Years ago, Americans probably would have greeted any mentions of “plant-based meat” with eye-rolls. Today’s consumers, however, are more aware of the health and environmental benefits of plant-based meat, and are actively seeking these products, creating countless opportunities for brands and retailers.

One example is Beyond Meat, which went public in May 2019 and has been expanding both distribution and product offerings ever since. Compared to one year ago, Numerator Insights data shows households purchasing Beyond Meat products are up 46.3%, trips are up 47.9%, and sales are up 71.3%. Since its May IPO, the company’s value* has soared almost 600% to $10.56 billion as of August 1.

To better understand the emergence of plant-based meat alternatives, let’s debunk the biggest myth about these products, identify who buyers are and the factors driving their purchases, and analyze the effectiveness of plant-based meat advertising.

Plant-Based Meat Mythbusting

“Plant-based meat alternatives are for vegans and vegetarians.”

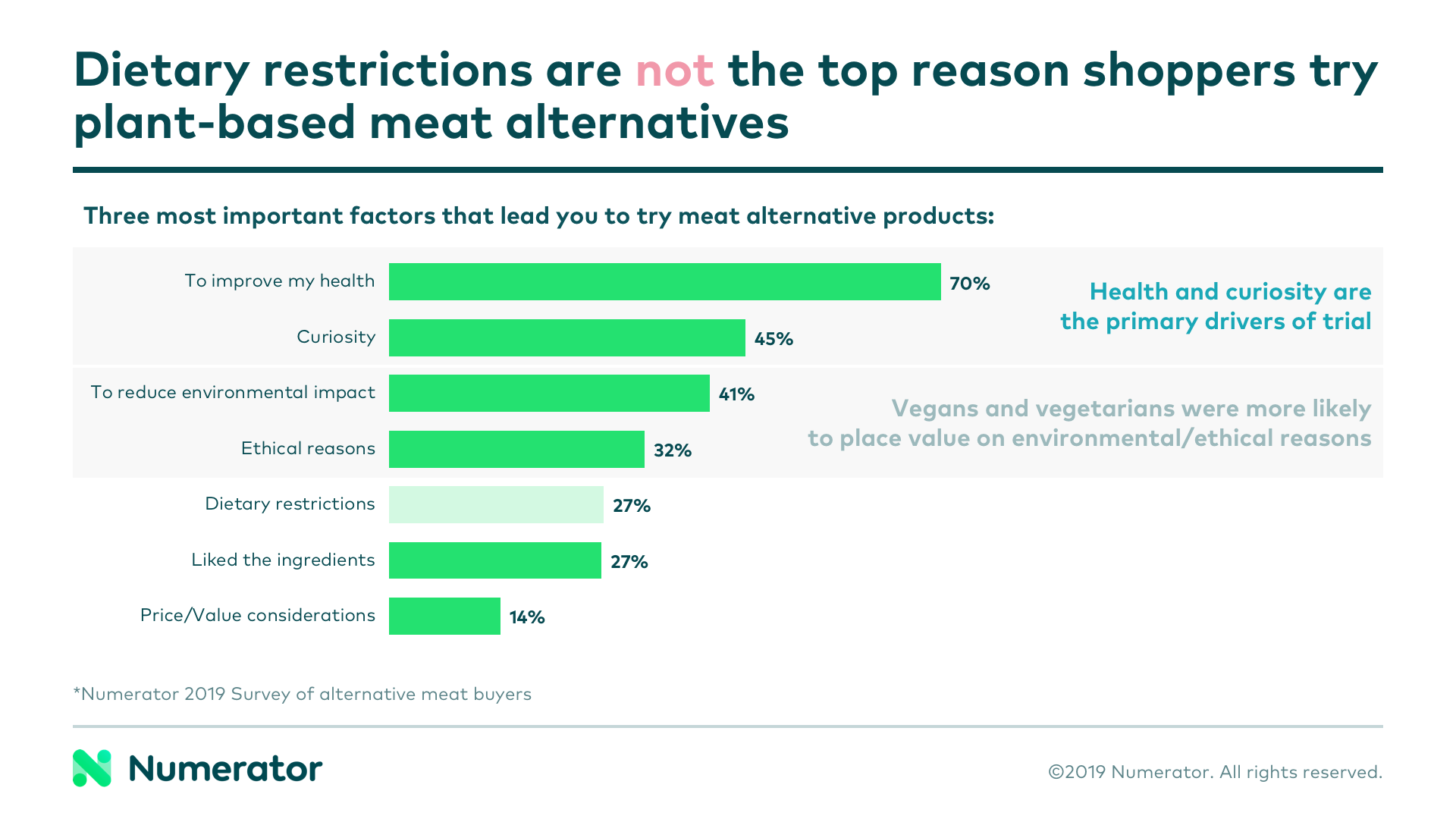

Surprisingly, this commonly-held belief is incorrect. According to a Numerator survey of more than one thousand plant-based meat buyers, we found that dietary restrictions are not a top reason shoppers are trying plant-based meat alternatives. Health and curiosity are the primary drivers of plant-based meat purchases, though vegans and vegetarians are more likely to be motivated by environmental and ethical concerns.

To further the point, nearly half of meat alternative buyers (48%) have no meat-avoidant members in their household, and only 30% have a vegetarian or vegan in the household.

Who’s Buying Plant-Based Meat Alternatives?

