In our recent webinar, Winning the Shelf: Data-Driven Sell-In Strategies for Emerging Brands, examples focusing on Garage Beer, Legendary Foods, and Cameron’s Coffee demonstrated how behavioral insights can help brands quantify market opportunity, highlight high-value shopper segments, and prove incremental growth potential. These use cases highlight the strategies that win with retailers: identifying unmet demand, minimizing leakage, and lifting both the category and the total store. In the sections ahead, we break down what these examples teach us and how emerging brands can apply the same data-driven strategies to strengthen their retail pitches.

Align your growth with the retailer’s challenges and quantify the dollars they stand to gain

When emerging brands look to break into a new retailer, the first step is understanding the market opportunity and grounding their pitch in the retailer’s reality. Garage Beer—a fast-growing light lager brand— illustrates this well. Before approaching Target, Garage Beer can identify a critical insight: Target’s premium beer category was declining in households and projected sales, while Garage Beer was rapidly expanding nationally. With buy rate up and projected households growing nearly 390% year over year, the brand can clearly show that new buyers were entering at an exceptional pace. For any emerging brand, this approach is essential— retailers want to see where you fit within their category and how your momentum aligns with their needs.

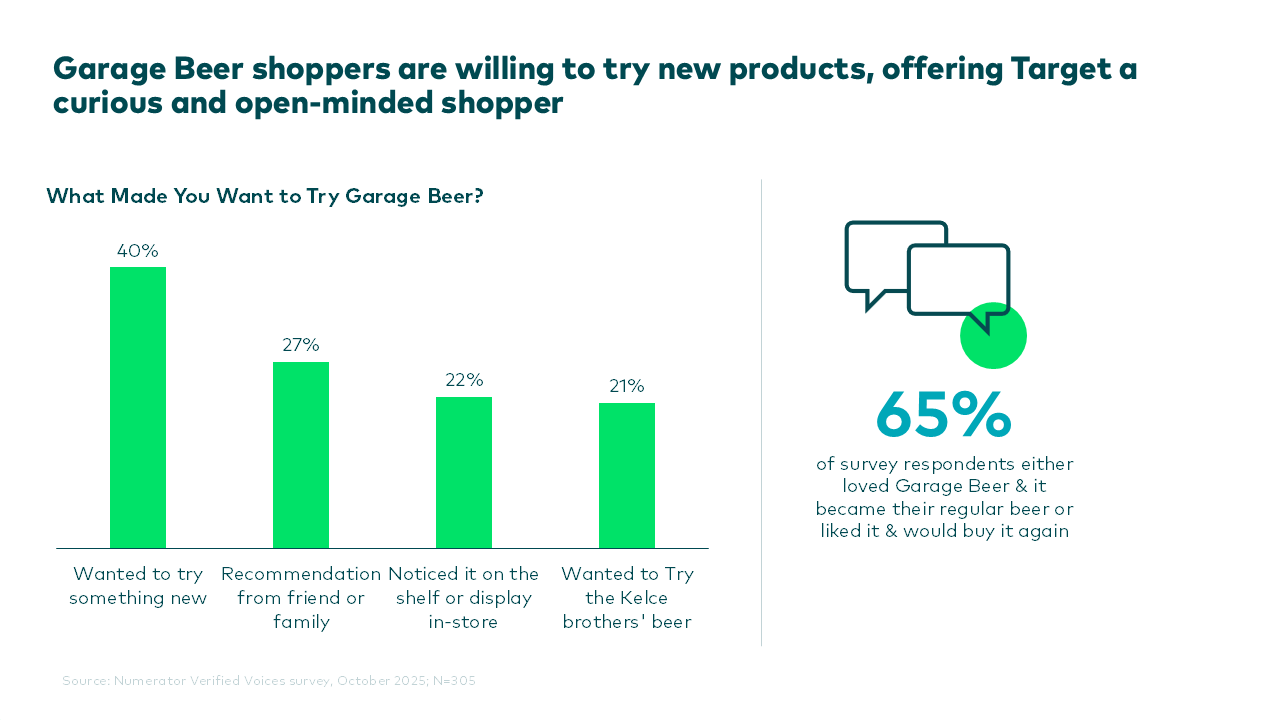

Once the opportunity is defined, brands must demonstrate the value of their shoppers. Garage Beer can do this by showing that its buyers are younger, higher-income, and already active Target shoppers—exactly the type of consumers Target wants to attract and retain. Numerator Verified Voices Survey data further revealed that these shoppers are motivated by discovery and report high satisfaction with Garage Beer, suggesting strong repeat potential. Emerging brands can apply this strategy by highlighting what makes their shopper unique, valuable, and strategically aligned to the retailer’s goals.

