Everyone knows Amazon’s business is booming. But do you know specifics on any of the categories most responsible for this growth? Over the past few years, categories like health care and personal care have driven immense gains for the Amazon brand. How has Amazon’s growth impacted sales within these categories at traditional brick-and-mortar stores, and which brands are reaping the most benefits from the Amazon effect?

Since 2017, Amazon has seen strong and steady growth within health and personal care categories. Not only have they grown dollar sales and trip counts, but they also have consistently increased household penetration, bringing in new consumers to the site and to the category.

Retailers Watch Out

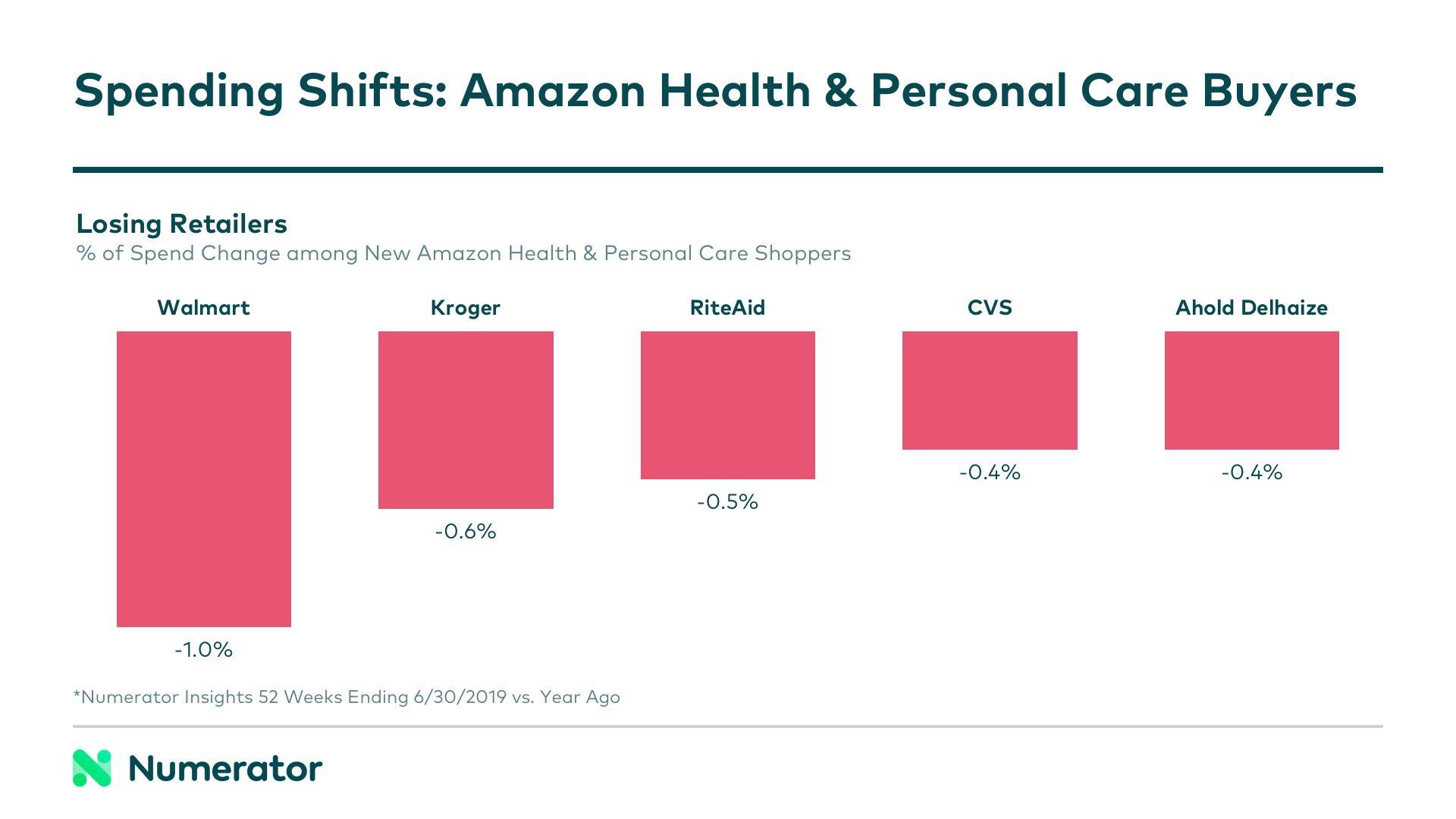

As households turn to Amazon for their health and personal care needs, they aren’t necessarily leaving brick-and-mortar. Buyers of health and personal care on Amazon still spent a significant amount of their category dollars at Walmart, Costco and Target. But the steady shift to Amazon is undeniable, and as Amazon grows share, others lose. Big players like Walmart, Kroger and RiteAid all saw decreased spending among Amazon health and personal care shoppers over the past year. And this shift extends beyond just health and personal care; we also see these shoppers shifting spend online for many other categories, including durables like home & garden, electronics and toys.

Brands Need to Capitalize

Many have the preconceived notion that Amazon shoppers will go for Amazon private label brands whenever they’re available. While this may hold true for certain categories or groups of shoppers, our data shows that it’s not the case with health and personal care buyers, meaning name brands have an opportunity to win with these consumers.

