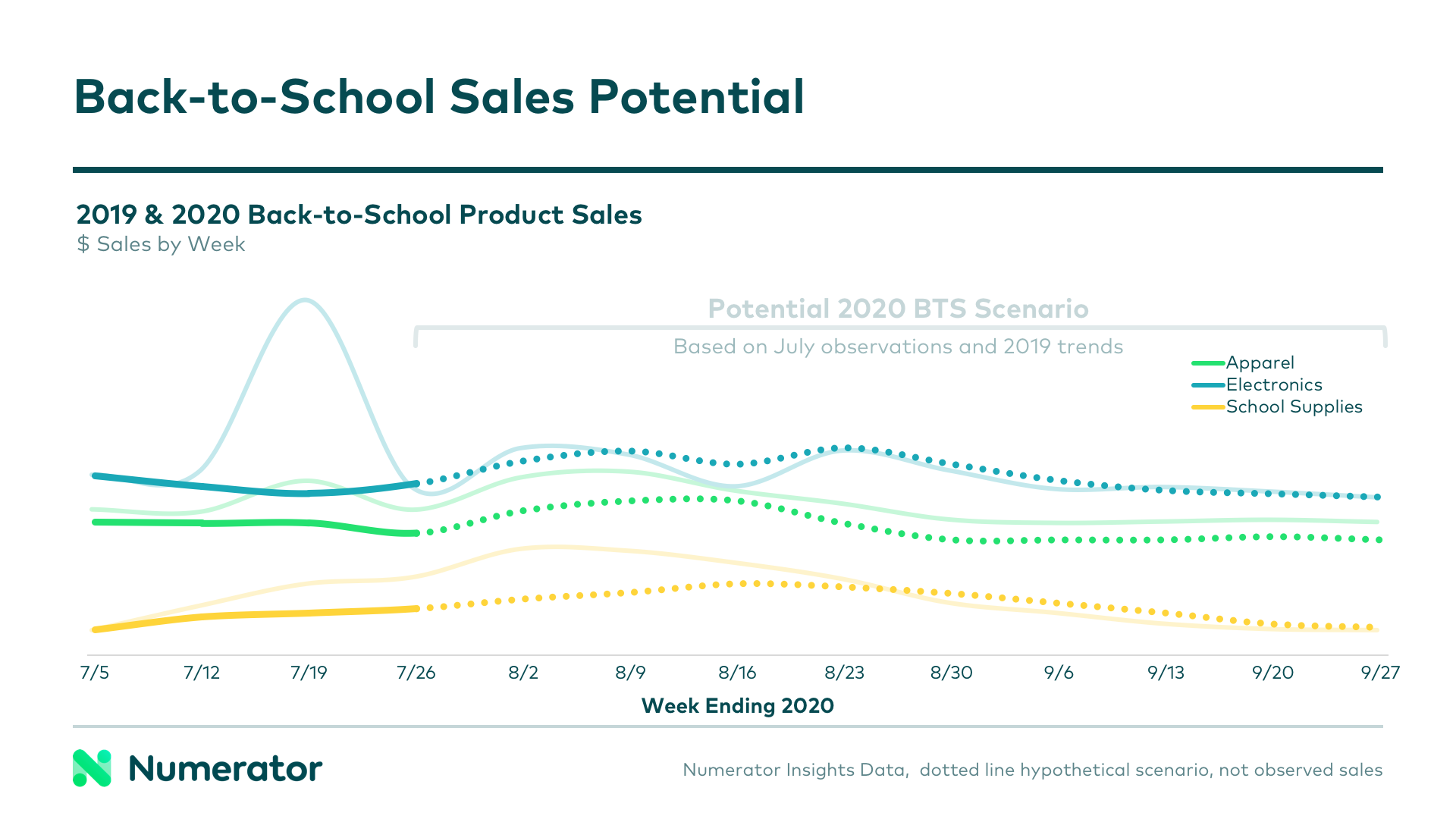

In 2019, back-to-school sales peaked around late July and early August. This year, sales have been lagging due to shifts in shopper needs and their uncertainty around the impending school year. The postponement of Amazon Prime Day, a huge mid-summer sales push in years past, also contributed to this year’s lower return, particularly for sales of electronics.

Because households have pushed back decision-making to allow for more direction from districts, we recommend retailers prepare for an extended back-to-school season. Sales may be lacking compared to last year, but we anticipate spending will continue beyond the standard time frame as families settle into a regular school routine in this new normal.

The COVID-19 crisis has dramatically altered the back-to-school sales landscape. Remain focused on your customers, stay flexible and prepare to pivot on messaging and promotions as consumers’ needs change. Brands and retailers who can stay on top of and adapt to these shifts and put their consumers’ needs first will see the most success. To do this, it will be vital to monitor back-to-school buyer behavior and spending for your brand and category.

We invite you to listen to our webinar replay for additional details on the data Numerator compiled during these early weeks of the back-to-school season. To become the best resource and support for your customers, you’ll also want to stay up to date on the latest data with our Back-to-School Index. This index is updated weekly and covers insights on advertising, promotions, and consumer spending both online and in stores. As always, we’re here to help, so contact us with any questions about our data, products, or insights.

—

Insights contributed by Jenny Weber & Andrea Huberty, Numerator Client Services Consultants