A compelling sell-in story also requires going beyond brand strength to prove incremental growth for the retailer. Garage Beer’s shopper is significantly more valuable than the average Target shopper across trips, spend, and basket size. There is limited overlap with Target’s existing beer set, suggesting that Garage Beer would bring new households into the category rather than cannibalize sales. This is a best practice for any emerging brand: use data to quantify the incremental shoppers, trips, and dollars your brand will introduce.

Finally, brands should tie their strengths to a retailer’s specific performance gaps. At Target, 33% of shoppers buy premium beer somewhere, but only 4% do so at Target, driving substantial leakage. One additional point of premium beer closure is worth over $24M to Target—Garage Beer can show how its shoppers directly address this gap. Target shoppers spent $53M on Garage Beer outside of Target last year; capturing even 10% of that spend represents a meaningful opportunity without needing to acquire new shoppers. For any emerging brand, this is the core of a strong retail pitch: align your growth with the retailer’s challenges and quantify the dollars they stand to gain.

Use behavioral data to show that a new item represents incremental revenue, attracts high-value shoppers, and taps into fast-growing consumer trends

When emerging brands aim to expand their assortment within an existing retailer, the first step is to define the market opportunity and identify where their shoppers are active but underrepresented. Legendary Foods, a health-focused brand known for high-protein, low-sugar products, offers a strong example of how to do this in exploring expanded distribution at Kroger. More than half of Legendary Foods shoppers already shop at Kroger, yet only 8% purchase the brand there. In the past year, Kroger shoppers spent nearly $94M on Legendary Foods products, but only $4.5M of that spend occurred in-store. This leakage highlights a clear growth opportunity, and closing even one percentage point of that gap would represent a $300K gain for Kroger. For emerging brands, this approach underscores a key principle: start by quantifying where retailers can grow penetration with shoppers who are already visiting the retailer.