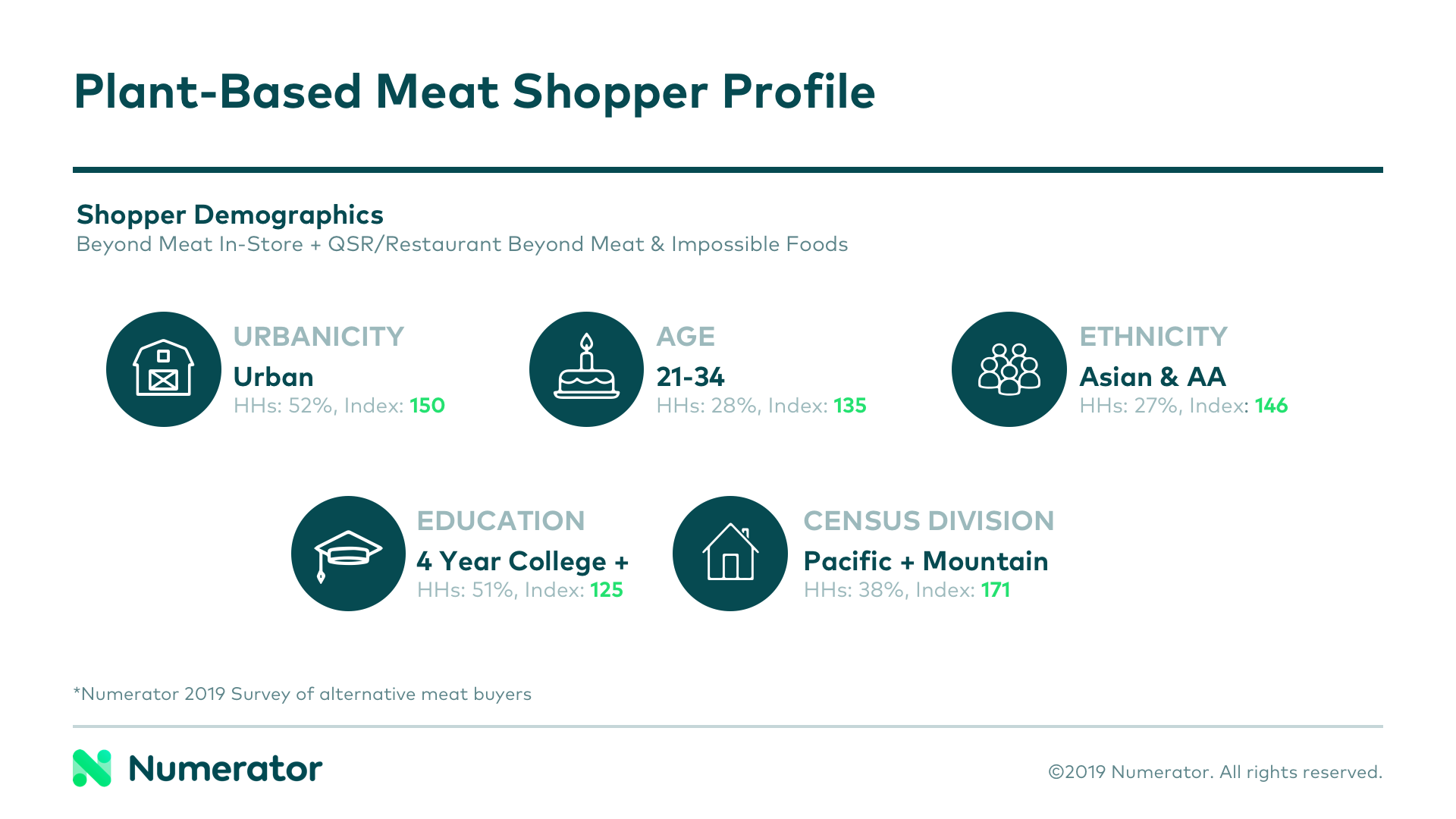

Buyers are typically high-income, highly educated Millennials of varying ethnicities living in urban areas, according to Numerator Insights data.

Plant-based meat alternatives are reaching a broad audience too. While 93% of buyers purchase these products for themselves, 45% purchase for their spouse or significant other, 28% purchase for children, and 26% purchase for a friend or another adult.

