Check out more up to date Prime Day coverage here!

Last week, we asked whether Amazon’s 2017 Prime Day could possibly top their 2016 record-breaking event. Short answer: A resounding YES.

In fact, according to Amazon’s own reports, the 30-hour event grew by more than 60 percent from a year ago, generated about $1 billion in revenue, and surpassed even Black Friday and Cyber Monday.

Given the success of this event, we decided to survey Prime Day shoppers, and dive deeper into the purchase data around this new retail holiday to learn more about the Amazon Prime Day shopper and their purchasing behavior.

Prime Day Shoppers

From our survey of 6,284 Prime Day shoppers, it appears that Amazon sure did their job driving awareness. A whopping 95.2% of Prime Day shoppers had heard of the event beforehand. And these shoppers also appear to be planners: 78.2% of Prime Day shoppers planned to shop on Prime Day, and 51.6% researched Prime Day deals ahead of time.

Overall, typical Prime Day shoppers live in larger households, are younger, and have higher income compared to the average shopper. This remains true year over year.

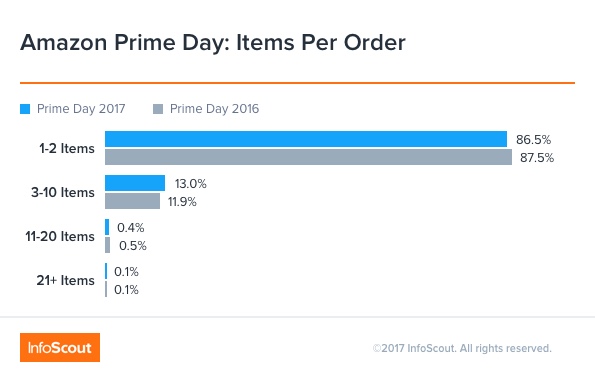

Prime Day Items and Order Sizes

Compared to 2016, shoppers are spending less per order, but visiting more frequently over the course of Prime Day. In fact, over 60% of the orders on Amazon Prime Day were less than $30, but the average shopper was placing three separate orders on the same day.

Perhaps this year’s extended Prime Day (30 hours in 2017 vs. 24 in 2016) gave consumers more time to search deals and come back for multiple purchases.

What did Prime Day shoppers buy?

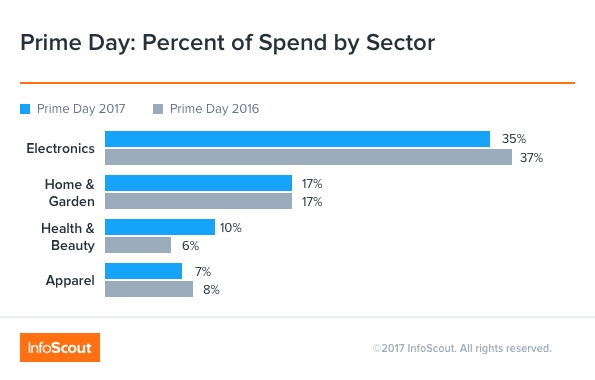

At the sector level, Electronics was the decisive winner, accounting for 35% of Prime Day spend. In fact, the amount spent on Electronics on Prime Day was over double the next largest sector, Home & Garden (17%). The top four sectors (Electronics, Home & Garden, Health & Beauty, Apparel) accounted to ~69% of total dollars on Prime Day 2017.

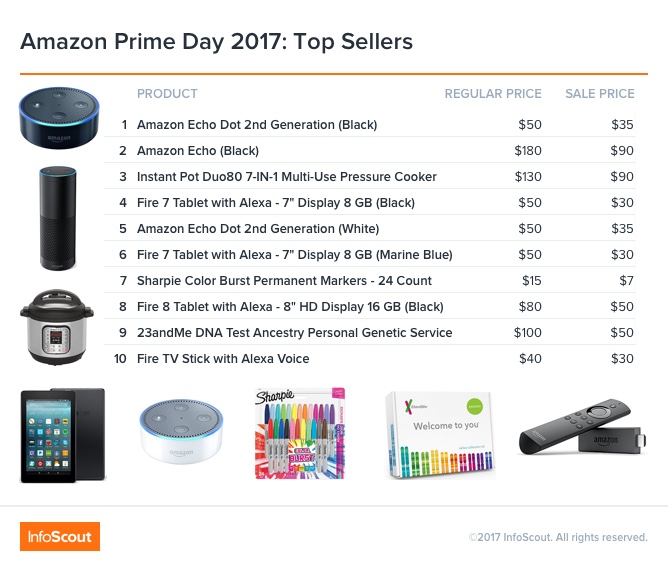

With the Echo Dot leading the charge, Amazon products represented 7 of the top 10 items by units sold on Prime Day this year. The only other brands to break into the top 10 were Instant Pot, Sharpie, and 23andMe, all of which offered steep discounts from their regular prices.

Who Loses When Amazon Wins?

From an InfoScout survey of 6,284 Prime Day shoppers, we asked which retailers these shoppers would have shopped if they hadn’t gone to Amazon on Prime Day. Interestingly, Amazon drew shoppers away primarily from brick-and-mortar stores, with Walmart (51.5%) and Target (37.4%) being the most affected, followed by Retailer Websites (18.0%), Grocery Stores (16.4%), and Dollar Stores (14.2%). Close behind were Costco (13.4%), Kohl’s (12.3%), Home Improvement Stores (11.1%), and Best Buy (10.9%),

Amazon Prime Membership

While Amazon hasn’t released exact figures on the number of people who signed up for new Prime memberships, Amazon did share that “more new members joined Prime on July 11 than on any single day in Amazon history.”

However, the majority (95%) of Prime Day shoppers were already Amazon Prime members before Prime Day. Of these Prime members, 80% had a regular Prime membership, 10% had a student membership, and 10% had a secondary membership.

With another record-breaking Prime Day under its belt, Amazon continues its march forward into retail dominance.