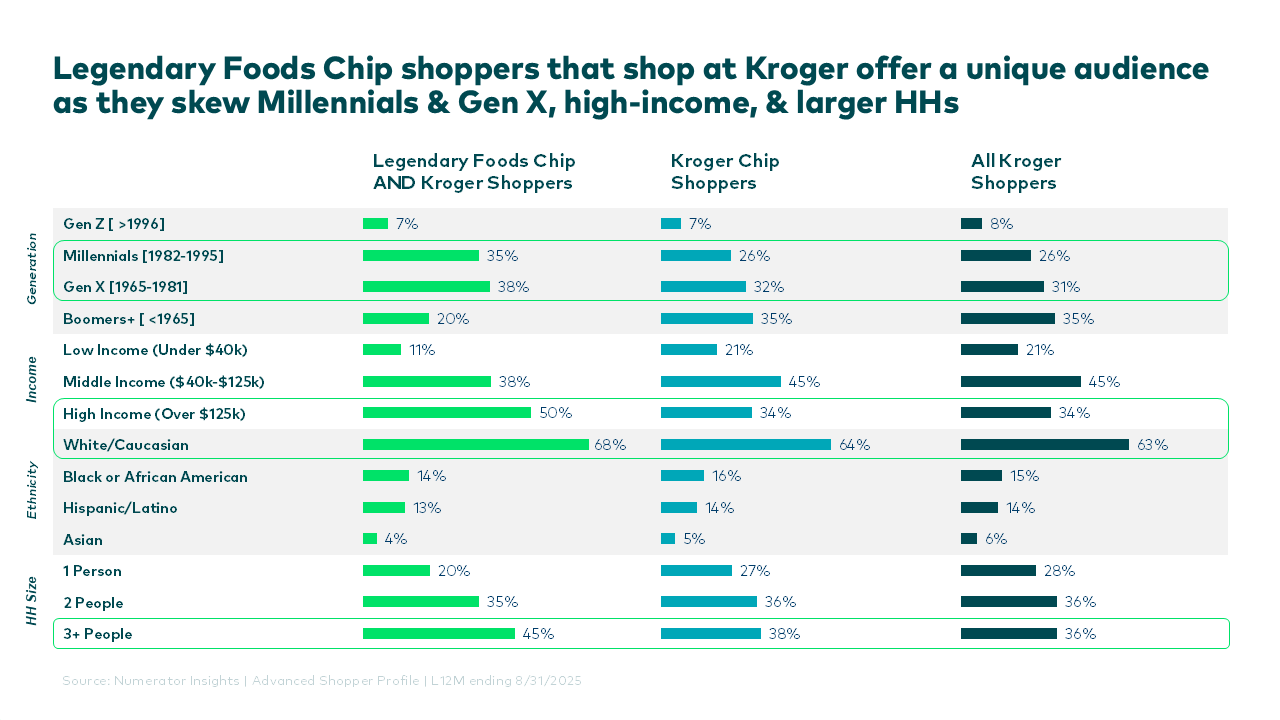

From there, brands should illustrate the strength of their shopper base and why it matters for the retailer’s broader strategy. Legendary Foods attracts a purpose-driven, health-focused audience that prioritizes protein, checks labels, and chooses functional snacks— behaviors that align with broader better-for-you trends. Within Kroger’s shopper profile, Legendary Foods Chips buyers are especially valuable: they skew Millennial and Gen X, have higher incomes, and live in larger households compared to both the average Kroger Chip shopper and overall Kroger shoppers. Emerging brands can use this same approach by highlighting how their shoppers differ from, and outperform, the retailer’s current category buyers.

A strong assortment expansion story also requires proving category incrementality. Legendary Foods demonstrates this through its Chips line, which attracts a largely distinct audience: only 7.7% of shoppers buy both the Chips and Toaster Pastries. This means the Chips line brings in new households, not just cross-shopping existing ones. The segment is also growing— year over year, 274,000 more households are exclusively buying Chips year over year, with a 7% increase in buy rate. Shoppers purchasing these items spend more per trip, purchase the category more frequently, and build larger baskets—all strong indicators of incremental category value. For emerging brands, this reinforces the importance of proving that new SKUs expand both your audience and the retailer’s, rather than cannibalizing the current set.

Finally, brands should highlight momentum to strengthen their case. Legendary Foods’ exclusive Chips shopper segment is rising in both household count and buy rate, representing 729,000 households and $11.1M in projected sales— all of which went to competitors outside of Kroger. Capturing even 10% of that spend would bring Kroger an additional $1.1M. For emerging brands, this is the blueprint: use behavioral data to show that a new item represents not just an SKU expansion, but a path to unlock incremental revenue, attract high-value shoppers, and tap into growing consumer trends.

Retailers prioritize brands that grow the category, not those that simply compete within it

When emerging brands need to defend or protect distribution, behavioral data becomes one of the strongest tools for proving their value to retail partners. Cameron’s Coffee at Walmart offers a clear example of how brands can build a compelling defense story grounded in category impact, shopper value, and long-term performance. The first step is demonstrating contribution to category growth— not just brand success. Cameron’s grew sales by 9% at Walmart through a higher buy rate, more shoppers, and increased trips. Importantly, the total dry coffee category also grew during this period, showing that Cameron’s helped drive incremental engagement within the aisle. For any emerging brand, this is a critical insight: retailers prioritize brands that grow the category, not those that simply compete within it.