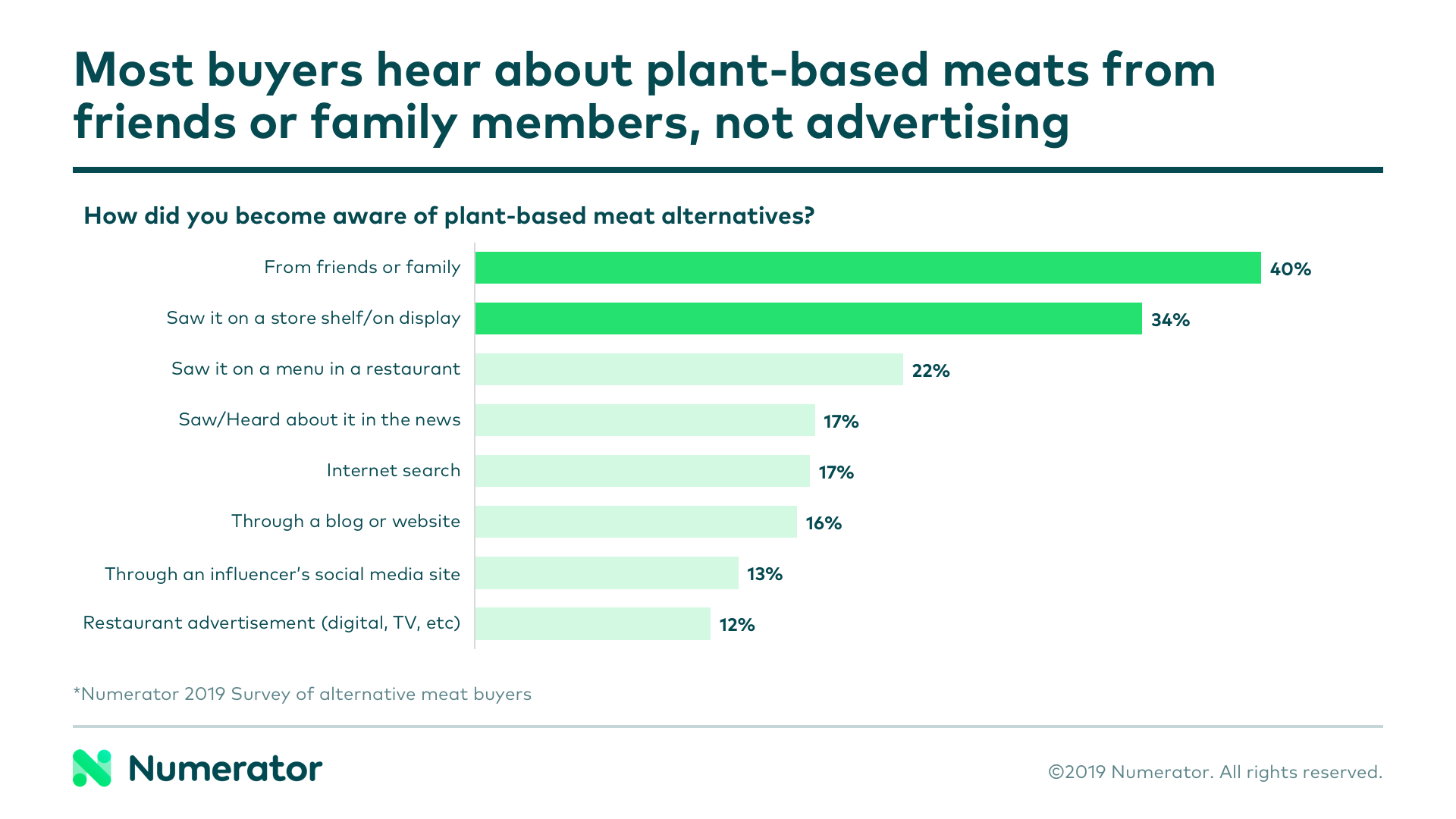

Advertising Is On-Target

You might have been hard-pressed to find an ad for plant-based meat alternatives in previous years, but ad spend has increased significantly in the first half of 2019. As it stands, most triers found out about plant-based meat alternatives from family and friends or when they saw it in a store or on a menu, but we’re excited to see how newer advertisements fare in the months to come.