But while private label may prove less of a threat with this group, big brands still have some work to do. In traditional brick-and-mortar channels, we typically see a few mainstay brands leading the pack, especially with heavy category buyers. On Amazon, roles seem to be reversed, with smaller brands capturing more attention and trips than they do in-store. Within the vitamins & supplements category, for example, smaller brands are winning with heavy category buyers, while big brands perform better with medium and light shoppers.

The Shoppers Behind the Shift

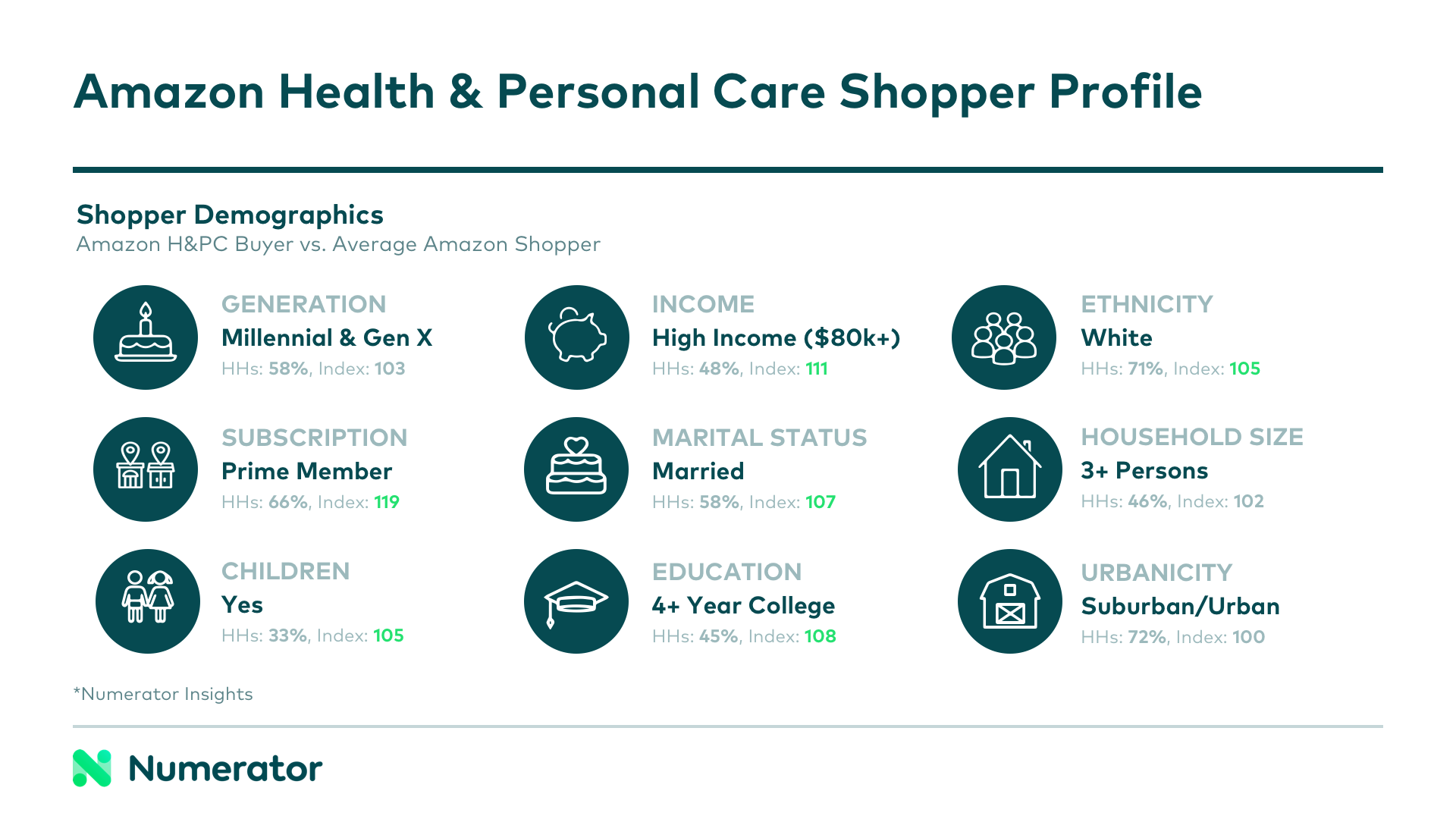

As of June 2019, 79% of Amazon shoppers had made a health or personal care purchase on Amazon. Compared to the average Amazon shopper, members of this group skew Gen X and Millennial, high income, and are more likely to be Prime members. They’re all about saving time and money, so it’s important to appeal to their needs in your brand’s messaging and positioning.

An understanding of these current shoppers is critical in winning and maintaining sales right now, but what about the 21% who have yet to make the jump online for these categories? Understanding the uncaptured group is important as well, as they are likely the future of the category.

These non-buyers are more likely to be Gen Z, multicultural, and low income. On some level, it’s a bit surprising that this group isn’t already purchasing this category online; they’re young, which means they’re likely tech savvy and prone to online shopping. However, it’s also fair to assume they’re not yet at the life-stage where they feel a time crunch and resort to online shopping to buy in bulk, search for deals or save time. Someday, though, they will reach this stage, and as a brand trying to build equity, it’s important to appeal to them and capture their attention early, so when they do start shifting their behavior, they still think of you.

Interested in learning more about this exciting topic? Check out the complete slide deck and a full recording of last week’s webinar, which includes more data from Numerator, in addition to tips and tricks from Tinuiti about Amazon best practices. If you’d like to explore any of these insights for your specific brand or category, set up a chat with Numerator today.