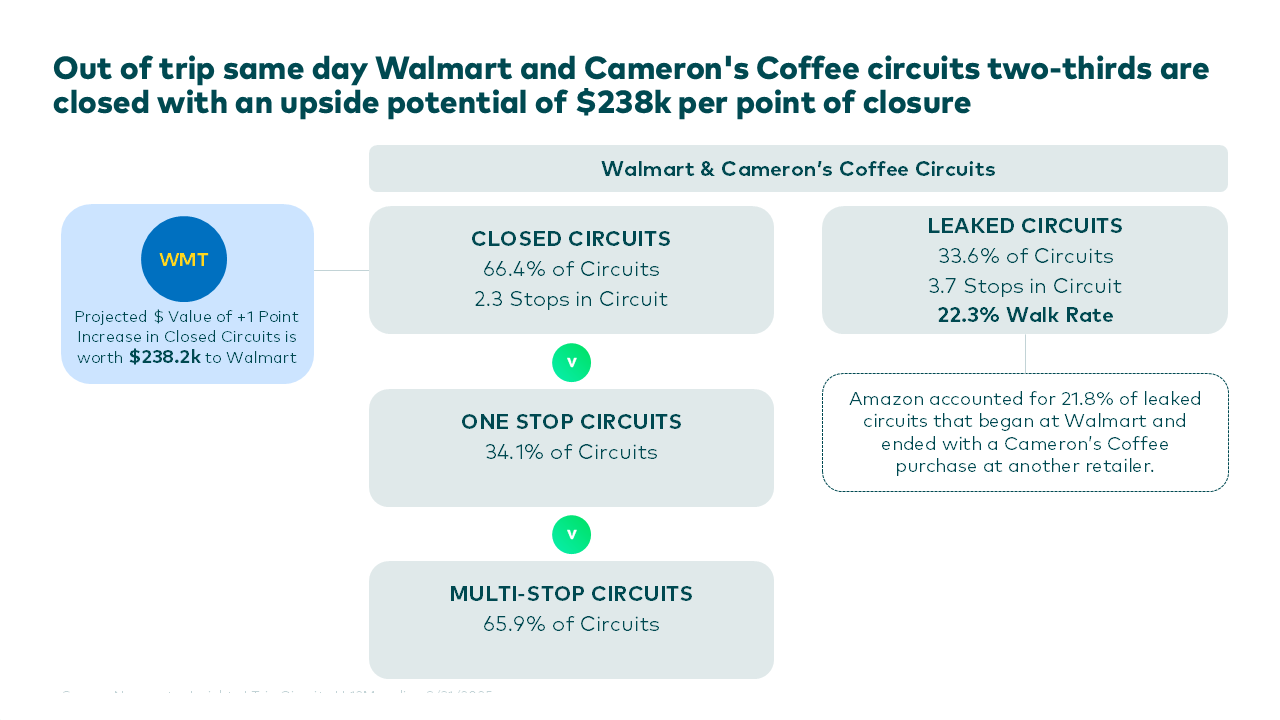

Once the contribution to the category growth is clear, emerging brands must prove their shoppers’ resilience and uncover opportunities for retailers to win more households. Cameron’s strong loyalty gives Walmart a clear path to reduce leakage. While Walmart already wins two-thirds of circuits that include a Cameron’s purchase, capturing even one additional point is worth $238K. Trip-pattern data further revealed that 22% of leaked circuits involve shoppers visiting Walmart before ultimately buying Cameron’s elsewhere— meaning Walmart is missing conversion moments. By showcasing where value is leaking and how improved shelf presence can recapture high-value shoppers, emerging brands can strengthen their defense narratives and quantify the upside for the retailer.