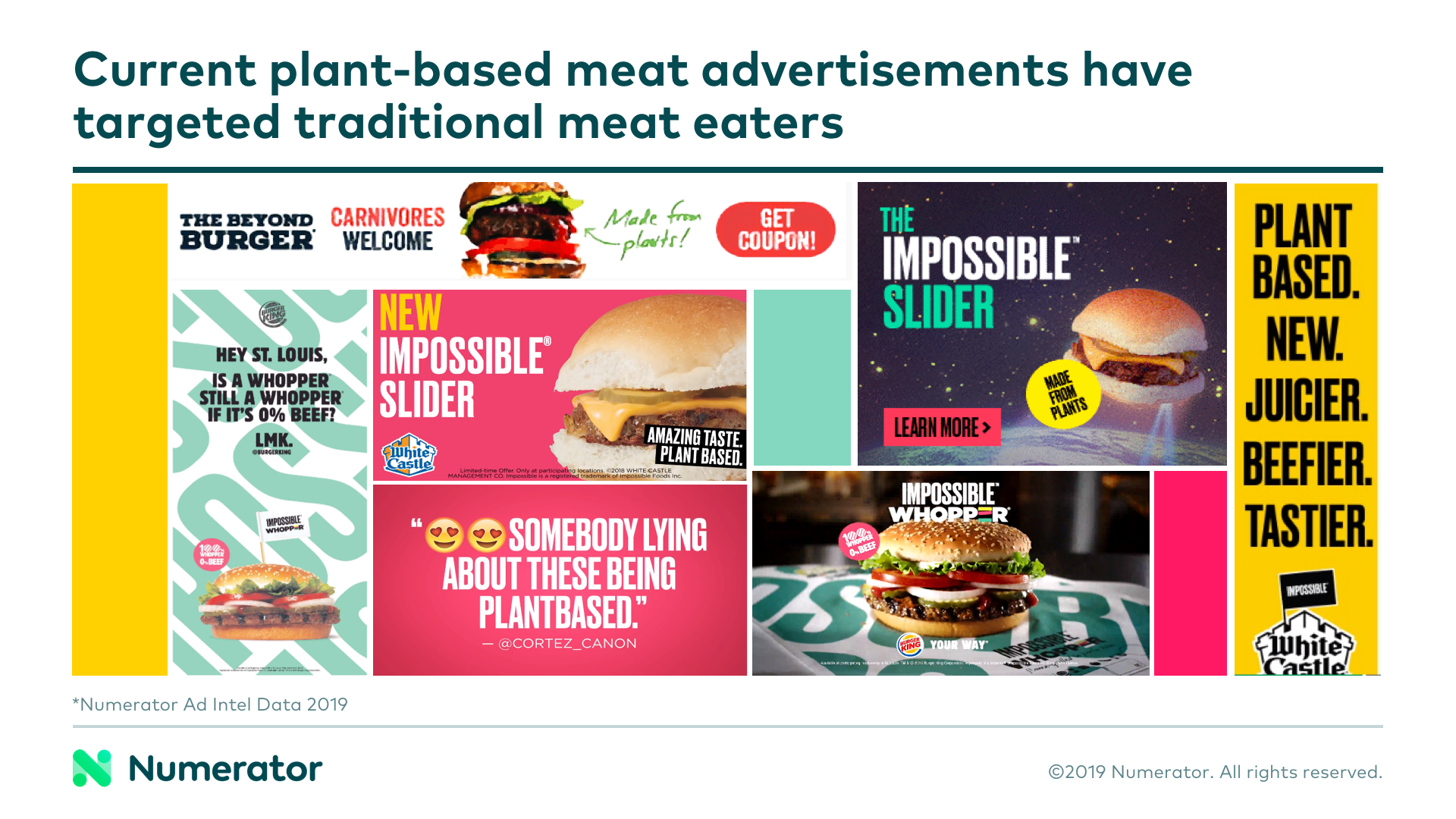

Numerator Ad Intel data indicates that brands seem to have done their homework, targeting consumers who love the taste of meat rather than those with dietary restrictions, while still highlighting the health benefits.

What Consumers Are Saying About Plant-Based Meat Alternatives

First and foremost, they love the taste and perceived healthiness. They also like that these products don’t involve harming animals and are better for the environment. And three out of four triers believe plant-based meat alternatives are healthier than real meat.

Overall, the feedback on these products is overwhelmingly positive: 62% of triers are very or extremely satisfied, 83% would recommend to someone else, and 81% would try other types of plant-based meat alternative products. Only 15% think this is a temporary fad, indicating that people like plant-based meat alternatives, and they don’t think they’re going away anytime soon.

Although vegans and vegetarians are certainly on board, dietary restrictions are not a top reason for trying plant-based meat alternatives. Brands have been very smart with their ad messaging, touting the health benefits and targeting consumers who love the taste of meat.

Most purchasers don’t have a beef with plant-based meat alternatives. In fact, the vast majority are satisfied and open to trying other plant-based products. But how does plant-based meat compare to real meat? How are these perceptions affecting purchasing habits, not only of real meat, but other grocery categories?

Real Meat Is Still the Top Choice

According to a Numerator Custom Survey, nearly half (49%) of plant-based meat alternative triers prefer real meat. 29% prefer meat alternatives and 23% have no preference.

When asked what they dislike about plant-based meat alternatives, triers pointed to high cost, taste that doesn’t measure up to real meat, and texture. But that’s not stopping them from eating the “fake” stuff for the health and environmental benefits.