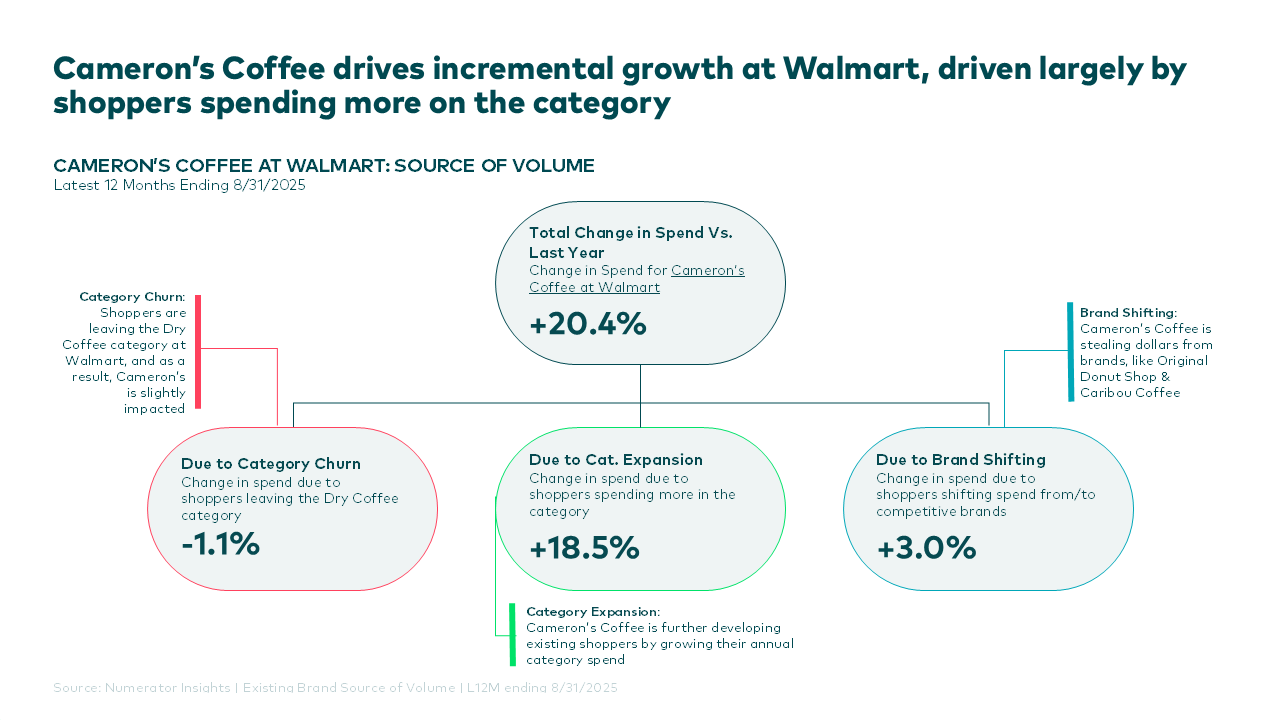

A strong story also requires identifying the source of brand growth. Most of Cameron’s gains come from category expansion, with shoppers spending more on dry coffee overall rather than shifting from competing brands. This distinction is essential for emerging brands: demonstrating incremental value and category growth momentum strengthens the case for why a retailer should maintain or expand Cameron’s shelf space.

Cameron’s further demonstrates the power of highlighting shopper composition. The brand attracts Millennial families with middle to high-income levels, while also outperforming in Walmart’s dry coffee aisle. Cameron’s buyers make 1.7x more trips, spend 1.8x more annually, and build larger baskets, signaling that the brand brings high-value, highly engaged households into the store. Emerging brands should analyze their own shopper profile to identify similar advantages, showing retailers not only who their shoppers are, but why those shoppers matter.

Finally, brands must reinforce long-term brand health. Cameron’s has strengthened all major KPIs— buy rate, frequency, and spend per trip— while cultivating loyal, high-value shoppers. Those who purchase Cameron’s two or more times are significantly more engaged with the dry coffee category across every key metric. Demonstrating this type of retention and sustained growth helps emerging brands show retailers what they stand to lose if distribution is reduced or removed. A strong defense story quantifies the ongoing value the brand delivers.

Looking Ahead

For emerging brands, the path to winning in retail is shaped by the ability to tell a compelling, data-driven story. The examples of Garage Beer, Legendary Foods, and Cameron’s Coffee show how behavioral insights can illuminate where opportunity exists, which shoppers matter most, and how a brand can drive true incremental value. Brands that leverage data to clearly communicate their impact will not only earn shelf space but also build the momentum and retailer confidence needed to sustain long-term growth.

If you’d like to develop a data-backed retail pitch, expand assortment, or defend shelf space for your own brand, reach out to hello@numerator.com or connect with your Numerator account representative— we’re happy to help.