The Categories Affected by Plant-Based Meat Alternatives

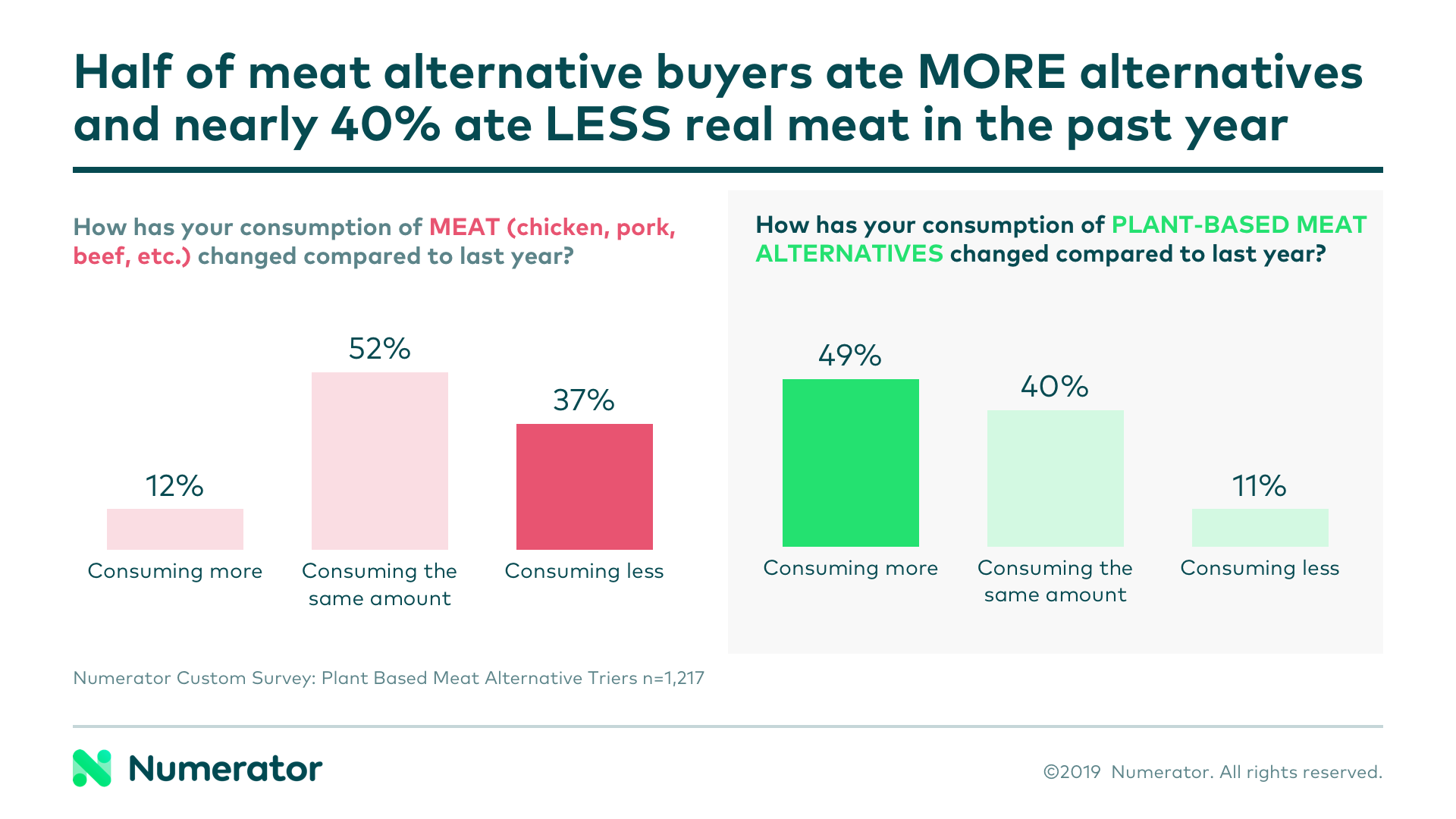

The Numerator Custom Survey also shows the increase in consumption of plant-based meat alternatives is coming at the expense of other meat, such as beef, chicken, and pork. 49% of triers say they’re eating more plant-based meat alternatives now than a year ago, while 37% said they’re not eating as much other meat.

We’re seeing a similar trend with dairy alternatives. Consumption is up this year for 47% of plant-based dairy alternative triers, while 29% are consuming fewer dairy products such as milk, cheese, and yogurt.

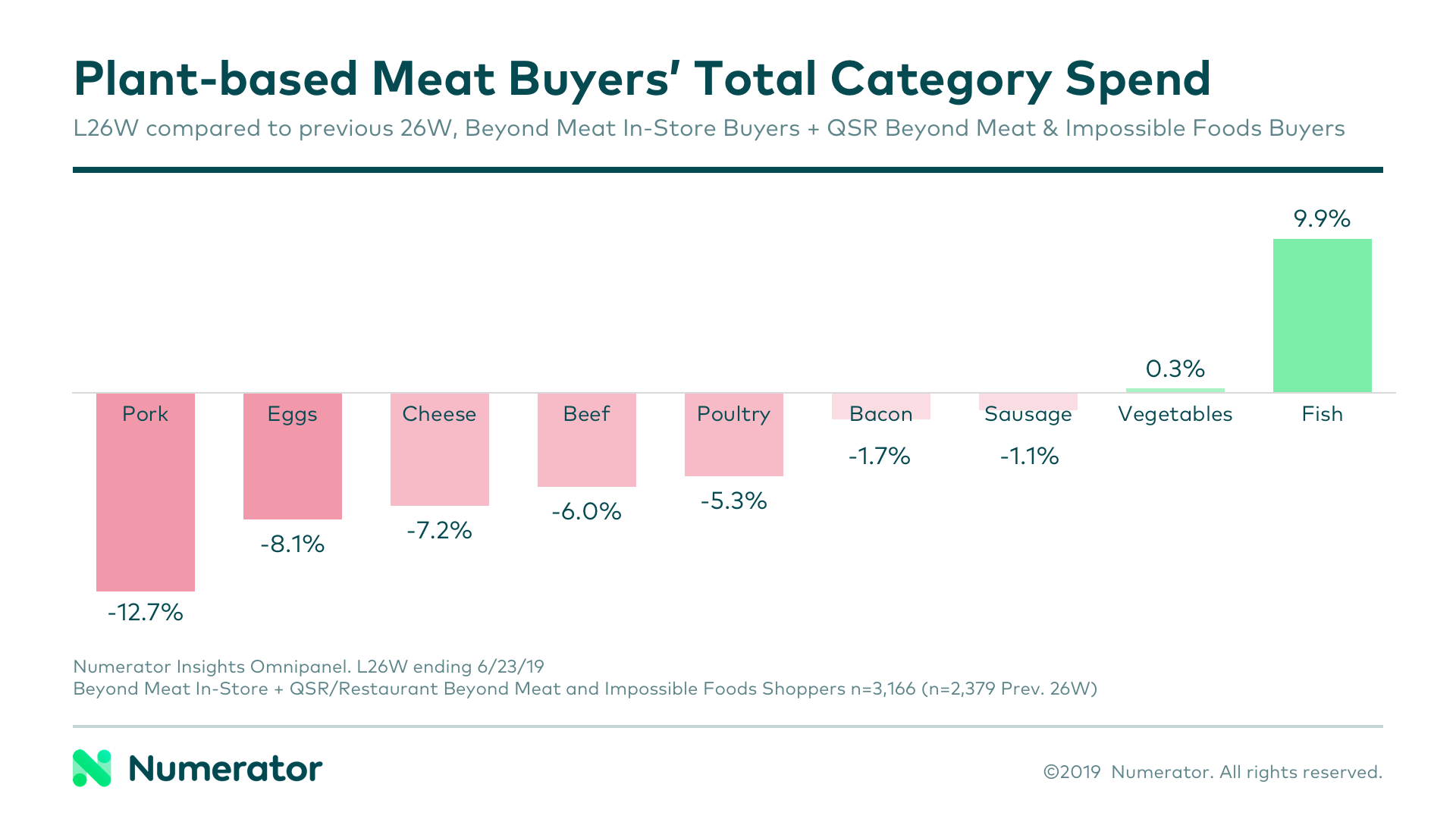

In the past year, plant-based meat alternative buyers have shifted their grocery dollars away from pork, eggs, cheese, beef, and poultry, according to Numerator Insights data. Interestingly, spending on fish has moved upstream by nearly 10%.

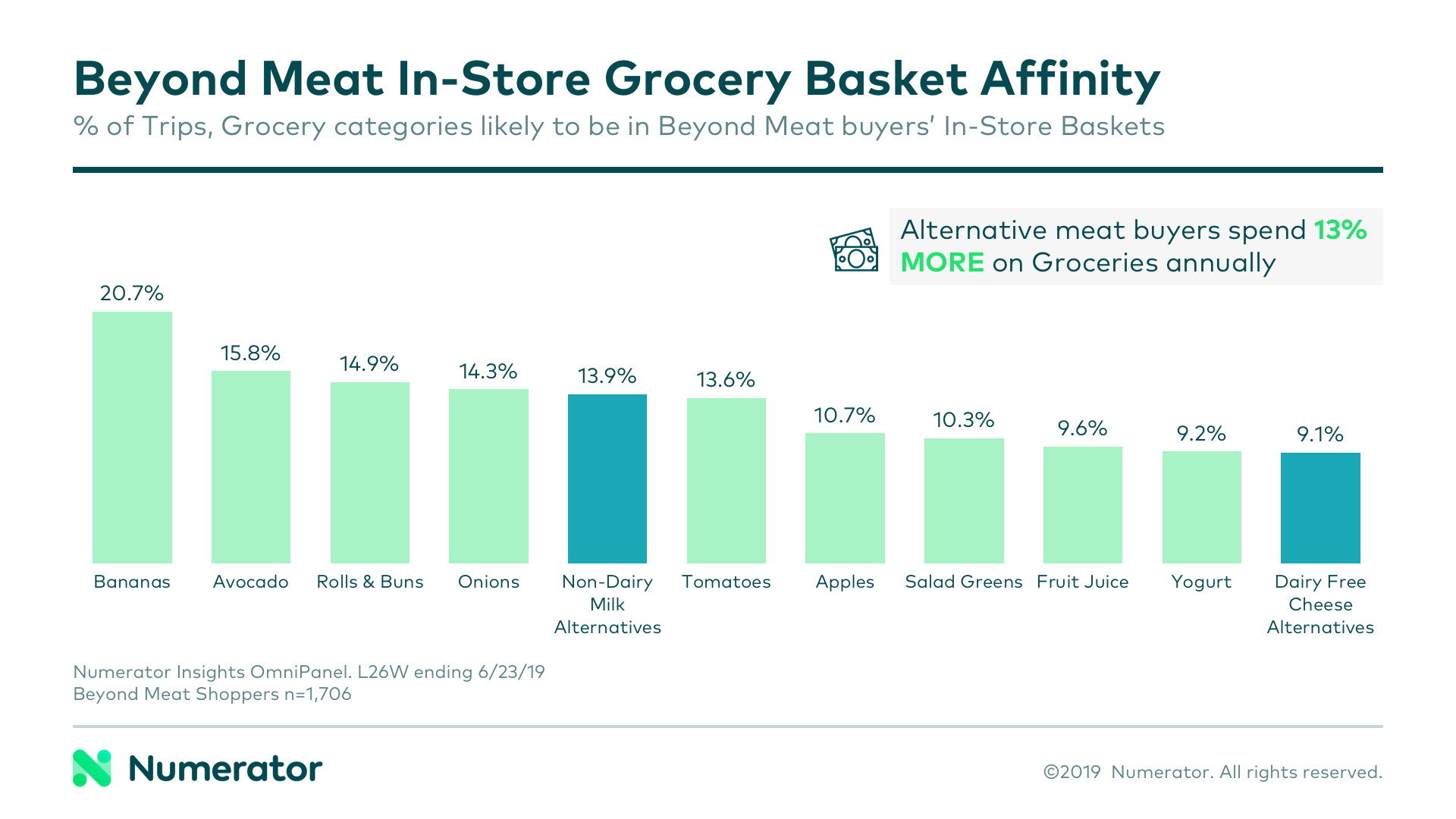

When we specifically look at in-store baskets with Beyond Meat products, we see that these health-conscious consumers are also filling their baskets with produce and non-dairy alternatives. As you might expect, healthy eating habits don’t stop with meat.

Overall, buyers of plant-based meat alternatives spend 13% more on groceries annually. This could be due in part to higher prices. However, as we pointed out in the previous post, these buyers also tend to have high household incomes.

No Signs of Slowing Down

Four in five plant-based meat alternative triers will replace at least some of their real meat in the next year, according to a Numerator Custom Survey. In fact, 21% said they’ll replace all real meat, while just 9% said they won’t replace any real meat.

Despite the enthusiasm and glowing reviews, plant-based meats are still on the rare side. More than one in five buyers said they have trouble finding plant-based meat alternatives at their typical grocery store. Some even have to visit special stores.

Retailers should take advantage of this opportunity to carry these products and win with shoppers who spend more on grocery items than the average shopper. Those who already carry these products could consider in-store displays or expanded shelf space to make plant-based meat alternatives more visible and increase trip spend.

Brands should work to enhance existing products, prioritizing the benefits of plant-based eating while looking for ways to improve taste and texture. There’s also a tremendous opportunity for product innovation as consumers have shown a willingness to try other plant-based items. With so few dominant brands and ongoing concerns about price, an opening exists for value and private label brands to step in and offer more affordable options.

Reservations about taste and texture are clearly taking a backseat to health, environmental, and ethical reasons for buying plant-based meat alternatives. However, because about half of plant-based meat alternative triers still prefer the taste of real meat, it’s a good idea for brands to continue promoting the likeness to real meat and win over those consumers.

If you’d like to dig deeper into how plant-based meat alternatives are affecting your categories and identify areas for growth, contact us for insights.

*Source: CNBC, Beyond Meat shares fall after pricing secondary stock offering at $160